New American Money Map

If you’re the sort that loves to turn a crisis into an opportunity, you still have time. The gold price itself should move higher in the cycle. But the junior miners haven’t started out-performing.

Friday, March 14th, 2025

Laramie, Wyoming

By Dan Denning

Today is the anniversary of Karl Marx’s greatest contribution to humanity, his death in 1883. Marx was only 64 when he died. But in his relatively short life, his particular brand of envy and economics produced one of the most murderous and destructive ideologies in human history.

It’s good advice, and proper civilized behavior, not to speak ill of the dead. But any time you get a chance to heap scorn and ridicule on Marx’s ideas, I believe you’re morally obliged to do so. Or heap scorn on the modern idiots who follow him.

With that out of the way, what can we say about gold that we haven’t already said? Let’s keep it simple. How much further could gold go up from here?

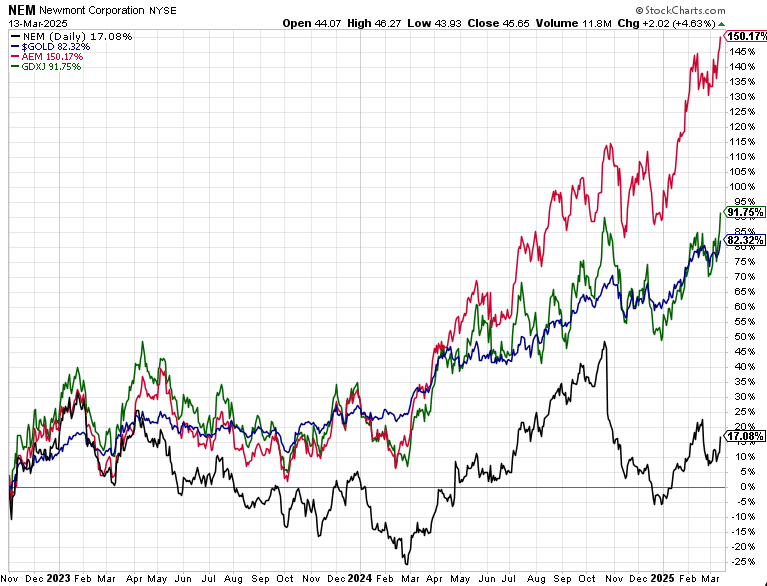

The chart below tracks gold (the blue line in the middle), two majors (Newmont and Agnico Eagle), and the Van Eck junior miners index (GDXJ). The Rule of thumb (I’m referring to Rick Rule’s experience in analyzing gold cycles) is that the gold price moves first. The big miners move second (trend following investors and improving sentiment bring institutional liquidity). Finally, the price action and cash flows attract the speculators.

Agnico’s shares have earned a premium because the company has turned higher gold prices into free cash flow. It’s a darling. By comparison, Newmont–the only other major gold stock with a market capitalization larger than $50 billion–has lagged. Translation, sentiment for the sector is still wary. How can you be sure?

Because the juniors are only tracking the price of gold. Later in the cycle, the juniors race ahead. That happens because the Johnny-come-lately retail traders who missed out on the price moves in gold itself are looking for a quick fix, a leveraged return that can make up for lost time.

The juniors HAVE begun to move lately. But not in that manic, late-cycle fashion you see when a bull market has captured the imagination of the public and the press. Central banks have been buyers. But even last night, the lead story in Barron’s was this: Wall Street Wants You to Buy Gold. It’s Still Risky.

Getting out of bed each morning is also risky. And holding US dollars or US government bonds as your reserve currency or top-tier reserve asset is also risky. I’ll take my chances putting both feet on the ground and buying gold. But how much higher can gold itself gold? Or will it be the Dow declining by 50% that brings the Dow/Gold ratio below five? Take a look at four of the worst bear markets in Dow history.