No Place to Hide

Markets turn red as equities and paper money begin simultaneous meltdown

(Source: Getty Images)

Joel Bowman, checking in today from Buenos Aires, Argentina...

And just like that, avoiding the “big loss” moved from a fringe concern for curmudgeonly newsletter writers to front and center of the general discussion. Well, almost...

Markets were draped in a cloak of red yesterday, diving into the close to notch their worst day (for the Dow, at least) since 2020. Down almost 1,000 points on the session, the Dow fell for a fourth straight week. The broader S&P 500 was off 2.8% on the session. The Nasdaq was down 2.6%.

Hmm... might this bloodletting be a sign that investors have finally woken up to the fact that the Fed is, to put it politely, ‘behind the curve?’ Time will tell, of course, but equity-heavy investors probably want more than a Friday closing bell to patch that kind of hemorrhaging.

As Bonner Private Research macro analyst, Dan Denning, observed in his market note yesterday afternoon, it appears even ‘The Generals’ (that is, mega-cap S&P stocks - Apple, Amazon, Microsoft, Tesla, Alphabet, etc.) are beginning to look a tad wobbly at the knees. Why does this matter? As Dan writes...

The top ten stocks (by market cap) are worth just over $10 trillion. That’s about 25% of the TOTAL market cap of the S&P 500 ($38.3 trillion). Apple is a $2.7 trillion company and makes up over 7% of the index. Microsoft is at $2.3 trillion and 6%, Amazon $1.4 trillion and 3.7%, Tesla at $902 billion and 2.4%, and Google at $836 billion and 2.2%. These are your ‘Generals.’ All of them were down on the day.

Those are big pillars, and they’re responsible for a large portion of this bull market’s epic run. (Tesla alone is up something like 14,000% – not a typo – over the past decade. Amazon and Microsoft pitched in a non-trivial 1,400%+ and 1,000%+ respectively over the same period.)

But what happens if the concentrated handful of colossal, leveraged funds that move the market begin to re-price their future expectations? Reckons Dan...

‘The Generals’ in this market could easily fall by 50% or more. That will only happen when asset and fund managers change their perception of reality in the equity market (when their perception finally catches up with what rising interest rates and inflation will do to sales, earnings, and the value of those future cash flows).

No army worthy of the battlefield expects to advance without surrendering a few soldiers to the cause... but when ‘The Generals’ start dropping, when the top brass begins questioning the mission at hand, it may be time to head for cover.

Ed. Note: Want full access to Dan’s weekly market updates? Get on board for just $2/week, here...

Meanwhile, BPR Investment Director, Tom Dyson, has been monitoring another realm of the walking dead, which is to say, fiat currencies...

The biggest story in finance (that no one is really covering) is the ongoing meltdown in the Japanese yen. The Japanese yen hit a fresh 20-year low yesterday against the US dollar. It fell for the 13th straight day.

But we’re at that point in markets where currency moves against gold matter as much as they matter against one another. The yen is weak against the dollar because the Bank of Japan wants it to be. What is it doing against real money? Against gold?

Look at this 5-year chart of the yen priced in gold. A rising line indicates the yen is losing value and gold is appreciating. You don’t have to be a chartist or a technical analyst to see that something is going on. Something big. Gold is breaking out big time against the yen.

Gold breaks out in yen

Source: TradingView.com

‘But Tom, Japan is on the other side of the world. I own US dollars. I invest and save in US dollars. Why should I care about the yen?’

Because, if I’m reading the situation correctly, the yen is showing us what’s about to happen to every other major currency, including the dollar, versus gold. Long time readers will have seen me write about the “synchronized global currency devaluation.”

Sticking on theme, a few days after his midweek alert to paid BPR subscribers, Tom sent this private note around to the BPR team, with the rather ominous subject line “Uh oh, there goes another one” ...

The yen is just the first pin to fall. Soon, I think the other big currencies – the dollar, the pound, the euro, the yuan, the Hong Kong dollar, the Canadian dollar, the Aussie dollar etc., are going to devalue too, one by one.

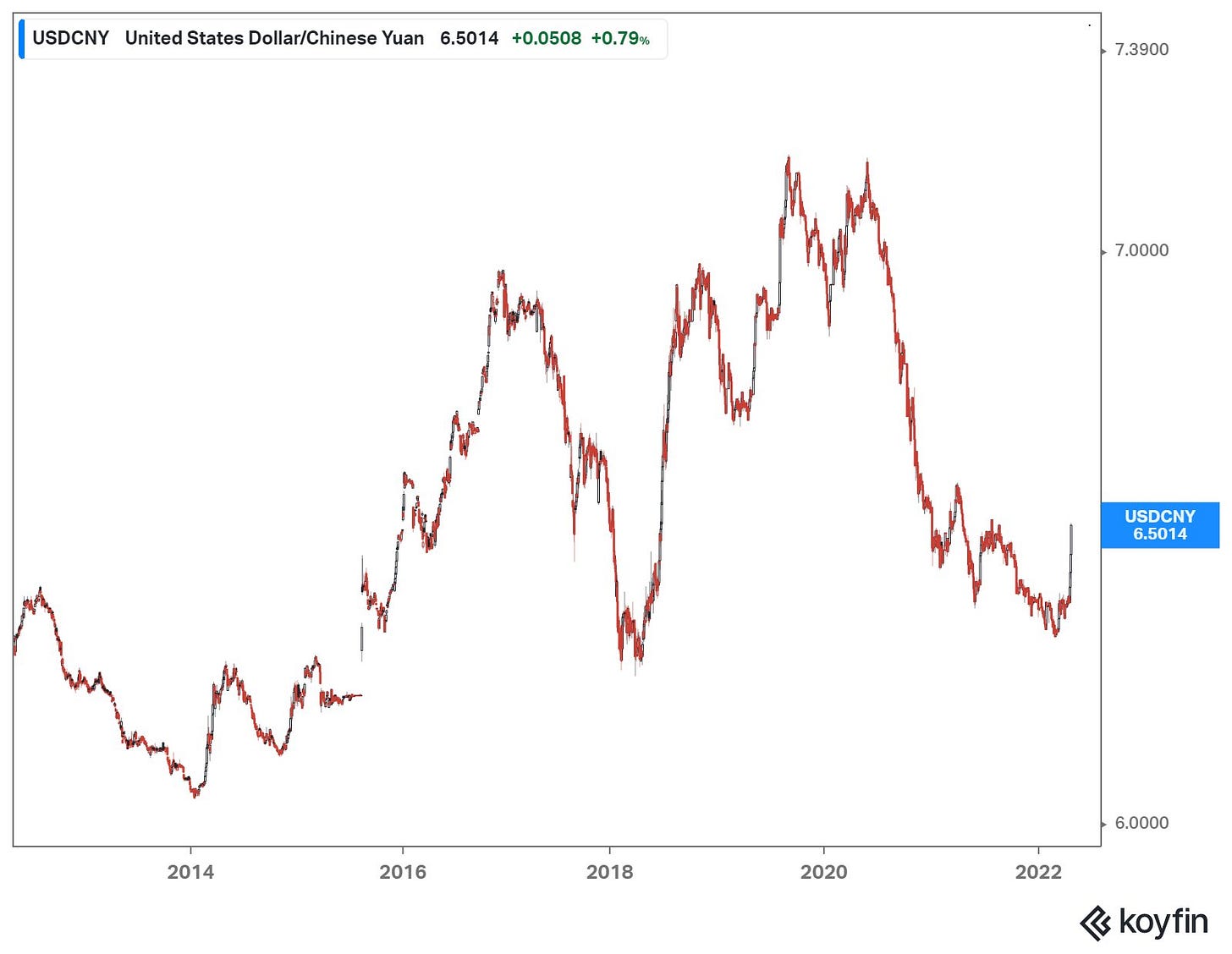

This chart shows the Chinese yuan in dollars. Looks like they might be next in line...

(synchronized global currency devaluation)

Dan’s response: This is another way of saying synchronized global inflation.

Bill’s reply: Yep... they're all linked to debt... too much debt.

Joel’s take: It’s been a long time coming, but it looks like the “S” is finally starting to hit the “F.” So, what to do?

First things first: Download Tom’s Gold Report (paying subscribers can access it here if they haven’t done so already). Spend a couple of days on it, properly digesting it. Next, study Dan’s Strategy Report (also for paid readers). It outlines our core thesis here at BPR... and what we’re doing to help readers protect their savings against the aforementioned – and potentially fast-approaching – “Big Loss.”

If liquidity is draining from the market, equities are going to be broadly crushed. And, as Tom has shown above, paper money will be no place to hide, either. You’ll want real assets, with real world value, as decided by real people with real wants and real needs. There will be opportunities in the market for patient investors. And we’ll be on the hunt for them. Join us, here...

And now for Bill Bonner’s missives from the past week...

And that’ll just about do from us for today. Remember to tune in tomorrow for your regular Sunday Sesh, where we’ll revisit that inglorious moment in English history known as the Brown Bottom.

Also watch out for the Fatal Conceits podcast, Ep #62, out tomorrow, featuring Woodlock House Family Capital fund manager and our longtime good mate, Mr. Christopher Mayer.

Over the course of an hour or so, Chris and your FC host discuss the themes and lessons in Neil Postman’s 1985 classic, Amusing Ourselves to Death: Public Discourse in the Age of Showbiz. As usual, Chris has plenty of interesting takeaways, both for everyday media consumers and for investors looking to “cut through the information glut.”

All that and plenty more, tomorrow. Until then...

Cheers,

Joel Bowman

© 2022 Bonner Private Research, Carrick Road, Portlaw, County Waterford, Ireland.

All Rights Reserved.

Any reproduction, copying, or distribution, in whole or in part, is prohibited without permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal circumstances–we are not financial advisors and do not give personalized financial advice. The opinions expressed here are those of the publisher and are subject to change without notice. It may become outdated and there is no obligation to update any such information.

Investments should be made only after consulting with your financial advisor and only after reviewing the prospectus or financial statements of the company or companies in question. You shouldn’t make any decision based solely on what you read here. Neither Bonner Private Research nor its employees and writers receive any compensation for securities or investments covered herein.

Hi Joel, I’m tracking with all you guys are advising, but I came across a thread that I’d really appreciate your perspective on. My own thought was, it doesn’t matter if the USD is the best of the worst because in the end it’s all crap—just a matter of when. Much appreciated.

https://threadreaderapp.com/thread/1503117588036874242.html

Question: What does Joel mean by "F" and "S"