Saturday, January 25th, 2025

Chiswick, West London

By Tom Dyson

Dear Reader,

Happy Saturday. Below you’ll find both the transcript of the Private Briefing I recorded with Chris Weber last week. For new paid subscribers, Private Briefings are where we sit down for a longer conversation with friends, analysts, and great investors we’ve met over the years. We try to publish one new Private Briefing each month.

Chris is an old friend and the most intelligent person I think I’ve ever met. He has the memory of an elephant and a supernatural ability to forecast the markets, which he’s been quietly doing successfully for almost 60 years. In this conversation, we unpack some of his great market calls and I ask him what he’s excited about now.

We discuss the brilliant free-market economist and philosopher, Murray Rothbard, who was like a ‘second Father’ to Chris and two unusual investment ideas...one is a deep sea mining company and the other is a new bank that makes it very easy to exchange currencies.

Enjoy!

Tom

P.S. Please note our discussion of stocks does not constitute financial advice or an investment recommendation and I’ve never discussed either of the individual stocks mentioned with subscribers to Bonner Private Research. I haven't done any of my own research into either of the individual stocks mentioned. The Metals Company [TMC] is a current recommendation of The Weber Report and Chris Weber may own stock in it personally. For our updated Official List, including the new recommendation I DID make, see the February Monthly Strategy Report. Comments and discussion are available to all paid subscribers on any posts we publish

TRANSCRIPT BEGINS

Tom Dyson: So I thought what I would do to start is run down some of the calls you've made in the past, because I think our readers may find it almost unbelievable how many times you've gotten the big calls right. So correct me if I get any of this wrong, please.

Chris Weber: Sure.

Tom Dyson: So the first one I've got written down is you bought gold in the '70s. And then you sold it in 1980?

Chris Weber: Yes. That's right. If you want to know the exact thing, I knew from when Paul Volcker took over the Fed ... I knew from October of '79 that he was really going to tackle the problem. So at that point I bought a lot of options on gold and silver too. I didn't know when the peak was going to be, but I knew it was going to happen. So each time the option contract would expire, I would buy a new contract. And at some point it got to be very expensive and it was just a single contract left by the time, on January 21st that the gold and the silver price had peaked, and then it began to crash. And so that was my way of exiting the bull market. But, prior to that, I had only purchased the actual metals.

Tom: Coins. Correct? And did you buy them at $42 an ounce?

Chris: No. No. It was even cheaper than that. It was still at $35 an ounce. It was illegal, technically, at that point for Americans to own, but it wasn't illegal for them to own the so-called numismatic coins. And in the town that I was in, in Phoenix, Arizona, a coin dealer, he was offering the old British sovereigns, roughly a quarter of an ounce, the pre-1931. That was the year that the UK went off the gold standard and those coins didn't have any premium on them, and you could buy them at four-to-one margin. So I took the few hundred dollars that I'd saved from my paper route. I was 16 at the time and I just went, I purchased them. And I don't know how or why, but whenever I thought it had gone up too much I sold. And then the price would fall back and I would buy again. And the price went from '71 to the end of '74, from $35 to $200, and the coins at four to one. It was fantastic and it set me up from then on.

Tom: I'd like to come back to this in a minute. But, I'm just going to just move through your trading history. And then after 1980, you made an incredibly bold move. Having sold out of gold. You then bought US government treasury bonds.

Chris: Well, at first it was only the T bills, because they were paying 20% the three-month. But, in that period, I became convinced that for a number of reasons, the interest rates had gone up too far and the relationship between the short-term rates, the three-month rates and the long-term rates, the 30-year rates was such that, while both of those interest rates would fall, the short-term rates would fall faster and farther than the long-term rates. Because it's very unusual to have such an inverted yield curve, where the short-term rates are 20% and the long-term rates are 11, 12, 13%. It's usually the longer term that has the higher interest rate.

And so I did what are called straddles in the futures market. I would buy the one and sell the other, so that I would profit if the short-term rates fell relative to long-term rates, and the T-bond prices would rise, relative to the fall in the T-bill one. And that was a great, great trade too. It was a very messy period from '80 to '81. It was only at the end of September of '81 that the long-term treasury bond peaked at just over 15%. I say that the bond peaked, but I actually mean the yield on the bond peaked. And it was after that that they began to fall and they fell until 2020 for almost 40 years, which was almost exactly the period before then that they had been on the rise. I don't know if that's a coincidence or not, but interest rates started to rise in 1942 in the US.

Tom: The chart forms a perfectly shaped cone, almost like Mount Fuji. I know I asked you about this the other day when we saw each other. You didn't hold the bonds all the way for 40 years?

Chris: I was always interested in currencies. And what happened was, starting in October or November of 1978, the US dollar actually began to rise. And by March of '85, it was so high you could go to Europe to two, three-star Michelin restaurants and it would be almost as much ... I know this sounds insane, but it was almost as much as going to a McDonald's in the US. The dollar was so high and, of course, I had bought US government treasuries in the US currency. So by March of '85, I thought, "Well, I'm going to take advantage of these very, what I think are too cheap currencies." The pound almost got to parity at that point. And the mark and the gilder from Holland and the Swiss franc, also very good currencies that were just too cheap, because I was over there at that time and I saw it.

So what I did was to buy the same instruments, but diversify amongst four European currencies. And so I still got everything from the bond. The interest rates was a global phenomenon, interest rates falling. So the price of the bond went up and everything, but the kicker was that the currencies went up, in some cases, almost 100% over the next few years. So as good as it was to be in the US dollar, it was even better to buy the currencies when they were cheap, and having the bonds do the same thing, but having the currencies do essentially what they had done from 1971 to '78. And so I had seen it happen before, so I took advantage of it. But, this time with the veneer of the bonds on top of that, whereas before, I didn't want to be in any bond, because interest rates were soaring during most of that earlier period.

Tom: What an incredible trade. And I can't wait to come back and talk about the dollar in a minute, because the dollar is once again very strong and the currencies are weaker. I don't think they're as weak as they were in the mid-1980s...

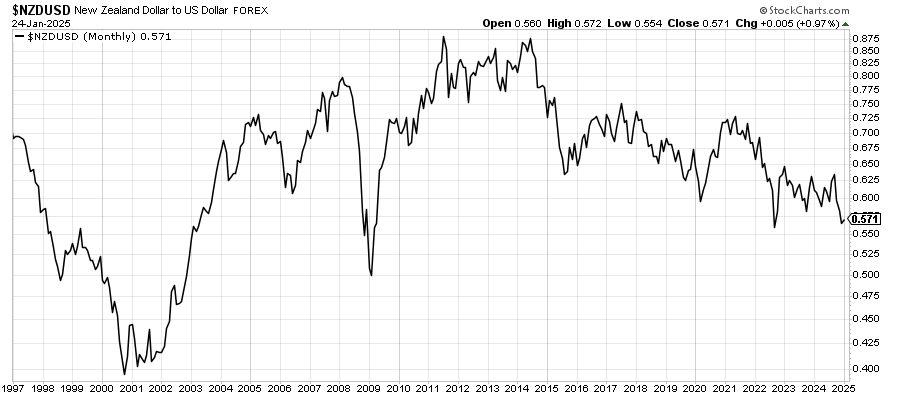

Chris: No. Not nearly so. But, yeah. That was an extraordinary time. It was on the cover of Time magazines, Americans everywhere boosted by the King Dollar. It was so cheap it was a joke. It was too cheap. The only time I've ever seen that since was in New Zealand in early 2002, and I did the same thing then.

And I wrote about it at that time. I had my newsletter. You could have a wonderful hotel room, a bottle of wine for a song. The New Zealand dollar was 40 cents. And within a short time it became 80 cents and you got all the coupon on the bond and the rising price of the bond all on top of that.

But those days, the last time there was a big currency move was 2008, when the euro went up to $1.60, having essentially gone up 100% from its low of 2000 when it got as low as 82 cents. But, ever since then, there haven't been any huge swings.

All right. You could say that the euro being $1.60 cents back in 2008, it's now a dollar and three or 4 cents. But, it's been a long time since 2008, whereas before you got these big, big moves in a matter of two, three, four years. So something has really changed in the currency markets. There hasn't been these big swings that are over a short period of time, ever since 2008.

Tom: It's a shame actually, because it would be great to have the volatility back in the currency market again.

Chris: Well, you sure had it from 1971 until 2008, which is what? Almost 40 years.

Tom: Yeah. Well, moving on then, and I know you were in that Euro trade as well. But, so just quickly, the other big calls, I know you got heavily into gold in, was it 2002 or 2003?

Chris: Oh, no. 'O1. April and May of 'O1 for gold and November of that same year for silver.

Tom: I read my first issue of your newsletter back in that time. So I remember that. And of course, that trade is still open and ongoing so we’ll come back to that in a minute. But you made an incredible call to get out of the stock market in 2007.

Chris: Right. November the 17th or the 21st, something like that. I put out an issue that just said, "Everybody out." And I was very, very, very lucky in that. It seemed to me that it was a time that the stock market was just overblown.

Tom: And then, did you get back in at the bottom in 2009?

Chris: Yes. In March of '09, pretty much at the bottom. I didn't know what to recommend specifically, but I thought that the whole thing was over. So I said you could pretty much be safe by buying anything. I ended up recommending the S&P and a few other things, but it would've been smarter to have actual things at the time, instead of just saying, "You're free to buy anything you want."

But, by that time I wasn't even sure, because it was a terrible time. The markets had just become so blown out. Even very good companies were being thrown out, which is always what happens. Yeah. People start just to sell everything.

But before that in the '90s, I spent a lot of time in Asia, especially Malaysia. And I could see that infrastructure was a big thing. So just to recommend the cement companies that they were using, which was Holderlin at the time, I think it's called Wholesome now from Switzerland. The best of every basic infrastructure thing, from telephones…even banking. I could tell that they were getting wealthy at an astoundingly fast rate, and not just Malaysia, but Thailand, Indonesia also. So that was an easy thing to see.