'Most of You Guys are Just Not Very Good'

Happy New Year! The team at Bonner Private Research will be back on the case tomorrow. In the meantime, we received the note below from our long-time friend Byron King. Byron is a frequent attendee and presenter at Rick Rule’s Natural Resource Investing Symposium. This year’s event is July 7th-11th at the Boca Raton Resort in Boca Raton Floriday. Get the new year off to a good start and register for the Rule Symposium here.

January 1st, 2024

By Byron King

“Most of You Guys Are Just Not Very Good.” Chuck Noll, former Head Coach of the Pittsburgh Steelers

The sun sets, a year ends, and seamlessly another year begins. Take a moment to look back at your successes and mistakes. And look ahead to more of the same. Just be better about it; more success and fewer mistakes. Get smarter. Be a learner, right?

Bill, Dan, Joel and Tom asked if I had anything to offer to subscribers of Bonner Private Research. Well sure, I have plenty up my sleeve. Because in 2024 we’re going to make some money. So stay paid-up, okay?

But first, let’s talk about football (n.b.: American football, not soccer).

What the Hell Is an “Acrisure”?

No, I don’t usually talk about football. Gold and silver? Oil and gas? Energy, mines, minerals, metals? Monetary policy? Military issues? Yes, that’s my beat. Not so much with football. I’m no sportswriter.

But there I was, Saturday evening, December 23, sitting in premium economy seats – just under the skyboxes – watching the Pittsburgh Steelers play against the Cincinnati Bengals at Acrisure Stadium.

A sea of Pittsburgh black and gold. BWK photo.

Here’s what happened. My son is in the Army. A while back, my wife and I asked him what he’d like to do while home on leave for Christmas. “Dad, how about if you and I go to a Steelers game?” he said. (Mom demurred.) And per the request, I made a visit to Stubhub.

So there we were, Sergeant King and I, at Acrisure Stadium where I was asking myself, “What the hell is an Acrisure?” Because the place used to be called Heinz Field, named after the iconic Pittsburgh food company, famous for ketchup and I know what ketchup is.

Turns out that Acrisure is a company involved with insurance, reinsurance, cyber services and mortgages. Apparently, they’ve made enough money to buy naming rights to a National Football League stadium. But that’s a digression; let’s get to the point.

Like I said, it was December 23, the anniversary of two important events, both of which crossed my mind as I viewed the gridiron proceedings from my perch above the 35-yard line.

Because on December 23, 1913 – 110 years ago – in Washington, D.C., President Woodrow Wilson signed the Federal Reserve Act. Hold that thought.

And also, on December 23, 1972 – 51 years back – in the old Three Rivers Stadium, Franco Harris caught what is known as the “Immaculate Reception” in a now legendary contest between the Steelers and the then-Oakland Raiders.

It just so happens that I was there, at that Oakland game; but not around, of course, for the Federal Reserve thing cuz I’m definitely not that old.

The 1972 Steelers-Raiders game was a special moment in life, an unexpected, early Christmas present from my long-deceased father. (“Hey Byron, I have Steeler tix. Against the Raiders!”) And somewhere in my basement, buried in a box, I still have my ticket stub.

Remembering Things Past

During my recent football attendance, the hometown team played well against the visiting Bengals. Plenty of exciting plays, strong runs, crisp passes, long marches down the field to score. And the Steelers won, 34 – 11.

And as it all unfolded, I rooted for the home team and thought back to that Oakland game. Me and my long-departed father, in a long-demolished stadium (“Three Frozen Rivers,” we called it, because the place was chilly even in July), watching players who have long-since grown old or passed away, in a greatly changed milieu of a long-ago city – Steelers-steel; get it? – and economy, in a world that has transformed into something totally different.

That is, December 1972 was still the good old days of U.S. industry, built on coal and coke, steel and manufacturing, oil and refining; you get the idea, eh? Indeed, back then U.S. Steel was still a U.S. company. Now, it’s about to be bought by Japan’s Nippon Steel, which prudently sees more value in iron ore, coal, rail lines and steel mills than in U.S. or Japanese government bonds.

Then again, December 1972 was also a mere sixteen months after el Presidente Nixon closed the gold window of the U.S. Treasury; truly, a monetary asteroid that struck the earth on the evening (Eastern Daylight Savings Time) of Sunday, August 15, 1971, an event which I recall as well.

That is, Nixon drove the final nail into the coffin of America’s long era of hard money prosperity built on a foundation of gold and silver.

Those days of yore, the early 1970s, were sixty years into the dangerous experiment of Federal Reserve monetarism, and despite this – certainly not because of it – the U.S. economy was still rolling along on its 1940s - 1960s/World War II and Space-Race momentum.

To view things from a different historical angle, in the early 1970s LBJ's Great (Expensive) Society was still taking root, while his (equally expensive) Vietnam debacle was winding down.

The full scope of the nation’s growing pile of bills and future obligations was not quite apparent, but deep damage was taking root. First and foremost, the U.S. government could not pay its many and growing debts in gold-backed, Bretton Woods currency. Hence, for better or worse, Nixon did what he did.

In retrospect, and if you’re just a bit mystical, abandoning the gold standard surely must have angered the gods, Vulcan if not Mars. Because not too long after that 1972 Steelers-Raiders game, and despite the crystal-clear mandate of heaven evidenced by Franco’s astonishing catch and scoring run, less than a year later – in the fall of 1973 – global oil markets went nuts over U.S. monetary inflation, and a war in the Middle East focused on Israel.

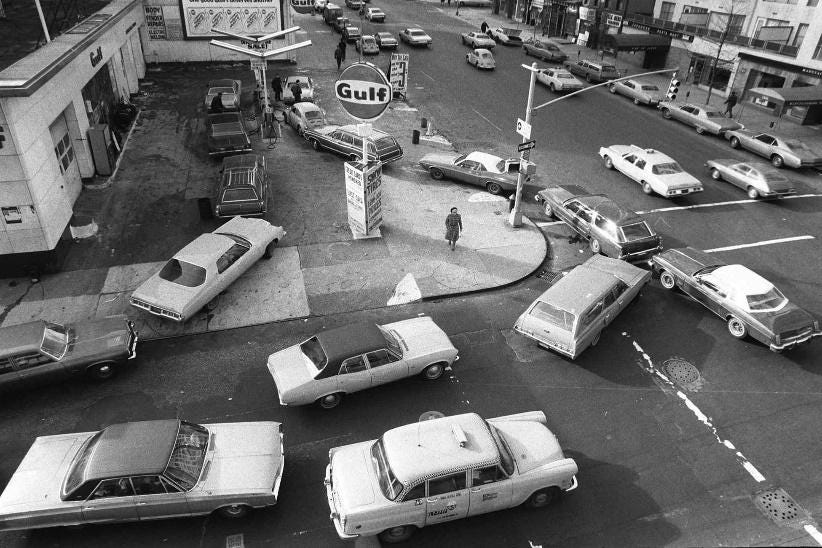

1973: Oil embargo, gasoline lines, American panic, petrodollars.

Out of that war came an Arab oil embargo against the U.S., and then a few months later, by the spring of 1974 and courtesy of the late deceased Henry Kissinger, we had petrodollars.

And you know the rest, yes? Unmoored from monetary reality, the world became a strange place for half a century.

Our country coasted along, awash in depreciating fiat dollars emitted from that Federal Reserve creature (see above, Dec. 23 anniversaries), blissfully oblivious to the tides of history. In other words, we lived large and lucky per the kernel of truth embedded within a wry quip by the old Iron Chancellor of Germany, Otto Bismarck, that “God has a special providence for fools, drunkards, and the United States of America.”

What’s the takeaway? Well first, it's easy to feel good about things when your country doesn't pay all its bills. Just charge up the national credit card. And if you hold assets, enjoy the bubble; but know that every bubble will sooner or later meet its own sharp pin. Stuff happens.

Meanwhile, it’s now déjà vu all over again.

As 2023 ends and ‘24 kicks off, we have war in the Middle East, via Israel, with hostilities now breaking out in the Red Sea and along adjacent trade routes. All this, coupled with other Middle East tensions from Libya to Syria, etc. And not to overlook the fiascos on tap or lined up in Ukraine, Taiwan, and whatever else pops up seemingly out of nowhere.

That same Red Sea is, for all practical purposes, now closed to much Western trade. The fact of drones and cruise missiles hitting ships kind of speaks for itself, although insurance carriers dropping coverage also does much to seal the deal.

A closely related effect to the Red Sea closure is that the Suez Canal is no longer a primary sailing route for Western trade. While far away, and for meteorological reasons (aka not enough rain), the Panama Canal is down to half capacity. Now, many ships must sail around entire continents to get places. Welcome to global trade based on navigation charts from the 1860s.

I could go on, but the true question is, how's that globalism thing doing? Or posed another way, was it really such a great idea to close down all those mines, mills and factories in the U.S. and Canada (think 1972!) and offshore everything to the other side of the planet?

Spoiler alert: Looking ahead through 2024 and beyond, there’s big money to be made by investing in real things – energy, basic materials, precious metals, tangible outputs – that are re-shoring back to the U.S.-of-A., as a half century of monetary folly unwinds.

What Would Chuck Noll Say?

Again, let’s revisit the lost world of 1972, of watching the Steelers beat the Raiders. And despite all manner of immutable human foibles at the time, it really was kind of an innocent level of bliss back then.

If you know your football history, then you’re familiar with Chuck Noll (1932 – 2014), who coached the Steelers from 1969 to 1991 and whose teams won four Super Bowl championships in the 1970s. His method, if not his hallmark, was to assemble great teams built around great athletes, coached to the pinnacle of excellence. Then take to the field and win.

Along these lines, I recall a story related to me some years ago by Andy Russell, an All Pro Steelers linebacker of the seventies, and holder of two Super Bowl rings. It begins right after the Steelers’ disastrous 1968 season when the owners fired the previous coach and hired Noll in January 1969.

Right after taking the job, Noll called a team meeting.

According to Russell, Noll stood in front of the entire roster of Steelers players and coaches and said, “I’m your new coach, and I’d like to say that I’m looking forward to getting to know you. But that would not be right. Because most of you guys are just not very good, and you’re not going to be playing for me next year.”

The room went into stunned silence. “Anything else?” asked Noll. And most players just stood up and walked out, as the new coach stared at them.

Per Russell, “That was my kick in the pants. I spent the next six months running, sprinting, lifting weights, and tossing big tires on a field. Then I showed up to training camp ready to go. And I made the team, although hardly anyone else from the old Steelers roster was still around.”

Great story. And really, don’t you wish that you – or someone – could walk into so many failing institutions these days, and repeat what Noll said?

Imagine walking into Congress, or the White House, or the Department of Defense, or State Department, or Federal Reserve, or Treasury; or walk into the board rooms of many companies, media empires and universities; or pick another favorite organization… and say, “Most of you guys are just not very good, and you’re not going to be working here much longer.” (It worked for Elon Musk at former-Twitter.)

Here’s the moral: Welcome to 2024, when we will work hard, focus hard, learn as much as we can, stay away from losers, and buy winners.

That’s all for now. Happy New Year. Thank you for subscribing and reading. Best wishes…

Byron W. King

Byron King writes on natural resources and geopolitical issues for Paradigm Press.

In the next 5 years the West will come to understand the 3 worse mistakes made in the history of the world. Starting with accepting the Petrodollar as the world's reserve currency, USA leading to the enrichment of the Saud fiefdom coupled with USA's involvement in Iran's nuclear program in 1953-79, and finally failing to recognize along with Israel the real enemy to peace in the Middle East and soon the world. Muhammad declared war on the entire world, terror, Hamas, ISIS, Taliban, Boko Haram. the Islamic Brotherhood, Islamic Jihad, PLO, etc are not the enemy but the death cult religion they have chosen to be enslaved by. According to Muhammad a peaceful Muslim is not a Muslim, a good Muslim is one who is engaged in forcing the World to submit to Islam.

China, Russia, pose no military threat to USA or anyone in the West. USA and Europe has allowed the deadly pathogen of Islam into their midst. Paris,Dublin, NY and all major cities in the USA are learning the s error of doing so. The last time Islam was well armed in the first 100 years after Muhammad's death the relgion killed half the worlds then population. The West stumbled into an Islamic struggle between Sunni and Shia Muslims that has been raging for 1300 years. In our wisdom we provided untold wealth to both sects while arming both with nuclear weapons and advanced weaponry. When their fight is over, or these two unite Oct 7 will look like a walk in the park. USA assisting Israel will not go well with our citizens living amount the combatants we've imported into USA.

I think most of us can agree the Federal Reserve has been a train wreck for Middle Class Americans. On the other hand, the Federal Reserve has done tremendous work for its owners. They've actually been able to subvert property rights with respect to securities. Here's some key facts from David Rogers Webb's book titled, The Great Taking:

• Ownership of securities as property has been replaced with a new

legal concept of a "security entitlement", which is a contractual

claim assuring a very weak position if the account provider becomes

insolvent.

• All securities are held in un-segregated pooled form. Securities

used as collateral, and those restricted from such use, are held in

the same pool.

• All account holders, including those who have prohibited use of

their securities as collateral, must, by law, receive only a pro-rata

share of residual assets.

• “Re-vindication,” i.e. the taking back of one’s own securities in the

event of insolvency, is absolutely prohibited.

• Account providers may legally borrow pooled securities to collateralize proprietary trading and financing.

• "Safe Harbor" assures secured creditors priority claim to pooled

securities ahead of account holders.

• The absolute priority claim of secured creditors to pooled client

securities has been upheld by the courts.

This isn't conjecture, its all spelled out in the Uniform Commercial Code (UCC). Its actually baked into the law now. Account providers are legally empowered to “borrow” pooled securities, without restriction. This is called “self help.” The objective is to utilize all securities as collateral. This is an example of Win-Lose on steroids. The government granted the Federal Reserve a monopoly and they did exactly what humans do; abused it.