Dance Like a Bear

Capital investment in AI–which may turn out to be the biggest misallocation of capital in US financial history–is based on the idea that the whole economy needs more AI, more compute, and more tech.

Friday, August 1st, 2025

Laramie, Wyoming,

By Dan Denning

‘The gypsies believe the bear to be a brother to man because he has the same body beneath his hide, because he drinks beer, because he enjoys music, and because he likes to dance.’

–The old man Anselmo, For Whom the Bell Tolls, by Ernest Hemingway

Greetings from the High Plains of Laramie, where the dog days of August have arrived. Did you know that since 1928, August is the second worst-performing month of the year for the S&P 500, in terms of total returns? September is the worst month. Add them together, starting now, and the summer slump becomes…a bigger fall.

Remember, even bears like to dance, drink beer, and listen to music. Some readers wonder if we revel in bad news and gloom. But that’s not the case. Like bears, we dance, hum along to a good tune, and drink a weekend beer or two. But we have to reckon with the world as it is while trying to be as cheerful as possible. Which brings me to this chart.

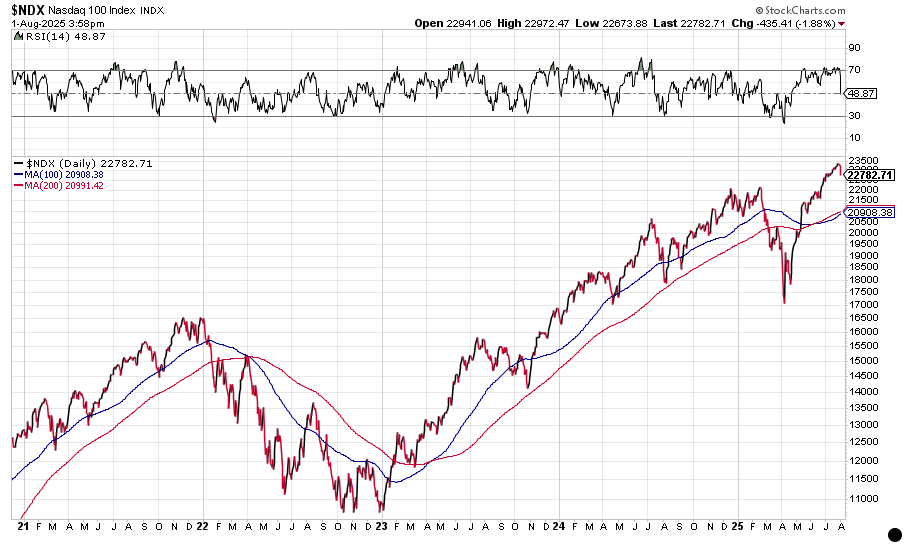

The Dow lost almost three per cent this week and all the major indexes were down big today. This is what happens when valuations are so extreme. The bad news–in this case data from the labor market–is blamed for the sell-off. But it could just as well have been the alignment of the stars.

The labor market news WAS disturbing. The Bureau of Labor Statistics reported a weaker-than-expected increase of 73,000 jobs for last month. But ALL of the new jobs came from the healthcare industry. Hardly a broad-base for a booming economy.

Then it got weirder.

The BLS revised the May increase of 147,000 jobs to just 19,000 and the reported June increase of 144,000 to 14,000. I say ‘the BLS’ but we learned later the woman announcing/making the revisions was Erika McEntarfer. We know THIS because President Trump fired her later in the day, claiming political bias in the BLS data.

He might be right. Washington is infested with career bureaucrats intent on preserving their jobs, even if it means making elected officials look bad. But it could also be that the BLS methods for calculating statistics in an economy with 330 million people are wishful thinking. Bad models. Garbage in. Garbage out.

Calculating things like the unemployment ratio, or new jobs, or prices down to the penny is straight out of the central planner’s fantasy wish list. Aggregate macro data creates the impression of information omniscience. If you know everything, then it’s just a matter of twisting the right knobs and pulling the right levers to keep the economy infinitely growing at a stable rate.

Balderdash!

This is why we re-launched the Doom Index a few years ago. Tom published the latest reading in the August Monthly Strategy Report. It’s showing a ‘moderate economic contraction.’ And remember, none of the underlying Doom data comes from the government. It all comes from the movement of goods, services, and energy throughout the real economy (not a statistical model from some back office in DC).

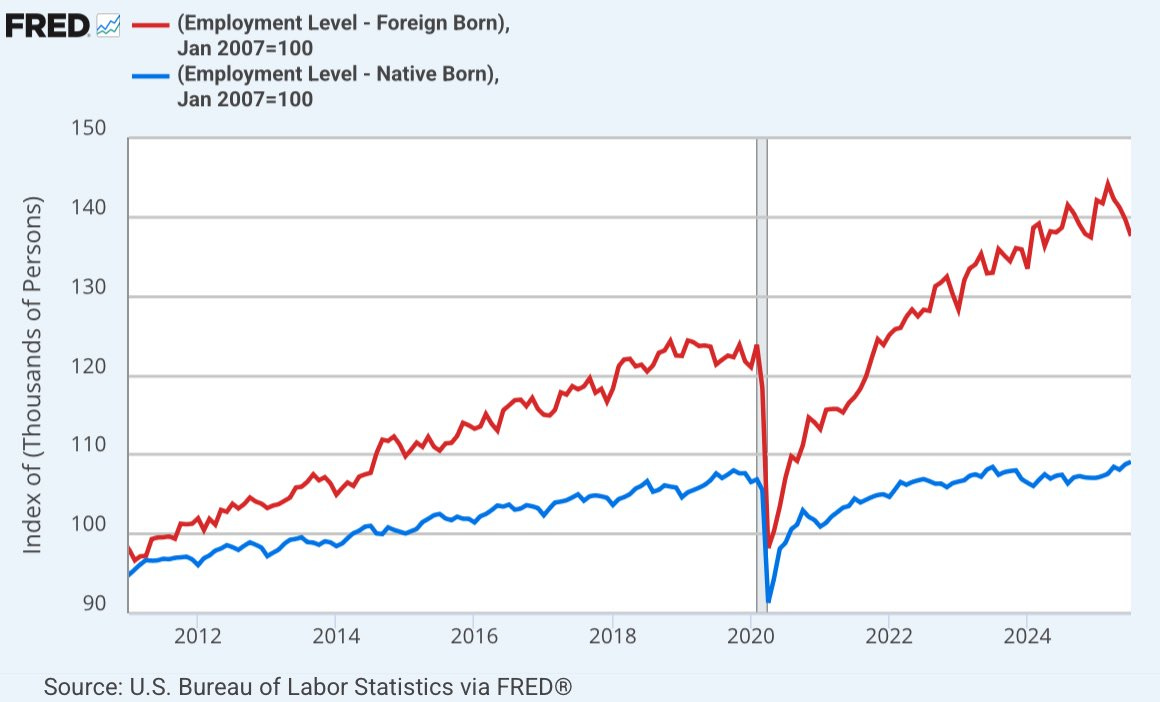

If it can be trusted, the most striking data in the BLS report was that in the last four months, native born Americans gained 1.8 million jobs while foreign-born workers (legal and illegal) lost 1.5 million jobs. How the BLS figures this is beyond me. But it IS exactly what some people voted for.

Whether or not that translates into higher average hourly wages for Americans remains to be seen. And keep in mind if BLS’ employment numbers can’t be trusted, should anyone believe the real rate of inflation, as measured by the Consumer Price Index (CPI), is just 2.7%? Also balderdash.

There is a whiff of Banana Lysenkoism to Trump firing a statistician. Bill has written before about how numbers in the old Soviet Union were changed or made up to match the wishes of the ruling regime. The American political establishment is increasingly ‘Soviet’ as the Late Empire rolls on.

If you’re new to BPR, Joseph Stalin’s head scientist, biologist Trofim Lysenko, rejected Mendelian genetics and Darwinian evolution because they clashed with Soviet ideology. The details of the rejection are beyond the scope of this letter. But it had a lot to do with individualism vs. collectivism and random mutations in nature versus the controlled, linear progress theorized by central planning communists.

In highly politicized and centralized societies, when reality is in conflict with ideology, ideology often wins (at least temporarily). Trump doesn’t like the statistics so he fires the statistician. Yet the whole premise of gathering actionable statistics from a large economy is itself a feature of collectivist/central planning thinking.

It’s all very weird. But it IS consistent with that stage in the market cycle where all the numbers seem made up…except the traditional valuation metrics which tell us markets are historically dangerous. Speaking of which….

Apple, Amazon, Meta, and Microsoft all reported earnings this week. It was a mixed bag. Capital investment in AI–which may turn out to be the biggest misallocation of capital in US financial history–is based on the idea that the whole economy needs more AI, more compute, and more tech. This kind of conviction and euphoria was also strong in late 1999.

For the record, I was writing a newsletter on small-cap stocks at the time, based on bottom-up company research. I started the newsletter in 1997 and left in 1999–returning to work with Bill on Strategic Investment (a big-picture, connect-the-dots macro newsletter) with a bearish view on what was coming next.

What IS coming next?

If August and September hold to form, the sell off in the Nasdaq 100 [NDX] will continue. The Relative Strength Index (RSI) hit 70 not long ago. It has fallen like a drunken bear on a spiral staircase since. All the big tech stocks are constituents of the NDX. That is where all the liquidity goes in good times. It’s where it will leave as well. Bonds?