It's the Money, Stupid!

A short history of the paper monies that cried wolf...

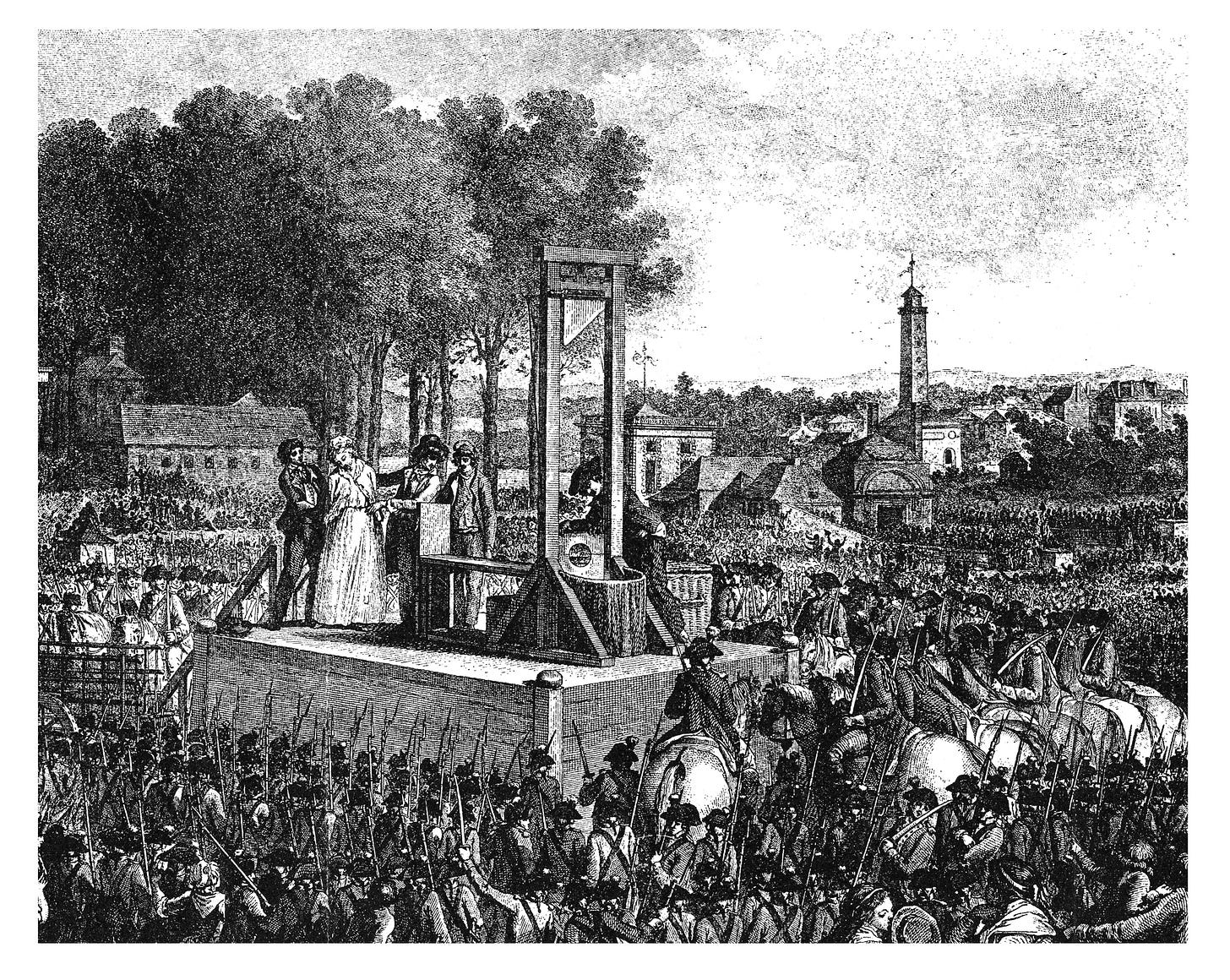

(Old engraved illustration of The execution of Queen Marie Antoinette on the "Revolution Square" (Place Louis XV.) on October 16, 1793. Source: Getty Images)

Joel Bowman, reckoning this Sunday from Trondheim, Norway...

It’s the money, stupid!

Every day, every moment, the world economy finds itself at another crossroads... one path leading down by the rushing rapids... the other headed over a cliff.

It’s the “Decision of the Century,” as Bill reminded readers this week. “There are only two real choices. One way or another, this scam economy is going to blow up. So, the question is whether the Fed blows it up by stopping inflation now. Or, it lets inflation rip and the whole thing blows up later.”

Speaking of inflation, everybody is pointing at rising prices. They are, as you may have heard, increasing at the fastest clip in more than 40 years. (See below.)

But let us pause for a gentle reminder. Ultimately, it is not prices that matter; it’s the quality of the money in which they are denominated. Prices go up. Prices go down. In a properly functioning economy, one rolling along on the rails of a sound money, basic supply and demand corrects for natural market aberrations. (“The cure for high prices is high prices,” as they say. And vice-versa.)

But when the money becomes corrupted, printed up ex nihilo, the value of the information conveyed through each transaction becomes corrupted, too. Consequent price distortions lure investors into deals they otherwise wouldn’t make, for example, turning them into speculators chasing yield. Or they keep wary entrepreneurs on the sidelines, when they might otherwise boldly enter the fray.

Either way, a money nobody can trust ain’t no good for nobody. And the surest way to fiddle with the reliability, predictability and functionality of a money is to crank up the presses and have them go forth and (through the “miracle” of the fractional reserve banking system) multiply. In the end, individual currency units become like the Dollar that Cried Wolf; nobody believes a word from their mouth.

That this is the preferred course of action for tyrants and demagogues throughout history leads us to believe this time will be no different. But that’s no good thing.

“[S]ticking with the inflation policy will be much worse,” Bill warned. “The longer it goes on the more distorted, indebted and fragile the economy becomes. ‘When the money goes, everything goes’ – including the political system… and the social norms that a civilized society depends on.”

As we spend the last few days with visiting family, here in one of the world’s priciest countries (more about which in future Sunday Seshes), we thought you might enjoy a look at what happens when a sound money really begins crying wolf.

We published a version of this essay a couple of years ago, back when covid was just getting to be “a thing.” We’ve updated it some, so as to reflect the path on which our minders have since embarked. Please enjoy...

It’s the Money, Stupid!

By Joel Bowman

Where goes sound money, so too goes civil society.

From drachma debasement in ancient Greece… to clipped coinage during the Roman Empire.

From the freshly-inked assignats rolling off the presses in the lead up to the French Revolution… to the hollowing out of the Weimar Republic during the hyper-inflationary period of the 1920s…

It seems that everywhere we look, monetary pride goes before societal decline… and fall.

Whether denominated in Hungarian pengos, Polish zlotys, Brazilian reals or Venezuelan bolivars, experiments in monetary hijinks invariably end in tears.

From where we usually spend our days in Argentina’s inflationista capital… to the ruinous state of Zimbabwe, once known as “Africa’s breadbasket” and now little more than an economic basket case… Literally from A – Z, in countries the world over, history is replete with cautionary tales of what happens when the feds crank up the printing presses.

And yet, that hoary old cry, “This time will be different!” urges us on, imploring us to ignore all past and documented experience to the contrary.

Why do we fall for such an obvious ruse, over and over and again? Why do we suppose that the immutable laws of economics will be suspended, in our favor, just this once? Is it arrogance or ignorance that causes us to see ourselves as the precious exceptions to history’s iron-clad rule?

Perhaps it’s a bit of both…

To Make and Do

We were pondering this phenomenon in light of the Labor Department’s latest inflation figures, published last week. (See yesterday’s Weekend Wrap-Up for details.) In a nutshell, the report confirmed what ordinary Americans already know, but which appears utterly elusive to the 400+ PhD.s on the Fed’s payroll. Prices are skyrocketing. Here are a few salient line items, courtesy of Forbes:

Meats, poultry, fish and eggs: 14.2% increase

Fruits and vegetables: 11.8% increase

Electricity: 12% increase

Utility (piped) gas service: 30.2% increase

Airline fares: 37.8% increase

Household cleaning products: 9.9% increase

Rent of primary residences: 5.2% increase

The energy index alone jumped 34.6% year-over-year, its biggest increase since 2005. Both natural gas and gasoline are up too, with prices at the pump hitting new records across the country. And since it’s hard to “make and do stuff” without significant energy input, the rising prices we see tend to be spread broadly, throughout the entire economy.

Of course, rising prices are not the cause of inflation, just as falling down the stairs is not to blame for drunkenness, nor are broken scales the cause of obesity. It is merely an unfortunate symptom of having had too much. Too much hooch. Too much cheesecake. And too much money-printing.

The Feds have created more than $8 trillion dollars this young century. And on February 1, 2022, the Treasury Department reported that the U.S. gross national debt surpassed $30 trillion for the first time ever. For those keeping count at home, that’s about $91k per citizen... or $242k per taxpayer.

A coupla trill’ here… another trill’ there… pretty soon, you’re starting to talk real money! (Or at least, real fake money…)

Hmm… what might this potent profligacy portend for the empire’s future? Perhaps a look into the past can provide some clues…

Panem et Circenses

To take just one of the aforementioned examples, that of the French Revolution, the printing presses were rolling long before heads – royal and otherwise – were.

Under Kings Louis XV and King Louis XVI, France had run up enormous debt loads, in part thanks to vast warfare expenditures abroad – including backing America in her own war of Independence – and lavish governmental expenses at home.

Guns and butter, bread and circuses, welfare and warfare…the items on the shopping list change throughout the ages, but the net effect remains the same.

By the 1780s, France’s balance sheet was in tatters. The country’s General Assembly tried tax increases and spending cuts but such austerity measures proved, then as now, unpopular with the masses and so were soon abandoned.

By the end of the decade, all honest options having been exhausted, the French did what so many mere mortals had done before: they looked around for a dishonest one. And they didn’t have to look far.

As the historian Andrew D. White recounted a century later in his rather unimaginatively titled book, “Fiat Money Inflation in France”:

Statesmanlike measures, careful watching and wise management would, doubtless, have ere long led to a return of confidence, a reappearance of money and a resumption of business; but these involved patience and self-denial, and, thus far in human history, these are the rarest products of political wisdom. Few nations have ever been able to exercise these virtues; and France was not then one of these few.

No doubt there were impassioned arguments on both sides, for and against money printing. Opponents pointed to historical disasters, such as the 1720 Mississippi Bubble, still relatively fresh in the Frenchmen’s collective memory.

Proponents, meanwhile, summoned that old saw, tried and true, against which so few politicians can hold their ground. “This time will be different,” they argued… same as always. And so it was that after long deliberation, the General Assembly agreed to a round of money printing…“juste cette fois,” (“just this once”) they’d have told themselves.

The bills, assignats, were to be backed by Church property… especially confiscated for this very purpose. And so, like magic, 400 million of them were put into circulation.

And for a while, the old elixir seemed to do the trick. Commerce picked up, confidence rose and people got to work spending their newly inked notes. Oh, to be alive in the Summer of 1790, France! ‘twas surely the place to be!

Cometh the Fall

By the time the leaves had turned from green to yellow, economic activity had begun to slump and, along with it, the hopes of the monetary conjurers and printing press prestidigitators.

And then, sure as one season follows the next, “The old remedy immediately and naturally recurred to the minds of men,” observed White, “Throughout the country began a cry for another issue of paper.”

Rather than admit they had erred – borrowing from the future that which the present had not yet earned – the General Assembly did what all such assemblies of men in their position do: they doubled down on their devilish deed.

It was not the money-printing itself that was to blame, they rationalized, but rather the magnitude of issuance. 400 million units was simply not enough to stoke the embers and get the fire going again. Perhaps another round would help…

But by then, the fix was in. The conversation has shifted from “to print, or not to print?” to how much should be printed. And so, the presses were cranked up once again, and the newly-inked bills were sent forth across the land… 300, 400 and 600 million units at a time...

Here again Mr. White describes the scene:

The consequences of these over issues now began to be more painfully evident to the people at large. Articles of common consumption became enormously dear and prices were constantly rising. Orators in the Legislative Assembly, clubs, local meetings and elsewhere now endeavored to enlighten people by assigning every reason for this depreciation save the true one. They declaimed against the corruption of the ministry, the want of patriotism among the Moderates, the intrigues of the emigrant nobles, the hard-heartedness of the rich, the monopolizing spirit of the merchants, the perversity of the shopkeepers, ---each and all of these as causes of the difficulty.

And this was only the beginning. Where sound money had gone, civil society was about to follow…

Slowly at first, then all of a sudden, peaceful protests turned violent, and angry mobs began smashing shopfronts and setting fire to businesses. A jilted peasantry thronged the cobblestones, demanding their daily bread, the price of which was cast adrift, afloat on an ever-rising tide of new fiat money.

By the time King Louis XVI received the guillotine’s closest shave, in 1793, there were some 3.5 billion assignats in circulation. And when his wife, Marie Antoinette, lost her own head later that same year, the price of her infamous cake was far beyond the reach of most peasants.

One wonders, when surveying the present-day landscape… with mobs again marching in the street, demanding their just deserts and decrying economic inequality, what role money printing has played in the current malaise.

Heads Will Roll

We see protesters, for instance, berating the world’s richest man, Elon Musk, for proposing to buy Twitter for $43 billion.

“He could have cured world poverty for only $6 billion,” they chided. The Tesla CEO has been the beneficiary of the Fed’s EZ money economy, no doubt about it. But he did not print the dollars himself. He merely saw that they were being pumped into the market... and backed up his electric vehicle in anticipation.

Besides, the US alone spends more than the Twitter deal in foreign aid per year, plus countless times that amount pretending to fight poverty at home. (The CATO Institute puts the cost of the War on Poverty at more than $23 Trillion. The poverty rate in the US in 1972 was about 12%... almost exactly what it is today, half a century on...)

And anyway, if the proposed buyer of the Little Blue Bird could have made an impact by donating some dollars, surely the proposed sellers – who, after all, stood to receive all the cash – could do the very same thing, no?

But all that’s beside the point. Had the protestors actually read their history, they might be inclined to redirect their righteous indignation toward the nation’s capital instead, specifically to those pulling the levers at the Federal Reserve building, whence the flood of new scrip gushes. Then again, if they really did know the story, they would know too that after the royal heads did roll, it was the Jacobin revolutionaries themselves whose necks were next on the block.

Where goes sound money, indeed.

Cheers,

Joel Bowman

P.S. Keep an eye out for the return of your Fatal Conceits podcast, next weekend, when we’ll be visiting Bill at his home in Youghal, Ireland. He’ll be back with his regular daily missives, tomorrow...

"Dad, how does inflation work?" asked my child of 23 the other day.

I gazed over at him as we drove through traffic. He held my gaze, and I sensed he really wanted to know this time. Not a Google answer, but something he could relate to. So I did my best to emulate Bill Bonner/Joel Bowman, two people I hold in high regard for having great insight and ability to wade through the bulls*it and make this all make sense to us.

"To inflate, means to make bigger than originally, in terms of size or volume. Take for example a balloon. When it sits there, inert and deflated, it doesn't really do anything. If you were a bug, you could alight it, and it would just lie there. No danger to you, or itself.

Now fill it full of air, and suddenly it reach lofty heights. Unfortunately, as with anything that goes up, it eventually will come down. Sometimes gradually, and sometimes, if it pops, catastrophically. And the alighted bug, would plummet to the earth along with it.

The economies of the world are like that balloon. You never want to inflate an economy, or make it larger than it really is, for the danger lies in bringing it back to normal size. No one in history (so far) has been able to do that. At least not without bloodshed and pain. Let me explain.

First of all, life is a game of supply and demand. In order to play, there is a simple rule. You work. You get paid. You demand something from a supplier. You give them $1 and they give you $1 worth of goods. You go back to work, to continue the cycle. You supply something that the world needs. The world repays you in dollars so you can go get what you need. In a perfect world (no such thing), the dollars even out in the game of supply and demand.

Let's break this down to a super simple example.

3 people. A Farmer, a Baker and an Accountant.

The farmer grows wheat. He then sells 2 units of wheat to the baker. For $2.

The baker makes bread. He then sells 1 unit of bread to the farmer and 1 unit of bread to the accountant. For $1 each. Total $2.

The accountant does books. He does the farmers books for $1 and the baker's books for $1. Total $2.

In this super simple example, total money is $6. No inflation. Just a supply and demand economy.

Now let's inflate this scenario by bringing in a 4th person. Someone who does NOT work. But has gotten FREE money from the government. Via a loan from the bank at 0% or a stimmie cheque. They come with $2 they borrowed or got for nothing. They turn to the baker and say that they would like to buy a loaf of bread. But the farmer wants to buy some bread too. As does the accountant. Faced with 3 people who all want a loaf of bread, but only 2 loaves to sell, he raises his prices. He sets the price of a loaf of bread at $2. The person with the free money gladly pays the $2 as he is hungry. The farmer and the accountant have to go back to work as they do not have enough money.

What happened?

Total money supply was increased by 33%. Whereas money supply was $6, it is now $8. But total work output, never changed. It was still 6 hrs of labor producing $6 of money supply. The printed money inflated the money supply, in turn causing prices to inflate or rise, based on supply and demand."

"So how do we fix the problem?" my son asked.

"Remove the fake money."

"How do we do that?"

"Two things.

Stop printing money. That one should be obvious.

The less obvious is to raise interest rates. Why?

If they remain at, or near 0%, everyone borrows money and prices sky rocket. Make it harder to borrow and a lot of those that did borrow money, will not be able to make their payments. Others that want to borrow won't be able to do so with high interest rates. Both won't have money to buy that loaf of bread. The price of bread will stop rising, as there will only be working people buying that bread. The ones that made their money honestly.

In other words, take free money (both printed and borrowed) out of the equation. And bring sanity back" I said.

"Is it possible?" he asked with a tremor of excitement in his voice.

"Anything is possible, but more than likely, those at the trough, the ones that have been voted in to make the hard decisions, will stay feeding until the last possible second. They'll keep interest rates artificially low as long as they can, kicking the can of responsibility (increasing interest rates) down the road for someone else to fix. And then run to the hills when the revolution comes."

"So there is a lot to look forward to" he said with a chuckle.

"A lot" I said smiling back.

Is it possible to put the Fed and the majority of our political leaders in the same position as Marie Antoinette October 16, 1793?