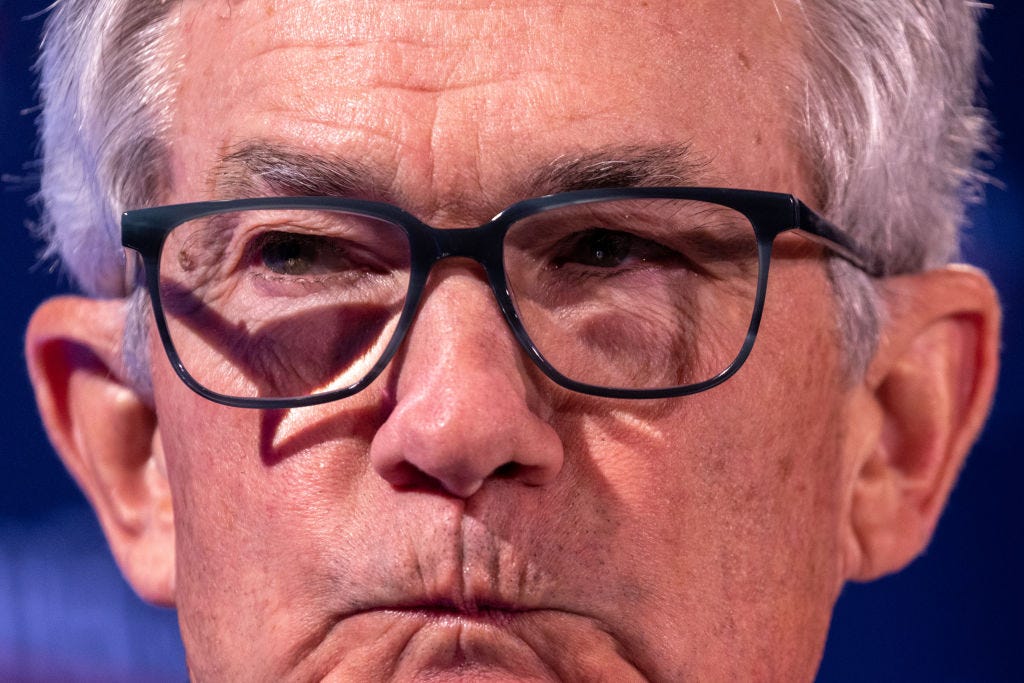

Powell Power

The mightiest mandible in human history moves markets at a mere muttering...

Bill Bonner, reckoning today from Youghal, Ireland...

The process which started in 2022 cannot — and should not — be reversed.

~ Vincent Deluard

Jerome Powell has what must be the most powerful lower mandible in human history… if it moves up and down, and tells the world that the fight against inflation is over…well, in a matter of hours, there will be millions more millionaires.

…if, on the other hand, it insists that it will take the Fed’s key rate to 9.5% – 3% higher than consumer price inflation – OMG…you would see billion-dollar businesses collapse in a heap…and billionaires suddenly homeless, penniless, and friendless.

A woman may start up a coffee shop. She borrows money. She does the math. At 5% interest, the numbers work. The shop prospers. But if the interest rate is forced up…say to 7%...all of sudden, the expenses are greater than the income. The shop loses money. The poor woman runs through her savings…and then has to close her doors.

The world economy is made up of millions of people like that. In small businesses…and big ones. And Mr. Powell, if he chooses…can wipe them all out in a matter of minutes. (We shudder to think that we sat so close to greatness …though we didn’t know it…when we both attended Georgetown Law Center in the late ‘70s.)

Extraordinary Jawbone

Whence cometh this superpower? A special gift…is he the richest man on earth…the smartest…was he elected? Was it an accident of birth or a product of his own genius? Apparently…none of the above.

Instead, Powell is just a salaried employee of a private company, granted extraordinary powers by the federal government.

And here’s the latest from Reuters:

Powell: A "couple of years" before Fed nears end of balance sheet decline

Federal Reserve Chairman Jerome Powell said Tuesday the U.S. central bank has some distance left to run in terms of shrinking its balance sheet.

"We haven’t put a specific target on it” when it comes to where the balance sheet run down stops, Powell said at an appearance.

"It will be a couple of years" before reaching the right level of banking sector reserves, Powell said…

A couple more years with a shrinking money supply? What will that do to stocks? To shop owners….and business titans?

We don’t know. But investors don’t appear to be too worried about it. Perhaps they should be. And with those shoes, Mr. Volcker kicked inflation out of the way.

Fake Money Shebang

The federal government changed the dollar in 1971. Thereafter it could be easily manipulated. Politicians overspend. And they typically cover their excess spending by printing extra money. Then, everyone begins to borrow and spend, all trying to stay ahead of the wilting currency. It is the kind of inflation that is endemic in a fake money system.

Volcker’s solution was simple. He raised the Fed’s key lending rate to the point where no one was lending and weak credits couldn’t be refinanced. The result was a recession – the worst one since the Great Depression. But it did the trick. With the bad debt and bad investments out of the way, interest rates could decline, lending could pick up, shopkeepers could get back to work and asset prices could rise.

That is, roughly, the happy situation we had from 1982 to 2022. And now, Mr. Jerome Powell aims to step into Volcker’s outsized shoes.

By the way, the money supply grows not only when the Fed ‘prints’ money to lend to the Federal government and member banks, but also when it pushes down interest rates. The lower they go the more incentive people have to borrow – especially when you can borrow below the rate of consumer price increases. When they borrow, the banking system ‘creates’ new money to give them.

More Surprises

The trouble with this whole fake-money shebang is that it comes with a cyanide capsule already in its mouth. As the money supply grows…so does the amount of debt in the economy. New money is borrowed into life. It dies – lowering the money supply – when the debt is retired, renounced, or inflated away. So, when the Fed lets its balance sheet decline, it means that the biggest lender in the world is reducing its holdings of debt and effectively disappearing money. That is when the lower mandible closes on the upward one….and the cyanide flows into the system. Money vanishes…and the whole circle of fake prosperity, caused by fake money, lent out at fake rates, reverses.

Many are the subplots and nuances of this drama. But the main story is this:

For the last forty years, the Fed pumped in cash and credit. Asset prices rose. Debt increased. Now, Paul Volcker re-incarnated as Jerome Powell is finally taking away the punchbowl. He’s siphoning off the cash and making credit harder to get.

That is the gist of our analysis here at Bonner Private Research. Of course, there will be plenty of surprises….and plenty of twists and turns as the play lurches forward. But as long as it continues, we can expect more surprises on the downside than on the upside.

Regards,

Bill Bonner

The blood in the streets will be beyond any imagination of the interest rates are increased 3%.

2 years before Covid I signed onto a $650k SBA loan after providing $300k in cash to build out a new Dairy Queen Grill and Chill end cap at a shopping center. I lost a lot of sleep, SBA loans require collateralizing the entire loan with other assets if you don't own the underlying property.

I did not proffer my personal home, but most all of my rental properties (except those hidden in trusts) were exposed. Covid hit and at $18,000 a month to service the rent and loan things were not pretty as I shelled out more cash to protect my investment and pay employees.

Uber, Door Dash, and our drive thru saved the ship from sinking. Later Joe B started passing out the loot to our landlord and the bank servicing the loan. All payments were suspended until further notice. I decided we'd pay the loan down with both the deferred rent money and the loan as usual, but to double down with all spare cash.

Joe B smiled on us again providing an employee retention credit of $150k which has been applied to the loan. In short the loan is now in the range were I could pay if off with cash. I'm not wanting to do that unless necessary.

Now if you think anyone else with a SBA loan did the same dream on. We've become quite close with the executives at the bank. They were quite surprised the loan payments were doubled and sometimes tripled during Covid. The original loan was 6.75% today it stands at 8.5%.

I sold a 21 unit apartment building before the DQ was offered us, I was going to retire (the wife didn't want me underfoot). The new owner of the apartment building paid too much and borrowed too much. He's looking for a partner, sorry pal the second happiest day in my life was buying those buildings for peanuts, the happiest day was selling them to you. I might buy the lot back out of foreclosure but because they are in Philly where an eviction now takes 5 months if you hire a lawyer and act quick about it, I'll probably pass.

Both DQ's rocked during Covid, suicide by ice cream is all I can figure. Currently 2 of our local DQ's have gone out of business. I believe both succumbed to increased labor and food costs. The Grill and Chill is an interesting situation, the dining room is not like it used to be but Uber and other delivery systems along with the drive through have increased cash flow. DQ is exploring a new idea and using my son in law (the manager and part owner as their Beta test site. He's planning on opening a new location void of a dinning room. It will have a pick up counter, drive through, and delivery service.

He's funding this location 100% without my wife and I. I'm good with that, let the young people loose sleep.