Dol Vol and 'the next 1979'

Extraordinary volatility in the gold price can also be seen as the entire world coming to grips with the fact of a doomed dollar…and not being fully prepared for it.

Wednesday, October 22nd, 2025

Laramie, Wyoming

by Dan Denning

First a quick reminder that Investment Director Tom Dyson is on the road for a family funeral. He’ll be back next week with the November Monthly Strategy Report. That will include our latest reading of the Doom Index, which, in the absence of official data due to the on-going government shutdown, will give us a clear picture on whether the real economy is expanding or contracting. And below, as usual, I’ve posted an updated version of our Official List with today’s closing prices (more comments on this below).

Second, the spot prices for both gold and silver closed higher today. After yesterday’s bloodletting, you’d be entitled to wonder if there would be more selling ahead today. Which prompts the question…

What DID happen yesterday?

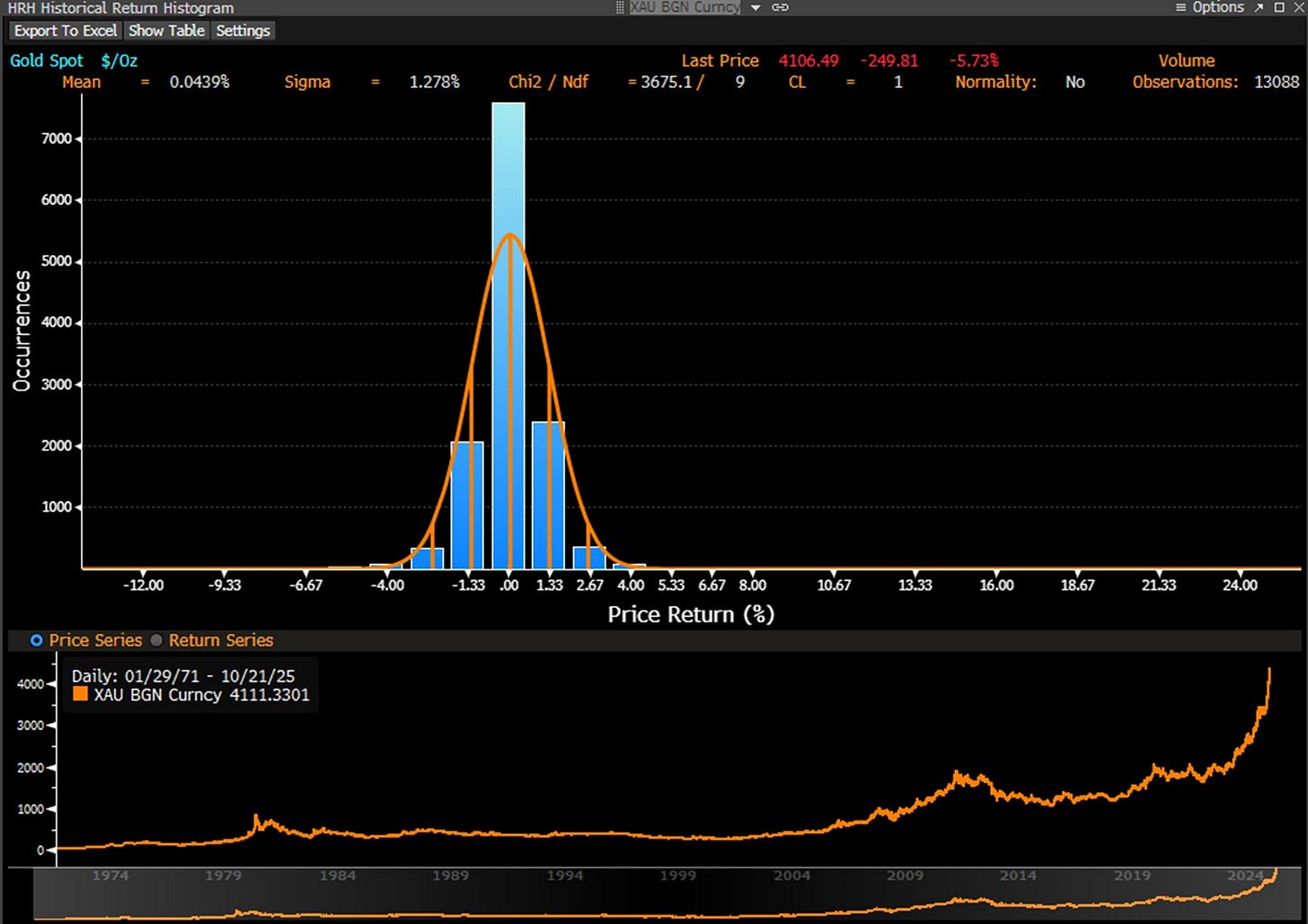

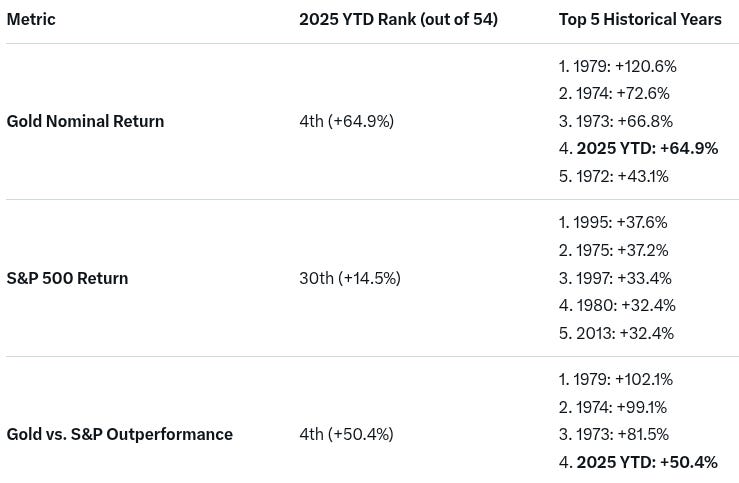

From a strict numbers point of view, the 5.7% one day fall in gold (8.7% for silver) was the biggest drop since 2013. Keep in mind this came after a nearly 60% year-to-date rise for gold. Some profit taking (rather than distressed selling) was in order after such a strong performance (in nominal terms AND against the S&P 500). See the numbers below that put gold’s year-to-date performance in historical context.

In statistical terms, this week’s price action is a good reminder that volatility is real (especially for the mining stocks, whose leverage to metals prices is thrilling on the upside and chilling on the downside). Even so, the chart at the top of my note shows how rare one-day moves are like this. Only 34 times since 1971 did you have bigger one-day moves (in either direction).

Let me also suggest something else…

Maybe this is not gold being volatile. Maybe it’s a cardiac arrest for the US dollar and the whole global system that runs on it. In the past I’ve showed you the performance of stocks (and gold) during the Weimar inflation in Germany in 1923-24. Extraordinary volatility in the gold price can also be seen as the entire world coming to grips with the fact of a doomed dollar…and not being fully prepared for it.

It hasn’t changed anything in our strategy. But you would have noted the big move down in the miners, which shaved off some of our gain in our silver position. This is why we generally avoid the speculative miners. Yes, you get leveraged upside exposure…but it comes with the volatility AND share price risk on the downside.

It has it’s place, but in the right position size and without compromising Maximum Safety Mode. If we’re right that these are the early rumblings which preceded a bigger currency earth quake, Maximum Safety Mode remains the best place to be. Here’s the updated Official List