Extinction Level Events

The positive case is that advances in computational power and AI are the most powerful technological changes of all time. In energy, medicine, and manufacturing, life will get exponentially better.

Friday, June 13th, 2025

Laramie, Wyoming

By Dan Denning

Well, if the sun comes up at 3am tomorrow, we’ll know things have gotten even worse in the Middle East. As it stands, the latest unconfirmed reports are that Iran has closed the Strait of Hormuz. If true, this will have implications for the oil price. More on that below.

In the meantime, stocks were down as the missiles flew. Precious metals, not so much. Silver closed at $36.38/ounce. You have to go all the way back to February of 2012 for a higher close, where it closed at $37.14. But back then, it had already begun making lower highs after hitting $43.90/ounce in April of 2011.

It’s a different monetary world now. And the Primary Trend is our friend. I suspect we’ll see new all-time highs in this cycle. There’s no better indicator of that than the gold price. Spot gold was up over $50/ounce in today’s trading to $3,452/oz. That WAS a new daily AND weekly closing high (in inflation adjusted terms). Most of the move came in early trading, which means that (so far) there’s been no reaction to possible escalation over the weekend. Stay tuned…and have a look at the chart below.

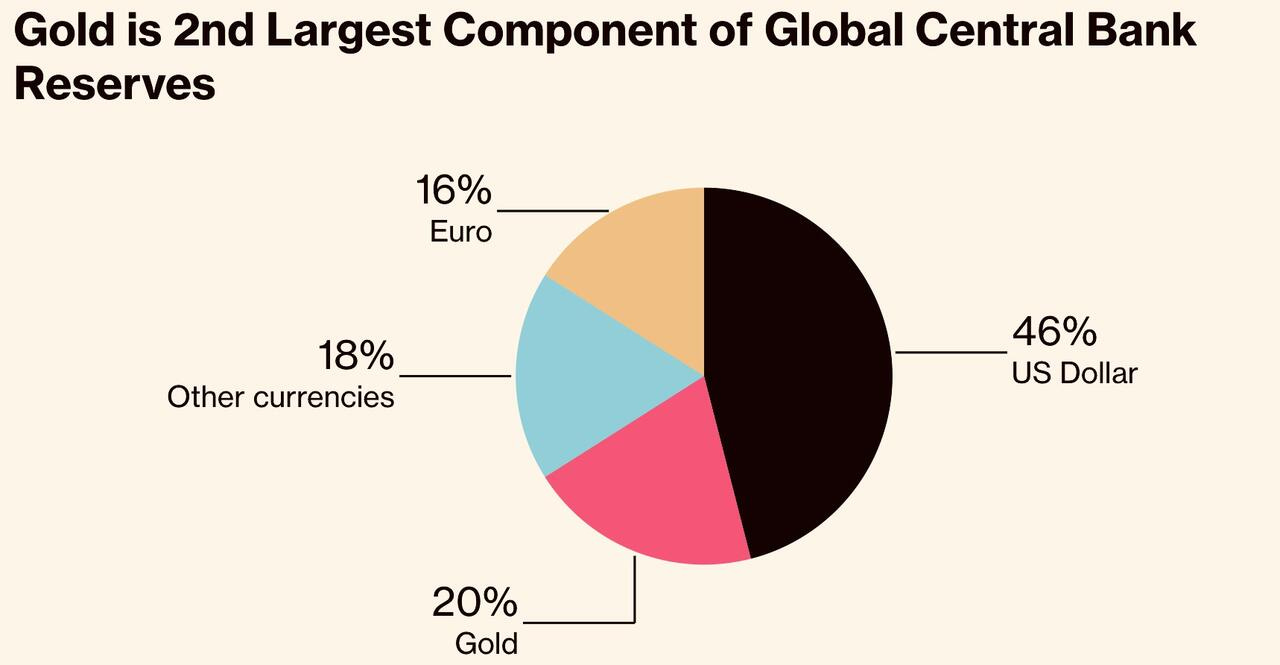

You could have had an ounce of gold for $1,991/ounce in mid-February 2024. It’s up 73% since then, and 44% in the last year. That gain is down mostly to central bank buying, which you can see in the chart above. Gold has now replaced the Euro and ‘Other’ currencies as the second largest component of central bank reserves, according to Bloomberg.

Central banks don’t know anything you don’t know (and probably, they know a lot less). But the trajectory of out-of-control US deficits has been clear for five years now. All projections are for deficits of 6% of GDP or more every year as far as the eye can see. The debt ceiling is likely to be abolished when the Big, Beautiful bill finally passes. And if America’s $37 trillion national debt wasn’t bad enough, there’s a 50-50 chance that despite being elected on an ‘America First’ mandate, President Trump may drag us/be dragged into another war. Let’s hope not.

My main point is that gold’s rise (and strength) have happened despite very little interest from retail buyers. When that kicks in, buckle up baby. But two other points. We’d probably be further along in the gold cycle if it weren’t for cryptos. Cryptos have become–and I know this might upset some readers–a vehicle for speculative liquidity to play around in.

In the past, some of that money would have found its way into bullion or into the market capitalization of the gold mining stocks that are generating heaps of free cash flow at current prices. The entire crypto sector has a market cap of about $3.2 trillion. Gold’s market cap, at current prices, is closer to $23 trillion.

But the more important number is $500 billion. That’s the total market cap of all the gold miners–and generous because it includes all the small fish that could be acquired by the big fish. Any marginal shift in liquidity from crypto to gold stocks will move prices–spectacularly higher if past cycles are any indicator. And that doesn’t include any shift in more general retail interest–which in past cycles has only come after the big price moves in bullion.

One final point, which seems fitting this week. I referred to gold’s strength. But what we’re really talking about here is the fundamental weakness of the US dollar (and of all paper money in a debt-based money system). Gold doesn’t move. It’s the dollar going down. And to the extent that we buy gold as ‘catastrophe insurance,’ we have to balance the satisfaction of great performance with the reality that catastrophes of any sort destroy lives and property. Speaking of which…