Desert Island Challenge

Where is the Big, long-term gain? We are looking at the biggest credit bubble in financial history; the risk is that it will blow up. Where can we rest comfortably… safely… profitably?

Wednesday, January 29th, 2025

Bill Bonner, writing from Baltimore, Maryland

Where’s the Big Gain? Is there one?

For every patch of ice on the sidewalk there’s a tort lawyer dreaming of a beach house. And for every big sell-off, there must be a big run-up somewhere else. Or not?

The press is focused on the techs, as we did yesterday. They seem extremely vulnerable… especially now that China has introduced a low-cost competitor. You could probably make money by ‘shorting’ them.

But that is for gamblers. What we want to know is: where is the Big, long-term Gain? We are looking at the biggest credit bubble in financial history; the risk is that it will blow up. Where can we rest comfortably… safely… profitably?

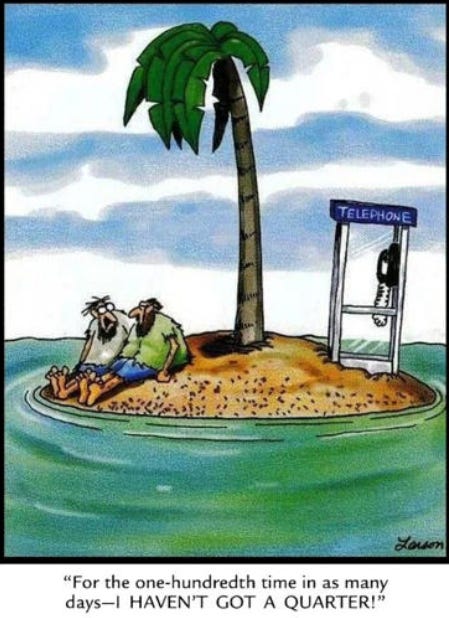

Early this year, a colleague, Porter Stansberry, put a similar question to a group of analysts. The idea was first proposed as the ‘Desert Island Challenge’ by Warren Buffett in 1969. Buffett invited prominent investors to the Colony Hotel in Palm Beach, Florida.

Each was asked to name a stock to hold for ten years… as if he were shipwrecked on a desert island. Most of them picked the bright, shining stars of the 1960s ‘Nifty Fifty’ market — Coca Cola, Polaroid, and IBM were favorites.

Buffett himself chose Dow Jones & Co, publisher of the Wall Street Journal.

But then came the stagflation of the ‘70s. The go-go market of the ‘60s had raised up stock prices… and then, the bleak ‘70s pushed them back down again. Stock prices went nowhere, while inflation reduced real values by more than 50%.

Even the shrewdest investors in America couldn’t beat the Primary Trend. Most of the choices were losers.

This time, Stansberry’s participants are once again betting on proven winners, expecting them to remain winners. Hershey, PSH (Pershing Square, Bill Ackman’s company), Chubb, CME, and Philip Morris were among the choices. Philip Morris, by the way, is the most profitable company in US history… with a very long record of both capital gains and dividends, stretching back to its incorporation in New York in 1902.

But this time at least two of the big-league analysts are betting against the stock market. They chose Bitcoin… reckoning that the crypto currency would do better than America’s most successful wealth-producing companies.

Who will be right?

Most likely, none of them. All are betting that the future will be much like the recent past. Which is why you have to know where you are in order to get where you need to go.

Led by the US, in the late 20th century, the whole world moved away from gold-backed money. This enabled people to borrow far more than they had before. Central banks conveniently lowered interest rates… making it easier to repay… raising capital values…and making borrowing more attractive than ever.

The US itself provides a good illustration. In 2000, total US debt was $5.6 trillion. That year, the federal government paid $350 billion in interest. Over the next 25 years, debt rose nearly seven times. But the interest paid on the debt only increased to $510 billion in 2020 — not even 2 times. Meanwhile, the Fed Funds rate went from 6% in 2000 down to under 1% in 2020… effectively masking the burden of so much extra debt.

Globally, total debt increased in harmony with the US. Worldwide, total government debt is running about $100 trillion… with total public and private debt over $300 trillion.

Last week, we explored how asset values (supported by debt) were no longer tethered to real output. A company that produces ten autos a year might make a 10% profit on each one… and be worth, say, ten times profits… or the equivalent of 100 autos.

Then the Fed lowers the interest rate, and suddenly, the company is worth 200 autos. But there are still only ten autos coming off the assembly line each year. Half of the company’s stock market value is phony. And now, all up and down the street, real estate, stock and bond assets have been boosted by central banks’ interest rate meddling… not by increases in earnings or real goods or services.

Charlie Bilello:

With a CAPE Ratio of 37.8, US equity valuations at the start of Trump’s second term are higher than the start of any other presidential term in history. Which is another way of saying that expectations today are extremely high. Historically, that has meant below average future returns for stocks when looking out 10 years.

This is where we are. US government debt grew by $2.2 trillion last year, while the interest rose to $1.2 trillion. Such a debt build-up (and corresponding increase in credit-supported asset prices) can’t continue for long. Which means, the future must be different from the recent past… and the investments that did well over the last ten years are likely to do badly over the next ten.

Meanwhile, lenders and investors hold trillions of dollars’ worth of assets — with no corresponding real-world wealth.

The risk of the Big Loss is obvious; those assets could fall in price.

But what’s on the flip side? What happens when $100 trillion of phantom asset values disappears?

Tune in tomorrow.

Regards,

Bill Bonner

Like I said, youngsters, the single worst mistake made by a president was Nixon's decision to take us off the gold standard. The big question is whether to be invested in Crypto's or precisous metals. Since I'm old, I'll stick with gold, silver and (gold/silver/copper) royalty stocks. Many of you youngsters are going with the Crypto's and could be correct. Consequently, we may find out whose correct in the next 2 years. It's the same old story. You pay's your money and you take's your chances.

I'm going with Bill's analyses. GOLD!. It's easy to forget about the leverage of 40 years and get FOMO especially as the rise of "only the FANGS" shoot upward in a grand finale. I've seen that formation before.