Private Briefing with Alasdair Macleod

'They cannot think, they cannot understand what is going on. It's their currencies being destroyed, not gold going up.'

Thursday, July 11, 2024

Laramie, Wyoming

By Dan Denning

Something special for you today!

Below is Part One of the Private Briefing I received yesterday from Alasdair Macelod of Macleod Finance. The full video of our conversation is at the bottom of this letter. I’ll publish Part Two of the transcript tomorrow morning (Bill Bonner returns on Monday after a vacation with his family in France).

In the first part of the hour-long briefing, Alasdair talks about his experience using technical analysis in the gold futures markets (some Dow Theory, some Elliott wave Theory for TA aficionados). He makes an important point about the difference between gold trading in the paper market in the West and physical gold buying in China by the People’s Bank of China and Chinese savers.

Part Two has a few bombshells. We talk about the possibility that the US election in November could be postponed. We also talk about whether Saudi Arabia blocked the sale of frozen Russian bank assets earlier this summer—and what that might mean for gold and US Treasuries. And speaking of gold, have a look at the chart below.

The monthly inflation rate fell for the first time in four years, according to the official May number released earlier today by the Bureau of Labor Statistics (BLS). The year-over-year change is still 3%, above the Fed’s 2% target but also the lowest in three years.

The gold price jumped almost two per cent on the news. Why?

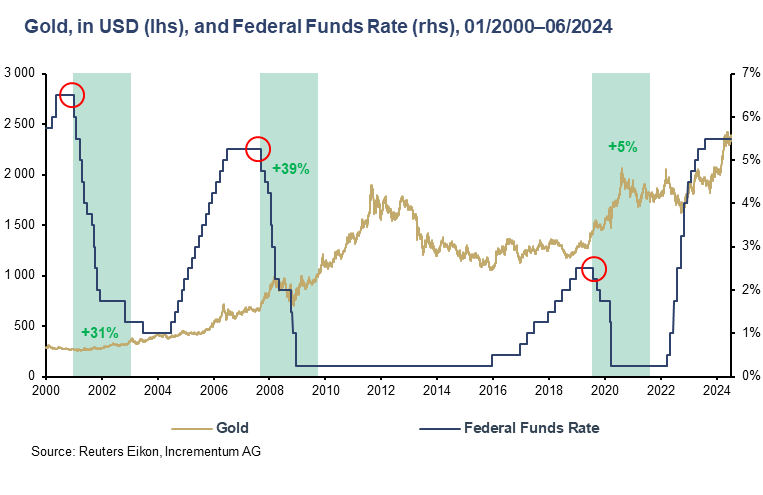

The conventional wisdom is that if inflation is whipped (and unemployment is up), the Fed can cut interest rates, perhaps as soon as the September 17th-18th meeting (though not as soon as the July 30-31 meeting). The chart above from Ronnie Stoeferle shows that gold has gone up in each of last three rate-cutting cycles.

Core CPI, which excludes food and energy, was actually up 0.1% in May and 3.3% year-over-year. That 3.3% was the lowest annual rate of change in three years. But also still higher than the Fed’s 2% target. Will the Fed really cut rates with inflation still above target?

We’ll find out! But in the meantime, it’s time to take a deeper dive into the gold futures market, technical analysis, and how China has been accumulating physical gold hand over fist while paper traders in the West dither. Enjoy Part of this Private Briefing with Alasdair Macleod of Macleod Finance and look for Part Two tomorrow.

Until then,

Dan

TRANSCRIPT BEGINS HERE (edited lightly for clarity and continuity)

Dan Denning: Welcome back to Bonner Private Research. I'm Dan Denning here in Laramie, and in the latest of our Private Briefing series, I'm joined by another guest from London, one I've had the pleasure of just meeting virtually earlier today. I've been reading his work at Macleod Finance on Substack. If you read about the gold market in London or just read about the gold market at all, then it's a name that'll be familiar, so let me welcome to the show, Alasdair Macleod. Alasdair, how are you?

Alasdair Macleod: I'm very well. Thank you for having me on your show, Dan.

Dan Denning: You're quite welcome. In just a minute I'm going to ask you about several things you’ve written recently about the price action in the gold futures market and really where the pricing power in the paper market lies right now because that's an issue we've frequently discussed and he has some interesting things to say on it.

But I wanted to give you a chance first to tell our listeners and our readers at Bonner Private Research a little bit more about yourself. I understand from your biography that you've been in the City of London and you started as a stockbroker in 1970, and of course more recently you're the head of research at Gold Money, which began in 2001.

What happened in between and how did you come to specialize in sound money and the gold market?

Alasdair Macleod: Well, I started as a stockbroker, as you said in 1970, and of course the '70s were very formative as far as my thinking is concerned because we had the 1971 Nixon shock and that was followed by very steep learning curve about the difference between fiat dollars and gold. And particularly in the UK, we went very heavily socialist, really heavily socialists. Tax rates were, would you believe that you could find yourself paying 102% of your income in tax? That was the top rate.

Dan Denning: How is that possible, by the way?

Alasdair Macleod: Well, under socialism, any level of taxation is possible. Let's not go into it.

Dan Denning: Fair.

Alasdair Macleod: But it's a combination of income tax, super tax, and then there was an extra tax on what they called unearned income, in other words, dividends or interest. So if you were making, I can't remember what the levels were, but I mean it would've been nothing like current salaries, you would find yourself in the super tax bracket and if you had any savings in which you were paid a dividend or interest, that attracted an extra tax on top of all that. So that's how it happened. The very high level of socialism really peaked in 1975, and at that time we had to call in the International Monetary Fund to rescue government finances and it was the IMF that actually insisted on remedial action. Now, I should make clear that the whole function of the IMF was not to rescue an advanced economy, it was actually to provide finance for emerging economies.

So, you can see that this was a very unusual situation. In fact, it was preceded by a loan from the US government to try and stop a sterling crisis. But obviously, the deal in off the pages it was, "Right, we will lend you however many billion it is, but basically we will put in the IMF and you will have to abide by their conditions."

Now, this in a sense is welcome to politicians because when they find they get themselves into a situation of promising this, that, and the other thing, they need someone to rescue them from the consequences of that. And that's basically what the IMF did. So, we went through that. We saw high levels of inflation, up to 25%, would you believe? And not only that, but the yield on government debt rocketed because of the condition that we put ourselves into.

And this actually has echoes for today and I'm sure will come onto that. But continuing with my sort of career path as it were in the securities industry, not only was I a stockbroker, I became an investment manager, this is all at a senior level, and I did a lot of corporate finance work as well. And eventually I left the UK and went to one of the Channel Islands, Guernsey, where I became a director of a bank. So, that really covers my entire experience as it were.

The economic side in terms of understanding economics, money, credit and so forth, really sprung out of that and reading and learning from the resilience and combining it with my own experience as it were. So it was that that led to me becoming head of research at Gold Money.

I was invited by James Turk who at that stage having been the founder of Gold Money, basically was the principle motivating force behind Gold Money. And I'm still head of research for Gold Money. But my role there has changed somewhat because I wanted to broaden out my appeal as it were because I can see that there are very substantial dangers to the value of credit and I want to get the message to a wider audience. I want them to understand the difference between money and credit. And while the Gold Money platform is extremely useful, it doesn't really have that broad appeal.

So, that's why I set up the Substack channel, and that was to educate people about the difference between money, which in law is gold, silver, and copper, though today we only really talk about gold and credit, which is everything else: currencies are credit, bank deposits are credit. If you have a share certificate, that's credit because it's an obligation to pay you an income stream or to accumulate an income stream on your behalf as a shareholder. It's an obligation. Everything is a credit obligation. We do not actually use money, in other words, a medium of exchange with no counterparty risk, which is essentially what gold is. That has been removed from the system entirely back in 1971.

We live in interesting times because if there is a parallel to any earlier situation, so far, I think we can say quite confidently that the 2020s are shaping up to be very similar to the 1970s.

Now, that should alarm us, particularly when you bear in mind that in the UK it ended up with the government issuing treasury debt bearing coupons of 15% and more, and just imagine what that does to US credit. So, that's where we are, and that I think probably is enough to set off an interview.

Dan Denning: Yeah, well that's fantastic. I would say given your professional experience, especially in the '70s and the way you described it with soaring inflation, rising government bond yields and even more debt now. Higher interest rates would be almost unthinkable with the level of sovereign debt that's in the economy now. The discussion about what is money and the role of gold has never been more pertinent. So, let's dive right into it now that we have the right man for the moment.

I want to start with two things you've written recently because you do something that we don't do very often at Bonner Private Research, which is to focus a little bit on the technicals of the futures market and what's driving the price action.

So, on the 5th of July in your piece called Firm Undertone for Gold and Silver, you wrote the following, you said:

Support has been established at the 55-day moving average, but while it would be a mistake to rule out a deeper correction to test the longer term 12-month moving average, the market feels very firm underneath. Undoubtedly, this reflects continuing Chinese demand for both physical and futures contracts in Shanghai, which is now driving prices in Western markets.

So two questions for you on that because I thought that was a really important point you made at the end. First, what is the technical outlook for gold right now? And is the Chinese demand for physical and paper gold the driving force behind the gold price now?

Alasdair Macleod: Yeah. Well, technical analysis basically provides some sort of framework for people who are looking at a security, if you like, in the broadest sense as to where they might expect the security to go purely in terms of supply and demand and how that supply and demand is likely to evolve. That's basically what technical analysis is, and it all goes back to Dow Theory, which sort of lays out the whole thing, things like moving averages are basically a confirmation of Dow Theory, and even Elliott Wave is a confirmation of Dow Theory. The whole thing sort of ties together.

Of course, the problem with technical analysis is that you can find that in a room full of technical analysts, you'll get about as many opinions as there are technical analysts. So there is a skill, if you like, involved in reading it. On top of that, what I try to do is to put my market experience into the mix, which is a very different thing.

I was weaned on a stock market where there was a floor, and you could go onto the floor at any time, it could be first thing in the morning, it might be after a coffee break across the road from Frog Morton Street, and it could well be after lunch when you've perhaps had a few drinks too many, whatever.

But the thing is that you get a feel for the market. In those days, we had jobbers, and jobbers basically were the people who made the prices. They're the equivalent if you of the bullion banks dealing in bullion today. And you could see from their boards and you get a feel of the buzz of the market, the general feel, and that tells you an awful lot.

And it's almost, I don't know how to describe it's just a feel; you get a feel for the market, and you can feel that this market's looking pretty good. It's not going to go any lower, and when you get that feeling, and if you are reading it right, that's the moment where you go and you buy a few stocks to trade.

On the other hand, you can come in and you can see that there's some red developing, red in our terms are falling prices on the boar. And you get a feel that this is turning into something worse. This market's about to fall. And we're probably talking about what, I don't know, 1%, 2%, something like that.

But that, to a trader, is a major fall. So at that stage, you start shorting the market. And if you're successful, good for you. But many years of doing this gave me that feel, and that's behind my statement: this market feels well under firm or underwritten or whatever.

This I think is another thing which I try and bring into my Substack articles when I'm talking about gold and silver, and I talk about other things as well, and I think that's something that just pure technical analysis.

We've got, for example, Elliott Wave people who follow gold, and I'm not going to really question that gold and silver follow an Elliott Wave pattern. I'm not going to go into the validity of that. But some people are very successful in terms of following it with Elliott Wave theory. Bully for them, good for them. But I do feel that it's important to understand what's going on actually between the buyers and sellers in the market.

Now, in this case, we are particularly talking about the paper market. There’s a problem for the shorts. And the shorts basically are comprised of two categories. You've got the people who should be using this market if you like to cover risk, and those are the producers, the mines for example, mines who know that over the next three months, they're likely to be able to deliver into the refiners, let's say 10 tons of gold.

Now, it would make sense for them to consider hedging the value of that gold because they've got bills to pay, they've got energy costs that are rising. They've got to pay their miners and all the rest of it. And in other words, they're running a business. They're not speculating in gold: they're actually running a business and they are running a balance sheet and they need to ensure the integrity of the profitability of their business. So, hedging is entirely sensible. So, that's one category.

The other category basically are the bullion bank traders and market makers. Now, they take typically most of the short side, and this is particularly true now because basically as the gold price rises, the margins of the producers tend to improve, and so there is less pressure on them to go into the market to hedge their forward positions. So, the short side is falling more and more on the bullion bank community. And currently, I haven't got figures in front of me, but what we're looking at is a net short position on COMEX in the order of $65 billion, something like that spread amongst about 29 of them. So, you've got over $2 billion on average net. The gross figure is obviously considerably larger. So, we're talking some pretty big numbers here.

Now this creates, if you like, a specific interest. They not only make trading profits the difference between buying and selling contracts. But also, on their short position in a rising market, they're making losses. Now, those losses generally are not necessarily as much as the profits that they're making on trading, but nonetheless that is something that they want to keep a cap on. So, that's the first thing.

The other side of the equation basically is a speculative interest. Now, these are on COMEX called the managed money category. Now, this is basically hedge funds, and the hedge funds have a very simple approach: they buy gold, sell dollar, or sell gold, buy dollar.

It is a pairs trade as far as they're concerned, and they never, ever, or very rarely anyway, stand for delivery, which of course is a facility which ties the paper contracts value into the physical price of gold at expiry. This is necessary for the market to work. And the hedge funds, if you see their performance, typically, they tend to get bullish when things are rising and they tend to get bearish when things are falling. And they are maximum bullish at the top and they're maximum bearish at the bottom.

The point is that the bullion banks know this. This, to them, is wonderful. They watch this. And I mean, the stupidity of it is because of the leverage on a futures position, it's absolutely enormous. You pay a margin of 5% or whatever it is, which means you're 20 times leveraged. This is fantastic. So you need to protect yourself and you protect yourself by putting in a stop. In other words, if the price falls by, let us say, half a percent, then you want to get stopped out because you don't want to take any losses greater than that half percent full because half a percent times 20 times is some serious money.

So you can see that this is information which our lovely swaps have, the swaps being the bullion bank traders. They know where the stops are, and so they know that when there's just a pause in the buying, then they could just come in and they just mark prices down.

Now, I'm not saying they necessarily collaborate in this. They may well do. But they all have the same feel. I was talking about the feel of the market. Jobbers' habit, the market makers' habit, as well as me walking into the stock market and after lunch, and thinking, my goodness, this market looks good or it's not going to go any lower. Perhaps I should buy some stock. They have exactly the same understanding. They know this. So they can see, when there is a pause, let us say, in the buying and maybe a tiny bit of profit-taking, then they can exaggerate this, mark prices down quite rapidly, take out those stops, which causes a further fall in the price and whoopee, they made a wonderful trading profit.

That is the way it works. And the point about understanding the market, if you like, not just the technical analysis, but actually what goes on, on the floor is the understanding of that, which is, I think, so desperately important. But there is another factor.

You mentioned Chinese demand. It has, actually, been a factor for the last 20-odd years. Let's face it. In fact, I'd go back beyond that because the People’s Bank of China was appointed under regulations from the Central Communist party as agent for acquiring and managing the Communist Party's gold and silver back in 1983.

Now, the People’s Bank of China also was responsible for managing the foreign exchange position, and this became very important after the death of Mao. In the mid to late '80s, in particular, you had very substantial inward investment as American and European corporations began to establish factories, manufacturing facilities. And then, really, from the late '80s and into the '90s, you began to have substantial export surpluses as all these factories' output began to be exported.

But if you looked at the money flows going through the People’s Bank of China's hands in terms of foreign exchange and took, say, 10% of that, investing that 10% in bullion would've been at the contemporary prices, which, remember, fell to a low of about $250 per ounce in 2002. Would've been the equivalent of about 20,000 tons of gold. Now, that, if you like, is my working assumption for what the People’s Bank of China acquired and hid in various accounts. We're not talking about reserves. We're talking about hiding in various government accounts, like, the People's Liberation Army, the Youth Communist party, and so on and so forth. It's all spread around but hidden.

It was at that point, 2002, that the Chinese people were then permitted by law to acquire gold and silver because before then, it was prohibited. So you have to ask yourself why, why was it that, first of all, the People’s Bank was appointed to do this back in 1983, why was it that China invested so much in gold mine output that it very rapidly became the largest gold miner in the world?

Why was it that the State hung on to the monopoly of gold refinery in China? Why was it that China continued to import substantial amounts of gold to feed its mining operation in the form of dowry, whatever, to feed into its refining operations and so on? Why was it that then, they decided, right, our people can now go into the market?

And they've started taking delivery out of the Shanghai Gold Exchange vaults. Shanghai Gold Exchange was set up for this particular purpose. Why was it that they suddenly started acquiring gold? Why was it that the Chinese government started advertising on television by gold? It's good for you, or whatever the byline was. So you can see that this was something which was a deliberate act of policy. And we know that ever since, really, since 1983, as far as gold is concerned, China is like Hotel California. You can get in but you can't get out, and it's been a one way street.

I have no idea what the State owns in terms of gold. I would not be surprised if it's north of 30,000 tons given the flows. On top of that, we know that something like 27,000 tons has been delivered out of the Shanghai Gold Exchange vaults into the public now. On top of that, we also know that the Chinese banks offer gold accounts to their customers, which hold gold in the Shanghai Gold Exchange's vaulting system. So this adds up to a hell of a lot of gold.

Now, the thing that's changed recently is that demand for gold has accelerated. And there are a number of points worth making here. The first is that the People’s Bank of China has been selling dollars to buy gold. Now, I think it's important to appreciate that what we're talking about is the selling of dollars rather than the buying of gold. This is entirely in accordance with the policies agreed by the Shanghai Cooperation Organization and the BRICS membership to get away from using the dollar as a trading medium.

So you could say that that's the only reason that the People’s Bank are selling it. But the Peoples Bank is not like other central banks. It does not have this Keynesian type approach to economics. It realizes that money is gold and all the rest is credit. And particularly, if you're talking about dollars, you're looking at American credit. Now, it's making a valuation on American credit. So that's the first point I'd like to make. The second point is more serious, and that is that the Chinese household savings rate is reckoned to be 35% of GDP.

Dan Denning: Wow.

Alasdair Macleod: Yeah, exactly. Wow. You're right to say, wow. That is the equivalent of $6 trillion in savings increasing every year. Now, where does it go? Well, it used to go into property. What's happening with property?

Well, that's on the no-go list now. We know that. Stock market? Well, the stock market has performed a bit this year so far but this is after a three-year bear market. And I would posit that what we've seen in terms of rise in the stock market so far, the Shanghai market, is certainly not enough to attract the attention, if you like, of the housewife, the Chinese housewife.

So where have all these savings gone? Well, we know the answer. It has actually gone into things called CD, certificates of deposit, which are, if you like, deposit accounts at Chinese banks, which have a maturity of up to three years, and they pay a higher rate of interest than cash, as it were. And that is, basically, where it's gone.

Now, because property's been cut off, because the stock market isn't attractive, because they're up to their necks in Yuan credit, as it were, you can understand that there is increasing interest in gold, particularly, since there is no interest in the West.

We have this extraordinary situation where until, literally, I think, last month or the last month or two, the West ETFs have been liquidating. Gold positions have been doing so over the last two or three years with gold ware. This is the behavior at the bottom of a gold market, not the top of a gold market.

But the Chinese have this facility offered by Chinese banks where you can open a gold account. So you can have a deposit account in Yuan, you can have a deposit account in gold. So how much? Well, all you need to have is the equivalent of about 500 Yuan in order to open a gold account, which is, roughly, $70.

So you can see that this is a very easy thing for Chinese speculators, if you like, the speculating housewife, the equivalent of the Japanese, Mrs. Watanabe, who I remember from a time past, they're putting money into gold accounts. And of course, the banks have to back their positions.

They probably run some sort of fractional reserve position. But I would very much doubt if it's on the sort of scale which our banking system operates on, like, 10 times liability to actual physical or more. So the Chinese banks are, basically, in the market to get what they can. On top of that, of course, you have a third element, and that is the smart Chinese punters who see this, they know this, they're not fools.

My acquaintance with the Chinese is that some of them are damn-site clever than anything I've seen in the West. They really are very smart cookies. And they're punting on the Shanghai Futures Exchange, ‘Shiffy’ as we call it over here.

This demand, as you can see, is a one-way street. The figures behind this are simply enormous, and they are particularly enormous in the context that we've already been cleaned out of physical gold. The only change in the physical position is mine supply coming in. And when you bear in mind that China and Russia are the two largest miners in the world. They produce, between them, around about 700 tons per year, out of a global total of around about 3,000 to 3,500 tons.

This doesn't leave an awful lot of liquidity in the West, particularly, when they're sucking out that supply. Not only are they absorbing their own supply, but they're sucking it out from us. So that is really what's going on. And do you know something, Dan?

We're sitting in the West and we are completely unaware of the dangers which are about to hit us, like, brown stuff hitting a fan big time. And I'm just looking at it from a market point of view. I mean, I do have a little bit of correspondence with people in the London market, and they're yet to rarely fully wake up to this. They think there's a large speculative element in this because they can see the futures demand on the Shanghai Futures Exchange.

And there is a game. You can maybe take delivery on COMEX or either directly by standing for delivery or through the mechanisms in the market and effectively arbitrage it off to China. And they're making good money doing this. Lovely. I mean, it's another source of revenue for the bullion banking community.

But what they don't realize is that this is being driven by a combination of savings, record savings and economic factors. No one in the bullion banking system that I've come across, actually understands money and credit and the economic theories attached to there, too. They do not understand that what is going on is it is the currency they're accounting in, whether it's dollars, euros or sterling. These are the three in London.

The currencies are going down rather than gold going up. From their point of view, they're booking profits and losses in the currency by dealing in gold. They cannot think, they cannot understand what is going on. It's their currencies being destroyed, not gold going up.

So this is the denouement that we are about to face. And I mean, this is likely to be triggered by... I don't know. I mean, we've got so many crises, potential World War III. We've got the debt crisis in America.

Look for Part Two of this Private Briefing with Alasdair Macleod of Macleod Finance on Friday, July 12th, 2024.

Dan, this was a great read. I've had an interest in gold and silver since the mid 80's. This interview brings an interesting perspective to holding a lot of "real" money. I believe most people think the almighty dollar is the king of the hill, man are they wrong.

Many statements here I've read in other articles but this piece ties many points together. Looking forward to part two.

Jim Marshall

Does Dan really believe the inflation numbers from the federal govt.? Inflation has been bouncing around 1.5% to 3.8% for decades, so I don't think 3.3% would have middle-class Americans this upset unless they are actually experiencing much higher price increases pertaining to essential goods and services. I think the leftist MSM know these numbers are suspect, but push them nevertheless, hoping it will help their Democrat allies. Just like they knew for years that Pres. Biden was frail and senile.