Oil, gold, and the dollar after Iran

Sunday, June 22nd, 2025

Laramie, Wyoming

By Dan Denning

Dear Reader,

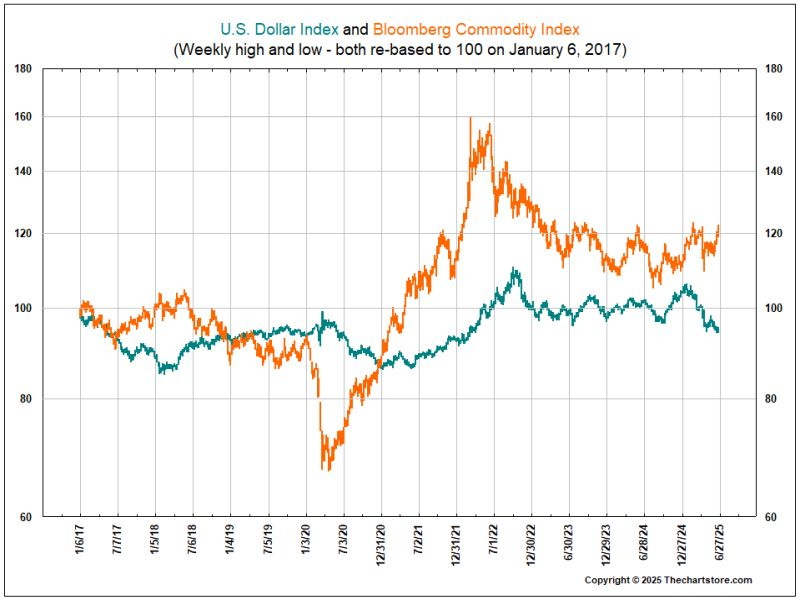

The futures markets open at 6 pm Eastern Time here in the US. While we’re waiting on the markets to weigh in on this weekend’s US bombing of Iran’s nuclear sights, let me bring the chart above to your attention for some broader context. It should help.

The US Dollar Index (DXY) is down 9% year-to-date (this is something I wrote about in January for paid readers in a research note which I’ve unlocked for free readers today). The index is at the bottom of a three-year range. And of the six sectors (and 24 commodities in it)—Energy, Grains, Industrial Metals, Precious Metals, Softs, and Livestock—energy has a 30% weighting. If Iran tries to close the Straight of Hormuz…

One of the thing’s we re-learned in the last 24 hours is that in the fog of war, nothing public is knowledge and can be trusted. For example, open-source Intel accounts on X widely reported B-2 bombers leaving Whiteman Airforce Base in Missouri for Diego Garcia, via Guam. The B-2s that bombed Iran were already en route—having headed East earlier.

Markets will render their verdict shortly. In the meantime, Edward Bonner from Sprott sent another essay over our way for consideration last week. We’ve published it below for your review. Now may be an excellent time to get commodities in your portfolio—if you haven’t already.

Regards,

Dan

P.S. I checked the calendar and couldn’t believe that Rick Rule’s Symposium on Natural Resource Investing is two weeks from tomorrow. I won’t be there in person. But I’ll be joining remotely to hear what all the experts have to say about gold, uranium, silver, Iran, China, rare-earths and more. Edward will be there too, if you’d like to arrange to talk with him in person. Please note BPR receives a small commission if you sign for the conference (virtual or in person) through our links.

How to Profit from the Next Commodity Cycle

By Edward Bonner

The team at Sprott has been hard at work, ducking, diving and weaving through the maelstrom of market data – be it energy, uranium, copper, gold, silver, platinum, “rare earths”, or even more obscure and long-forgotten commodities.

Of course, the big piece of news last week was the Israeli attack on Iran, sending 200 fighter jets to hit over 100 strategic assets, including nuclear enrichment facilities, scientists, and commanders. “As many days as it takes,” said Netanyahu. Trump weighed in, “Excellent”.

No Peace in the Middle East…Yet another sad war front, countless more deaths and misery.

Crude oil rose sharply. Fertilizer markets did too as Iran is the third largest global exporter of urea, a nitrogen fertilizer.

Yet again, gold is distinguishing itself as a safe haven. Bitcoin was down, and so were US bonds. Both trading more like risk assets than defensive positions.

The likely implication, of course, is higher inflation, higher bond yields, and lower economic growth (i.e. stagflation).

Paul Wong, Sprott’s Market Strategist, was on the case last week, publishing a lengthy note on gold, which you can read here: I’ve gone through and picked out the most salient points, which you can read below.

“The U.S. has now paired century-high tariff rates with an increasingly unilateral foreign-policy stance, walking away from multilateral frameworks and casting doubt on long-standing security guarantees. The Trump administration argues that the U.S. dollar overvaluation and reserve-currency obligations undermine U.S. industry. It is openly questioning whether the U.S. should continue to underwrite the system it built and has maintained for generations. Foreign investors, however, see something different: a surging U.S. fiscal deficit near 7% of GDP, tax-cut proposals skewed toward the very wealthy, and an executive temperament that appears erratic and authoritarian.”

“While investors question the neutrality of Treasury bonds and the stability of the U.S. dollar they reach for non-sovereign stores of value, primarily gold bullion. Commodities with robust supply-demand fundamentals also stand to benefit from a structurally weaker U.S. dollar and from investors' search for real assets that hedge against both inflation and geopolitical disorder. The bond market, by contrast, faces a future in which yields may drift higher even during slowdowns, reflecting not just inflation risk but also a creeping discount for political unpredictability.”

“Structural inflation constitutes another pressure point on government spending. It is driven by factors like deglobalization, tariff and trade tensions, an aging population, larger defense budgets, the green transition and a rising cost of capital. Combined, these forces place heavy fiscal demands on governments.”

“The rise in long-term yields is not unique to the U.S. It is a global trend. Countries like Japan, the UK and Germany are seeing similar pressures, with yields climbing as fiscal risks mount. Japan, for example, is grappling with a debt-to-GDP ratio exceeding 200%, and the country's central bank has struggled to cap rising yields. This underscores the fact that high levels of sovereign debt and rising yields are a global risk.”

“The failure to address growing deficits, has only worsened the outlook for long-term debt management. A case in point is the latest proposed U.S. spending bill which is projected to add about $2.4 trillion to the national debt over the next 10 years.”

“As the “sell America” trade intensifies and bond vigilantes return to the market, the pressure on governments to stabilize their debt and restore investor confidence will only increase. Whether through fiscal reforms, debt restructuring or financial repression, the coming years will likely be marked by significant challenges in managing sovereign debt with potentially severe consequences for economic growth and financial stability.”

Perhaps in preparation, Central Banks have been loading up on gold. Take a look at the chart below showing the sharp increase in central bank purchases of gold since the US weaponized the dollar. Gold is now the second largest component of global central bank reserves, weighing in at roughly 20%. For reference, Central Banks allocated as much as 70% of their reserves to gold back in the late 1970s.

In his latest piece, Paul also digs into the silver markets, which are currently experiencing a breakout above the $35/oz resistance. He reckons the next resistance is the $40-42/oz range. If interested, you can read the whole piece here.

Given this backdrop, one would think investment banks would be all over this. But here’s the catch. After twelve years and three commodity cycle crashes, pretty much anyone who was involved with commodities was wiped out or forced into retirement, and with them all the commodities and mining sector knowledge and expertise.

Here’s one last word of wisdom from Paul: “The basic message for multi-asset class portfolios is to buy commodities (the good ones) and sell bonds.”

On that note, I hope you’re having a nice weekend. I will be up in Newfoundland, visiting a couple mining projects that I am currently invested in alongside my clients.

If you have any questions, or if you need any help with managing your natural resource investment portfolio, please feel free to reach out. I will be back in the office next week.

Kind regards,

Edward

P.S. I will also be attending the Rick Rule Natural Resource Symposium in Boca in July. Sprott is a sponsor of the event, and we will have a booth. If you are attending, please let me know so we can arrange a time to meet. I look forward to seeing some of you there.

Edward Bonner

Investment Advisor, Geologist

Sprott Global Resource Investments Ltd.

Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold is referred to with terms of art like store of value, safe haven and safe asset. These terms should not be construed to guarantee any form of investment safety. While “safe” assets like precious metals, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary, and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.

I have owned gold copper silver forever. I've commented on this site prior about this. Gold sucked forever. It recently caught up. I saw the silver Issue and I believe it's real it's way behind and we'll catch up. I recently had a meeting

with some of my folks and asked, " Why aren't we in any commodities...?.For once in a long time, I think there's opportunity here." REPLY. " Sir, there are opportunities here. There is no way to draw steady income. It's risky. A bad move can be very expensive . I agreed.....

I did however set up some shielded personal accounts. I am a sprott investor.

Thank you for sharing Mr. Ed Bonners report. While I am so very glad that I am well guided having BPR input, I find Ed's report is a great addition, making things in regard to commodity related investment more comprehensive. His knowledge coupled with writing skill is fantastic, so much appreciated by me who is still having to learn more. With much, much appreciation, TMZ