Jubilee Days

New mine supply is not very responsive to rising silver prices. If and when silver follows gold higher, don't expect new mine supply to come to the rescue. Only one thing can.

Wednesday, July 10, 2024

Laramie, Wyoming

By Dan Denning

Greetings from Gem City, where Jubilee Days are in full swing and the traveling carnival has set up shop downtown. Funnel cakes will be eaten. Line dancing will be watched.

What are Jubilee Days? It doesn’t mark the cancellation of $300 trillion in global debt. At least not yet!

It’s a Laramie street festival that celebrates Wyoming’s birthday. Well, it celebrates the day–July 10th, 1890–that Wyoming became the 44th State in the Union. It’s a big party for the rest of the week with a rodeo to boot.

Let’s hope the Union lasts another lap around the sun!

One programming note. I’ve just finished recording an hour-long Private Briefing with another one of BPR’s contacts in London. It was enlightening and sobering. You’ll see why when I publish Part One tomorrow. Look for Part Two on Friday.

Meanwhile, I’ve been cherry picking presentations to watch from Rick Rule’s Symposium on Natural Resource Investing. It started off Monday with Gold. The presentations prompted Tom Dyson and I to get on a call and speed up with the re-release of The Dollar Report–but with several new gold stock recommendations (Tom has been watching a few companies and waiting for the right time). Stay tuned for that soon.

Also keep in mind that as a virtual attendee, you can go back and review all the presentations at your leisure, anytime between now and December 31st. Being there in person is great. Watching live is the next best thing. But being able to listen and take notes at your leisure is, by far, the best part about registering as a virtual attendee. And there are still two full days of the show to go! Now check out the chart below.

It takes 17.5 years for a new discovery of a silver resource to turn into actual mine production, according to yesterdays’ eye-opener from Phil Baker of the Silver Institute. And half of all current global mine production comes from just three countries: Mexico, Chile, and Peru.

What’s more, only 25% of annual silver mine supply comes from mines that are primarily silver mines. Most of the rest of new silver mine supply is a by-product of copper, lead, zinc, and gold mines (deposits that also tend to have some or a lot of silver).

This means, Phil explained, that new mine supply is not very responsive to rising silver prices. In other words, if and when silver follows gold higher–and the things that drive gold also drive silver, according to Phil–don’t expect new mine supply to come to the rescue. What will?

There are thought to be about five billion ounces of above ground silver held privately by investors, warehouses, and exchange traded funds (ETFs). Those are just the above ground supplies that are reported. There could be more. The question, according to Phil, is at what price private holders would sell to meet new demand or fill any supply deficit.

That’s a very good question. When you’re willing to sell (or IF you’re willing to sell) depends on what you paid to begin with, or your cost basis. If you paid $35/ounce to build a position, you’re not selling at $30.81 (the price earlier today). Maybe at $50, to make up for inflation and capital gains taxes. Or maybe much higher. How high?

The nominal high for silver was $48.53/oz on April 2011 (it was $48/oz in January of 1980). The inflation adjusted 2011 price is now $67.80. And the inflation adjusted 1980 price is $193.77, which would be….quite the rally from here.

I’m not saying it can’t happen, or that it won’t. After this week’s Private Briefing, you may even be convinced it’s inevitable. Or not. I’ll let you decide. Meanwhile, a second chart.

Phil listed three major factors that could drive silver prices higher. The first was the supply/demand dynamic. There’s already a supply deficit. That is largely a function of mine supply, which as I mentioned above, isn’t price sensitive. What about demand?

Two big things are driving silver demand. First is silver’s use in the construction of photovoltaics, otherwise known as solar panels. You don’t need to have a religious belief in the Energy Transition (I certainly don’t) to understand this. Solar panels have become more efficient in the last ten years, turning more sunlight into electricity. A lot of this is down to reduced costs.

Silver is a cost because it’s an important component for solar panels. As long as government policy backs renewables with incentives and subsidies, solar panels will contribute to overall silver demand. I won’t go into details here. But if you’re attending Rick’s show virtually, you can watch the entire presentation.

India is the other big driver for silver on the demand side. India imported 77 million ounces of silver in the first quarter of 2024–the same number as ALL of 2023. Silver is moving out of LBMA vaults in the West to Indian households in the East. Just as the Chinese have been incentivized to save in gold, the Indians are saving in silver (more on this in the Private Briefing as well).

Tom and I are discussing whether it makes sense to add any silver equities to the Official List. They are super volatile and perennially disappointing, so the answer is likely to be ‘no’.

Over the long-term, gold stocks probably provide more reliable and less risky leverage to precious metals prices—if you can find the right project and management team. But stay tuned for that when we release the updated version of The Dollar Report.

Until tomorrow,

Dan

P.S. Uh oh!

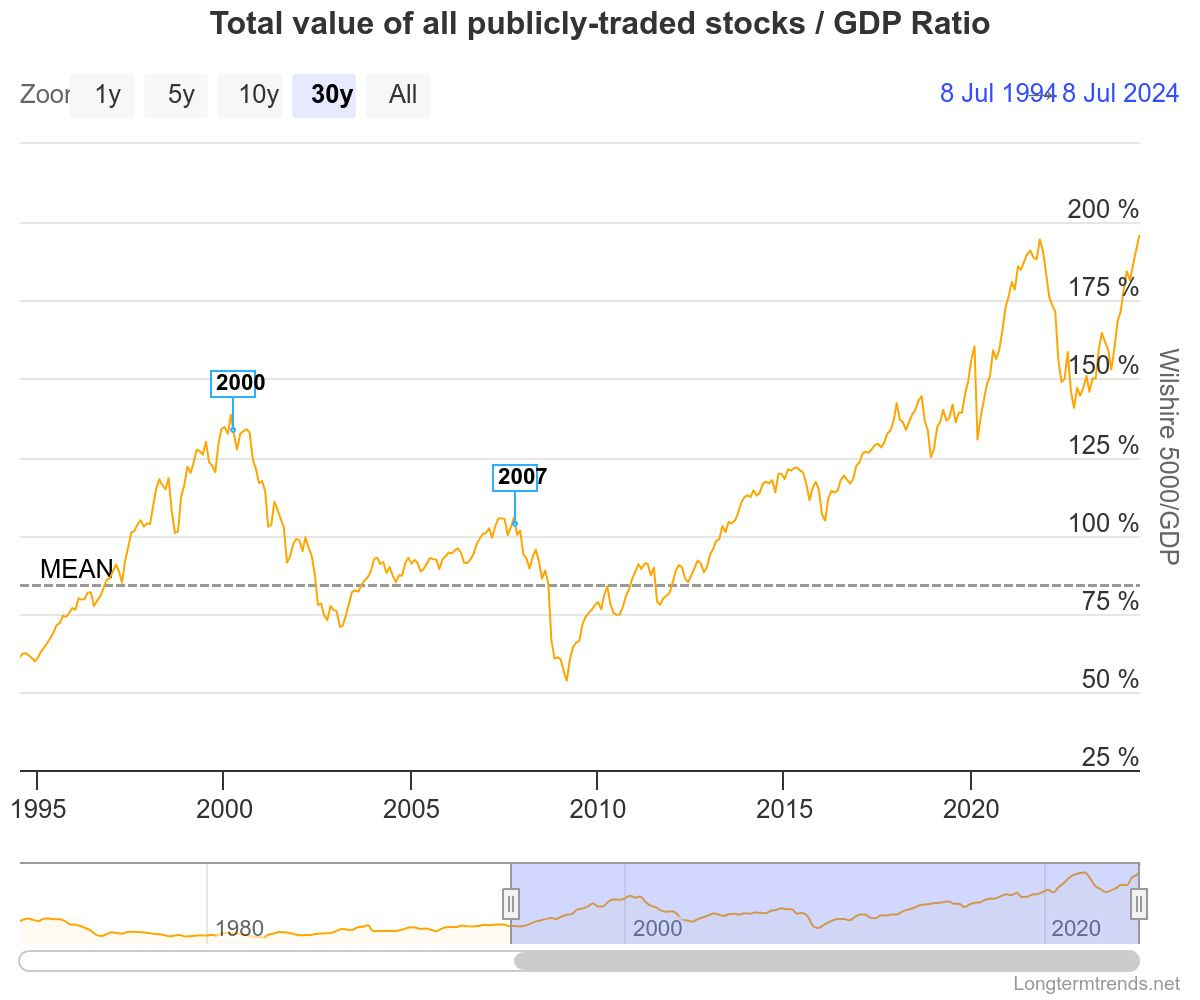

The ‘Buffet Indicator’ has made a new all-time high. For new readers, it’s the ratio between the total market value of all publicly listed US stocks and US GDP. See below.

At 196%, this market has taken out the 2021 peak as the most expensive ever, relative to the real economy (which we believe has entered a recession). The indicator has its critics. But for us, it’s yet another reason to remain firmly in Maximum Safety Mode. Tom will have more to say later today in his Weekly Update to paid readers (with an updated Official List).

Dan, Wyoming became a state in 1890.

In 1980 the silver/gold extraction ratio and the monetary value ratio were very close @17-1. Gold was at $800, silver at $50. The math is close enough.

Today the extraction ratio is 7-1. If the monetary value ratio had moved in tandem over the past $50 years, silver would be $350 per ounce.

Price suppression of silver is more important than price suppression of gold, due to the massive demand by the MIC. They want to keep their raw material costs as low as possible and the collusion between govt, (and not just the US govt) bullion banks, Comex, big hedge funds, and maybe even some of the global miners does that very well. It’s a work of art really.