Mania-level Sentiment

The greatest risk to the market continues to be a change in investor psychology from optimism to pessimism that leads to cascading stock prices, margin calls, deleveraging, and more losses.

Chiswick, West London

Wednesday, July 9

By Tom Dyson, Investment Director

Mayhem in the Red Sea this week…

On Monday, Houthi bandits boarded a bulker — the Magic Seas — rigged explosives to the hull and sank her. A few hours later, they published a social-media style video of the attack, set to suspenseful music.

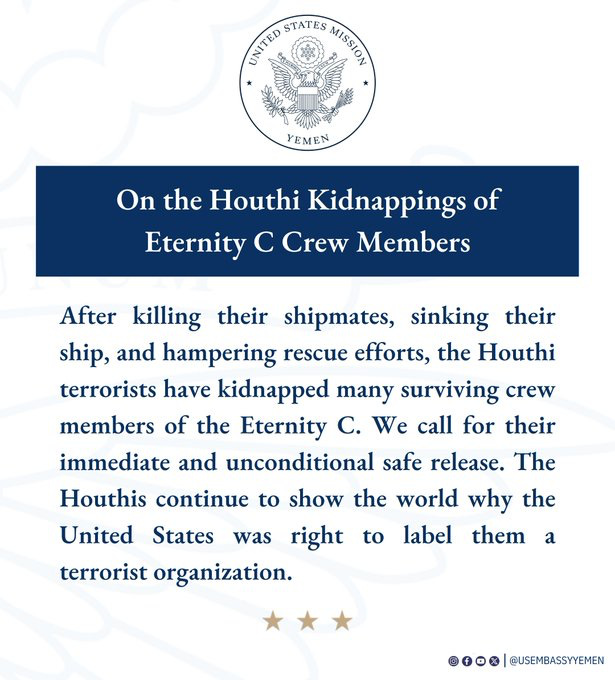

Then yesterday, the Houthis attacked another ship — the Eternity C — carrying soy beans. The last I heard, the ship sank, five members of Eternity C’s crew were killed and the rest were forced into the water (as lifeboats were destroyed.) Most have surely drowned.

Both ships had trading links with Israel.

There has also been a series of attacks on tankers trading Russian oil, using magnetic “limpet” mines to blow holes in their hulls.

So far, six tankers have been attacked. None has sunk. The latest, an LPG tanker carrying ammonia, was attacked three days ago in a Russian port and spilled some of its cargo. (Ammonia is extremely poisonous.)

No one has claimed responsibility for these attacks. Ukraine maybe?

If we didn’t already have the dial set to Maximum Safety, I’d definitely be putting it there now.

We’re already monitoring all-time-high valuations and mania-level sentiment. This week I’ve noticed an ominous divergence in the stock market that has marked important turning points in the past.

Analyst expectations for S&P earnings in 2025 and 2026 are starting to fall, even as the S&P itself continues to rise… now just below its all-time high at 6,284.

Expectations for S&P earnings in 2025 have fallen from about $278 last September to $262 today (a P/E of 24).

Expectations for S&P earnings in 2026 have fallen from about $317 last September to $299 today (a forward P/E of 21.)

According to Robert Prechter, in his book Conquer the Crash, a divergence between the S&P and its earnings is a strong indicator of a major turning point in the stock market as it shows a total disregard for fundamentals by bullish investors. “[It] indicates entrenched optimism in the face of falling stock prices and a weakening economy and therefore an immense psychological potential to drive stock prices lower.”

The greatest risk to the market continues to be a change in investor psychology from optimism to pessimism that leads to cascading stock prices, margin calls, deleveraging, more losses, then a negative wealth effect, lower consumption, less investment, lower corporate earnings, job losses… wash, rinse, repeat… until we’re in the middle of a classic deflationary crash and everyone is begging for a bailout as was the case in 2008 and 2020.

I know this sounds unduly pessimistic and unlikely, but that’s what has been keeping me up at night recently. With 40% of our savings in cash and another 40% in physical precious metals, we’re protected and there’s nothing more to do except wait.

In April, as the markets were crashing on the tariff announcement, we speculated that one of the easiest ways for surplus countries to reduce their trade imbalances with the United States would be to buy US-sourced grain, oil and petroleum products.