Now THAT's ugly!

Stocks down... inflation up... and bonds lookin' like the ugliest pig in the sty

(Source: Getty Images)

Joel Bowman, checking in today from Tenerife, Spain...

Okay, okay... let’s get the bad stuff out of the way first. Then, we’ll get to the ugly stuff...

Stocks officially closed out their worst six month start to any year in over half a century last week.

The Dow Jones Industrial Average ended lower by 1%... the broader S&P 500 fell by 1.8%... and the tech-heavy Nasdaq shrank by another 3.6%.

For those of you keeping/agonizing over the score at home, the three indices are down by 15, 20 and almost 30%, respectively, for the year. Ouchie!!

As we mentioned on Friday, tech stocks alone have given up over $4 trillion dollars since their all time highs of late 2021... an amount roughly equal to the entire GDP of Germany, the world’s 4th largest economy. (If they cough-up another cool trill, they’ll have fallen by more than Japan’s annual GDP.)

The last time markets were hemorrhaging this badly, Burt Bacharach and Hal David had a couple of Billboard Top Ten hits – “Raindrops Keep Falling on My Head” (recorded by B.J. Thomas) and “(They Long to Be) Close to You,” (recorded by The Carpenters).

That was back in 1970, the beginning of a decade marred by persistent inflation, economic recession and high unemployment (stagflation) at home and beset by oil shocks, trade embargoes and geopolitical uncertainty abroad.

Hmm... sound familiar?

Apples to Apples

Inflation, as if your memory needed jogging, is running at a white hot annualized rate of 8.6% (over the 12 months ending in May). Again, you have to go back to That ‘70s Show to find those kinds of numbers. And even then, you still have to believe the cheeky buggers calculating them!

As you might expect, the gate-keepers over at the Bureau of Labor Statistics love few things more in this life than a little methodological prestidigitation. It’s kind of their thing. Which is to say, they’ve rigged up various torture instruments over the years in order to make the numbers sing like proverbial canaries.

That’s why it’s good to check in occasionally with people like John Williams, over at Shadowstats.com, who tracks the data using both 1990 and 1980 baseline methodologies to get his “alternative” (read: historically comparable) prints.

Comparing today’s apples to the 1990 era crate, our current inflation rate is probably closer to 13%. And using the 1980 calculation method, it looks more like 17%.

(Is that in line what you’re experiencing at the pump and the store? Feel free to comment below with anecdotal observations from your own neck of the woods.)

But despite what you see and hear with your own eyes and ears, the American economy is stronger than ever. At least, that’s what President Joseph Robinette Biden Jr. told members of the press at a NATO summit here in Spain on Thursday.

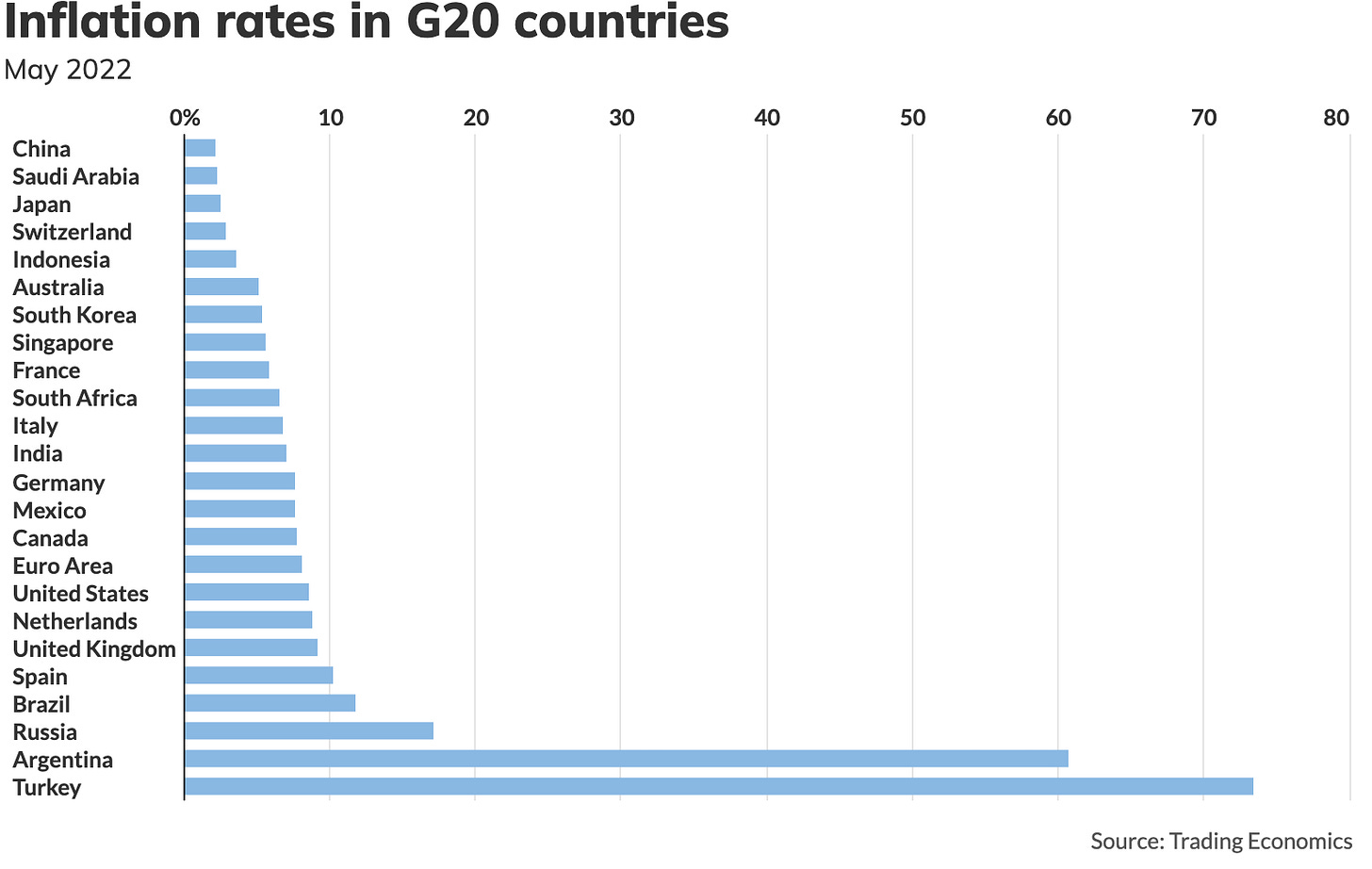

“America is better positioned to lead the world than we ever have been,” Mr. Biden assured the room full of reporters. “We have the strongest economy in the world, [and] our inflation rates are lower than other nations in the world.”

And it’s true. Inflation is higher in “other nations”... if those nations are Argentina... Turkey... Russia... Brazil... and a tiny handful of others.

To be fair, at least he didn’t claim that inflation was higher in “every other major industrial country in the world,” right?

Oh, wait... here’s the transcript from an interview Biden gave with the Associated Press earlier in the month.

“First of all, it’s not inevitable,” the President said of the recession into which many economists believe we have since plunged. “Secondly, we’re in a stronger position than any nation in the world to overcome this inflation.”

Asked who is responsible for the 40-year high inflation, the man who once proudly tweeted “When somebody is President of the United States, the responsibility is total,” shirked...

“If it’s my fault,” Mr. Total Responsibility snapped, “why is it the case in every other major industrial country in the world that inflation is higher? You ask yourself that? I’m not being a wise guy.”

And indeed, he wasn’t. Here’s the chart:

(Source: Trading Economics)

So stocks are down. And consumer price inflation is up. Way up. That’s the bad. For the ugly, we turn to the bond market...

Bonner Private Research’s own macro analyst, Dan Denning, shared the gory details with members in Friday’s update. Here, a choice snippet...

You have to go back to the 18th century—before George Washington became America’s first President—to find a worse first half of the year for benchmark US government bonds. Ten-year Treasuries are on pace for an annualized loss of 11%, according to Deutsche Bank. To give you an idea of how bad that is, the previous ‘worst’ year in recent history was a 2.4% annual loss in 1994.

Government credit—the ability to borrow on behalf of the American people—did not exist in the late 18th century. In fact, until the Constitution replaced the Articles of Confederation in 1787 and was finally ratified by nine of the thirteen States in 1788, the central government did not have the power to tax or issue bonds.

It’s a bit beyond the scope of this week’s update, but the link between government borrowing and the Warfare/Welfare State (unlimited debt and unlimited government) is at the heart of many economic and political issues we face today. In Article VIII of the Articles of Confederation, a Common Treasury was established for ‘the common defense or general welfare’ of the new nation. But the money was to be collected by the States, based on a proportional land tax.

One of the big criticisms of the Articles (by the Federalists) was that the federal government was powerless to raise money. The Constitution ‘rectified’ that in Article 1, Section 8, by giving Congress the power to ‘lay and collect taxes’ and ‘borrow money on the credit of the United States.’

You could argue that it’s been downhill ever since—that the Constitution has failed in limiting the size of the Federal government. And you could argue that by giving itself a monopoly over money, regulating the value thereof, and borrowing on the public credit, it was only a matter of time before we got to where we are: $30 trillion in debt with no end in sight. But here we are, nonetheless.

And there you have it, dear reader... where we’ve been... over the past six months... the past 40 years... and since the founding of the nation. The big question, of course, is where to next?

Dan and Tom have been hard at work helping readers avoid “The Big Loss,” as they call it, something that is more critical now, as the meltdown continues apace, than it has been in a long, long time.

Priority #1, as they repeat, is capital preservation.

If you’re not already a Bonner Private Research member, please note that the window is closing to get in at the introductory price. For now, you can still grab a subscription at the $10/month or $100/year rate... but that goes away shortly.

So if you like what you read here and want to get the “full experience”... if you’ve been on the fence until now... putting membership off until another day, now’s the time to get on board. Once the new rates come into effect, that’ll be that. These introductory prices will be long gone... like competent statesmen and good songwriting.

And now for Bill Bonner’s missives from the past week...

And that’s all from us today, dear reader. We’ll be back in the saddle tomorrow, with your usual Sunday Sesh. As promised a few weeks back, we’ve got a bunch of letters and comments from your fellow readers, which we’ve been working through in between buses, trains, planes and ferries. Don’t worry… we haven’t forgotten!

All that and more in tomorrow’s Sesh.

Until then...

Cheers,

Joel Bowman

In the UK, inflation according to Government is near 10%. My monthly home energy bill in October last year was £153.00 - this month it was £256.00, (and it is July - though my heating is gas and that is cheaper by a long shot than electricity!), my energy supplier tells me it will be £275 next October.

Filling my car with diesel (with the gauge claiming half-a-tank) cost me £47.25 in January according to my credit card receipt, filling it last week at about the same gauge reading cost £98.00.

Many of the packaged foods we buy have gone up in price and down in size, so trying to work out the level of inflation for those isn't so straightforward. But whatever inflation is, here it is rising rapidly in a short time, and our stupid Government hits Russia with sanctions that hurt us more than them.

The futility of applying cool logic to the chaos we mortals are living through is apparent. It changes nothing. Corruption, tyrants, insiders, greed, war mongering, is not ever going away. The fortunate ones saw it coming much before all this, and moved their money, they didn't wait for a guru's advice.