It's a Trap

Thanks largely to the EZ money era wrought by America’s funny money, the world’s reserve currency, feds everywhere spend too much money. Economies adapted to the cash flow.

Thursday, September 11th, 2025

Bill Bonner, from Poitou, France

‘Democrats are a party of America’s professional elites plus various interest groups. And given that Trump won a majority of blue-collar voters, they are no longer the natural home of the working class...The practical difficulty is that the party is shaped by elite professions, particularly law, government, media and academia. Such types often have a hard time concealing their distaste for those who voted for Trump. This is a poor starting point.’

--Ed Luce in the Financial Times

The deeper problem for the democrats is the one signaled by German Chancellor Merz: Their program is bankrupt...the economy doesn’t produce enough wealth to support their giveaway social programs and heavy economic regulation.

Since the days of Lyndon Johnson they have promised guns and butter. And in the days following Lyndon Johnson, 1971-2021, the fake dollar made it look as though they could afford them both. But debt rose. Growth slowed. And with the money running out, they turned to disguising the decay, like an aging dowager, hiding harsh truths under a veneer of botox and plaster. The result was hideous.

During the Biden Administration, we were meant to believe that the world would be a better place if we hooked up with a man from Addis Ababa...and pedaled to work after a meat-free breakfast. Federal employees were asked which pronouns they preferred. Bathroom policies became a battleground. And if a murder was committed by a member of a special group, the media was not permitted to say so...or be labelled ‘racist’ or ‘transphobic.’

Much of that cultural claptrap has been sucked down into the maelstrom of Trumpism...causing much wreckage...and leaving the democrats with nothing to offer other than not being Trump.

But Trump faces the same problem. The social spending continues…military spending increases. He can’t afford so many guns and so much butter either. And it will become a bigger problem as stagflation becomes more obvious. Here’s the latest from the OECD:

U.S. GDP Growth Expected to Plummet Amid Trade Policy Uncertainty

New trade policies are expected to slow American GDP growth from 2.8% to just 1.6% this year. Economic uncertainty and higher tariff rates are driving the projected decline, according to the latest OECD forecast.

And from Newsweek:

Falling lumber prices suggest there is trouble ahead for the struggling U.S. housing market, as builders scale back new construction because of a recent inventory glut and growing economic uncertainty.

After Trump exhausts his phony solutions — lower taxes, tariffs and interest rate cuts, all of which make the situation worse — he will be forced to choose. Guns or Butter?

Our guess is that he will choose guns, as Big Men tend to do. That is the real reason, the historic reason, for switching the Pentagon from defending the country...to making war.

Here in France, too, the Wall Street Journal describes a similar situation. Running out of money, President Macron — like Donald Trump in 2017 — hoped to boost revenues by stimulating the economy with tax cuts. The result:

Eight years later, the boom hasn’t arrived. And the yawning deficit created by those tax cuts is now fueling one of France’s most serious political crises of the postwar era, casting doubt on the future of his ambitions to unshackle the French economy.

Macron lost his second government in less than a year on Monday, after a no-confidence motion went against Prime Minister François Bayrou, who had proposed 44 billion euros in cuts to reduce the deficit, equivalent to $51.76 billion. Bayrou resigned on Tuesday.

Thanks largely to the EZ money era wrought by America’s funny money, the world’s reserve currency, feds everywhere spend too much money. Economies adapted to the cash flow. And now, the politicians are all in an ‘inflate or die’ trap. If they cut back, the bubble economy has a coronary and political careers go to the grave. And if they inflate...well...they get a few more years of Argentina, Venezuela...or the Weimar Republic, perhaps followed by re-armament and war.

And what about the great hope from the pampas — Javier Milei? He chose to let the bubble economy die. Rather than try to goose up revenues with more fake money stimulus, he told voters ‘we have no money,’ and cut spending, balanced the budget, and reduced inflation by 90%.

But the river of ‘something for nothing’ runs wide and deep. And the current runs swiftly through Buenos Aires province, where he just lost an important local election. If he loses the national election — in 2027 — he will mount the scaffold, the elites will go back to stripping the economy for their own benefit, and Argentina’s 70-year decline will continue.

More to come...

Regards,

Bill Bonner

Research Note, by Dan Denning

Core inflation, which does NOT include food and energy, is running at an annual rate of 3.1%, according to government data released this morning. While the real core rate is almost certainly higher, markets are pricing in a Fed rate cut of at least 25 basis points next week. Meanwhile, initial jobless claims of 263,000 were both higher than expected AND a four-year high.

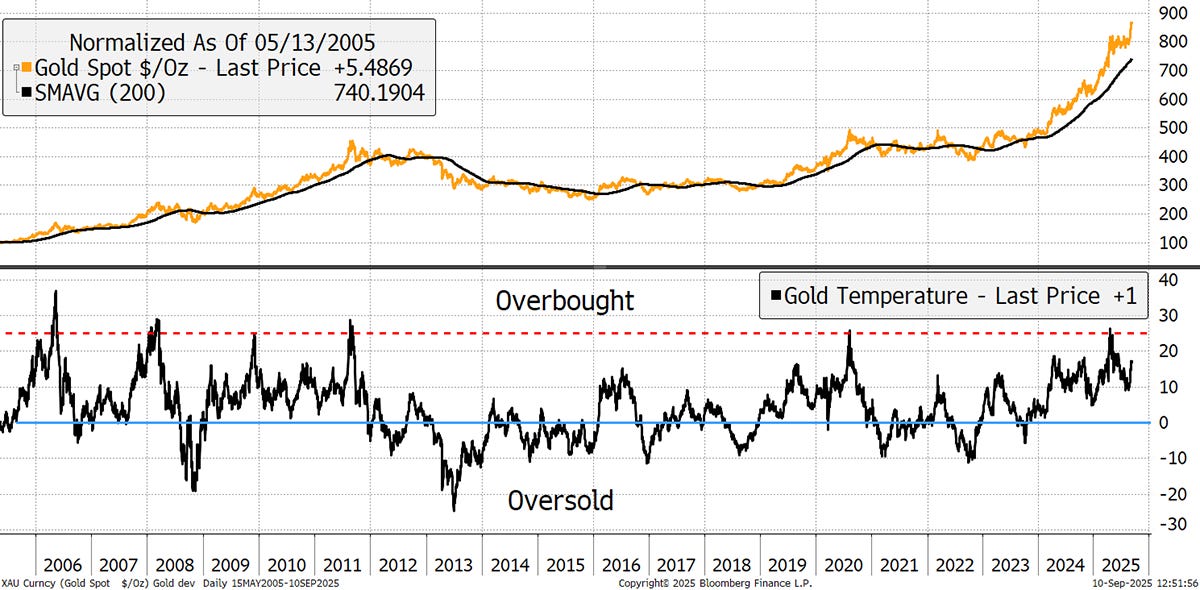

So inflation is higher than the Fed’s target and has been now for years. Yet the labor market weakness (if the official data can be trusted) suggests rate cuts are coming anyway. Into this stagflationary set up we look at the chart above from our old friend in London, Charlie Morris at Byte Tree.

Charlie says that earlier this year in Apri, gold was overbought when it traded 30% above its 200-day moving average. It is ‘less’ overbought today trading at 17% above its 200-day moving average. For perspective, at the peak of the market in the late 1970s, gold traded 145% above its 200-day moving average. That would imply a price of $7,969/ounce today.

.

Let’s quit calling these failures “Administrations,”. That word’s too polite, too bureaucratic, too much like they’re handing out library cards instead of cyanide pills.

Nah, these are gangs. Straight-up Bloods and Crips with better pensions. Red ties, blue ties, same body count, same racket, same colors spray-painted on the casket. You thought Tupac and Biggie was bad? America’s headlining the world’s first bipartisan drive-by democracy. And it doesn’t end with bullets, it ends with stagflation, debt ceilings, and bathroom wars.

So they promised us guns and butter Bill, now all we got is bullets in our wallets and margarine that tastes like ass and despair. Trump ain’t no savior, his plan is basically the Atkins Diet for economies: cut taxes, binge tariffs, and pray your arteries don’t explode. Either way, butter melts, guns jam, and the only thing growing is the deficit and the worms feeding on it.

But don’t worry, folks, Sir Elon Musk, the only genius left breathing without embalming fluid is hovering out there like a one-man Third Party, waiting to beam us up before America’s last act looks like a Vegas Elvis impersonator reading Revelations on a karaoke mic. Until then, enjoy the feud, Bloods, Crips, Dems, Repubs, same gang, same hustle, different flavor of apocalypse.

If I was Trump I would do exactly as he is doing. I would get a budget which allows himself money to work with. If he was to move into austerity immediately his support would collapse.the non-savers are simply too large a component of American society. They would not support him for very long if the economy and their jobs turned south. Then after I exposed the corruption and the causes and removed the DOJ stalwarts, through the Supreme Court, I would have two years and Congressional support to make the dire changes of austerity and a tiny window to make those changes work, like Milei has. Once society has been shown all the corruption, the lying main stream media, the healthy changes to a drug infested society and they have seen the assassinations of conservatives globally and the direction of left wing globalists Then society will be ready to accept the punishment of hard money to correct the obvious problems forced upon society by left wing leadership. They will see the left wingers as war mongers and economic incompetents and assassins that would provide a clear view of what society would be in for with their self centered, incomplete understanding of reality, like climate change and covid vaccines, given their self righteousness and elite mistakes in their understanding of society. Yes, society is not that insightful but it needs decent leadership that sees the good, rightful and God centered leadership something that has been poorly lacking for decades, until Trump.