Interest Rates, Observed

Lower interest rates encourage borrowing. That’s the whole idea. Debt goes up. Spending goes up. The feds ‘print’ more money to cover their deficits. Prices rise further.

Thursday, June 26th, 2025

Bill Bonner, from Youghal, Ireland

Let’s return to the question ‘What to do with your money now?’ keeping in mind that things can change, fast.

On Monday, we were at war. By Tuesday, it was ‘TIME FOR PEACE.’ And now, investors hold their breath, awaiting the next news flash. Trump vs. Powell, the US vs. Iran war, the Big, Beautiful Budget Abomination vs. fiscal rectitude…ICE vs. ‘illegals’…the Supreme Court vs. Presidential power – at any moment, the artillery shells could begin landing.

And bonds are an obvious target of opportunity. They appear to have entered a long-term primary downtrend. If the patterns of history repeat themselves, we could be looking at higher interest rates for the rest of our lives.

Interest rate cycles may reflect the human life cycle. Before 2020, the last low for yields came about the time we were born — after WWII. You could get a 4% mortgage in the late ‘40s. And then you had to wait about 70 years to refinance at the same rate.

Mr. Market controls the long cycles in bond yields. But Mr. POTUS thinks he knows better. He wants the Fed to cut rates and keep them low. Trump:

“Europe has had 10 cuts, we have had ZERO. No inflation, great economy - We should be at least two to three points lower. Would save the USA 800 Billion Dollars Per Year, plus. What a difference this would make.”

What difference would it make?

One of the differences came in the news today, Bloomberg:

Dollar Weakens as Trump Considers Naming Next Fed Chair Early

Bloomberg’s gauge of the greenback dropped to the lowest level in three years.

A lower dollar makes differences of its own. Imports become more expensive. Add tariff taxes and price hikes can be substantial, making consumers poorer.

Digressing for a moment, poverty is not always easy to see. Average wages can rise...even as most people have less money and less spending power. GDP can go up even as it becomes harder and harder to find a good job or afford a decent place to live.

Recall that the Biden team had trouble convincing voters that the economy was strong. The statistics said so. But people didn’t believe it.

We’ll come back to this subject — the fakiness of our ‘leading’ statistics — but here’s a hint. Newsweek:

While headline unemployment may be stable, an increasing number of Americans are experiencing what is referred to as "functional unemployment," a term that highlights the deeper issues facing America's workforce.

According to the Ludwig Institute for Shared Economic Prosperity (LISEP), 24.3 percent of the country now find themselves "functionally unemployed," defined as "the jobless plus those seeking, but unable to find, full-time employment and those in poverty-wage jobs."

Would lower interest rates help? Between 10% and 0% are 1,000 basis points. The odds that POTUS will know exactly which one the economy needs are very, very low. The right rate is not chosen – neither by the Fed or by the president. Instead, it is discovered by Mr. Market.

In practice, politicians always want lower rates. People borrow and spend. Laissez les bons temps rouler…and get re-elected. But interest rates are a price — the price for using someone else’s savings. And like any price, it gives us valuable information about the amount of savings available, the eagerness of borrowers, and so forth. Any interest rate chosen by anyone other than Mr. Market himself is likely to be ‘wrong.’ It will convey false information to both borrowers and lenders.

Don’t lower rates encourage employment and GDP growth? Maybe. But only if they are true. Following the mortgage finance crisis, the US had more than a decade with the lowest interest rates in history. Below zero, in real terms, for much of the period. But the only thing that changed substantially was the level of US debt. It toted to $10 trillion in 2008. By 2020, it was up to $27 trillion.

Lower interest rates encourage borrowing. That’s the whole idea. Debt goes up. Spending goes up. The feds ‘print’ more money to cover their deficits. Prices rise further.

Then, interest rates go up, as lenders anticipate more inflation...and sooner or later bonds go down as the full faith and credit of the US government erodes.

There’s nothing new about this. Nothing we don’t know already. The cycle is unrelenting. Uncompromising. Irresistible. Logically inevitable. Empirically proven.

Bonds rise. Then, they fall. The politicians can blab and bluster. Fed governors can pretend to know what they are doing. But Mr. Market always has the last word.

Regards,

Bill Bonner

Research Note, by Dan Denning

Investment Director Tom Dyson published the July Monthly Strategy Report last evening. Paying subscribers can find it here. The report went public just as the S&P 500 is on the verge of a new all-time high (in nominal terms), with the ten largest companies making up a record 38% of the index’s total market value.

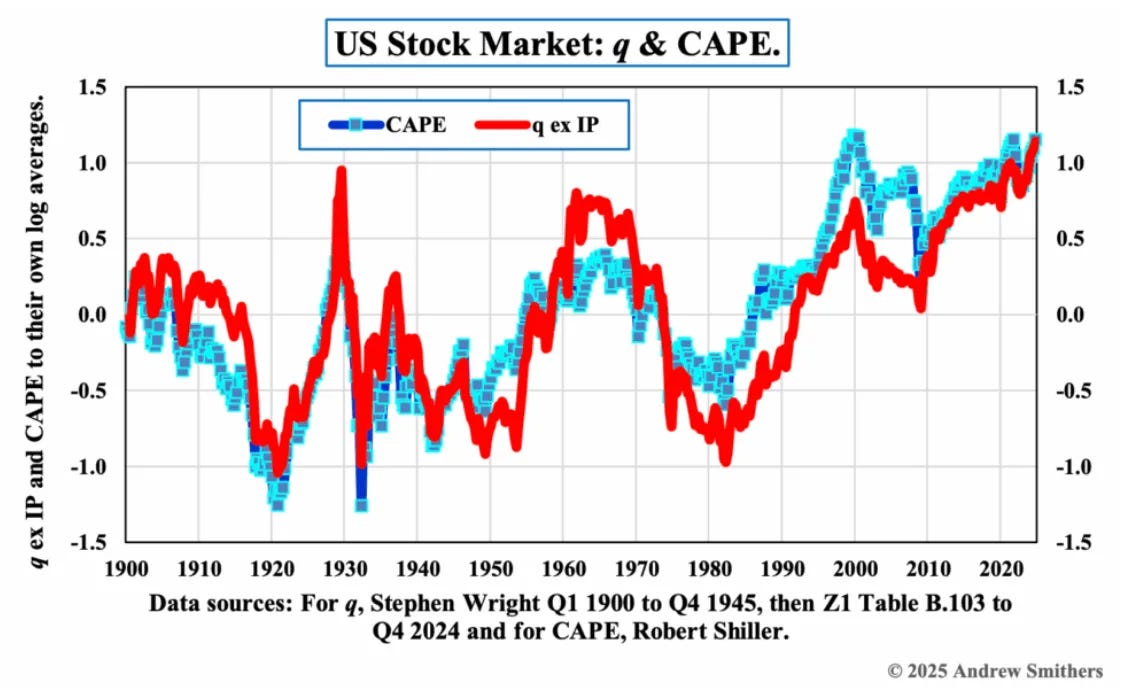

Tom also brought to our attention the ‘retirement’ of the famous ‘Q’ ratio. The ratio is a quick and dirty way of measuring whether a company is over- or under-valued. It does so by comparing the market value of the company to the replacement cost of its assets. A ratio higher than ‘1’, where market value is higher than replacement costs, tells you investors are expecting a lot of earnings growth (and that the stock is probably over-valued).

Q, like all conventional measures of value, shows that US stocks are historically over-valued. Critics of ‘Q’ say that the market value of America’s leading tech firms is increasingly driven by ‘intangible’ assets whose value is not accurately measured on the balance sheet, but that give American firms and a long-term competitive advantage. Q is outdated, in other words. Tom wrote this in yesterday’s report:

There is no example of an overvalued market that did not become undervalued. If so, stocks will be dead money for many years to come…maybe decades…Every year we’ve warned about stock market valuation and every year it seems to get more and more extreme. Bull markets don't die of old age. And a one-day war with Iran is not enough to stop them. But from a strategy point of view, we are right on target by favoring gold over stocks, hard assets over paper money and income over growth.

Thinking you know what hundreds of millions of market participants are thinking is the height of arrogance and ignorance. Both know the U.S. government has a pile of debt to refinance that will blow a huge hole in the big beautiful abomination of a budget at the current rates. Solution; financial repression. Give the retirees and savers nothing for their savings and thus force them into riskier assets to seek yield. A government that takes advantage of its most vulnerable citizens (i.e. Retirees) in this way doesn't deserve to exist. The only way these miscreants are able to get away with this theft is by keeping the masses financially illiterate. The moron politicians should reinstate the pre-plandemic budget and begin cutting from there. A good stiff recession to purge the decades of malinvestment is long overdue. The continual kicking of the malinvestment can down the road does nothing but insure a systemic collapse. Sovereign debt crisis here we come :-)

Thank you gentlemen🙏 this is why I signed up to BPR!