Breaking Up

We got the letter below from Edward Bonner on Friday. Edward is a geologist and investment advisor at Sprott Global Resource Investments Ltd. There is no financial relationship between BPR and Sprott. We just thought you might enjoy the note. Edward can be contacted via ebonner@sprottglobal.com

Dear Reader,

What a mess. Not even 24 hours had passed since tariffs took effect and Trump was already reversing course. But not before he tweeted: “THIS IS A GREAT TIME TO BUY!!! DJT”… Four hours later, the White House announced a 90-day pause on reciprocal tariffs…

Now, if I’m a sovereign wealth fund or a foreign central bank, I might also take a second to pause and reflect on what…just happened.

This is not the kind of behavior you might expect from a reliable and trustworthy partner.

What’s the next move you make? Maybe you make a few phone calls.

“Hey Jerry, remind me, how many US assets do we hold?”

Pause…

“A lot.”

Pause…The phone hangs up.

Somewhere else, the phone rings…

“Dump it.”

The line drops.

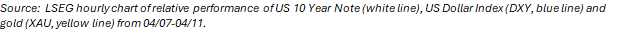

It’s quite possible something like this actually happened. The US 10Y Treasury Note Yield (“10Y bond) shot up over 10% (white line on the chart below) in the week following Trump’s announcement, indicating someone was selling the 10Y bond.

US Treasuries and the US dollar have traditionally been a refuge for investors when markets go bananas, but maybe not this time. Last week, the USD fell nearly 3% (blue line). And there are growing signs that the Fed might be losing the long end of the yield curve, according to the latest Michigan Survey data.

Arguably, the only safe haven* this time was gold, up over 6% last week (yellow line).

In fact, central banks have been steadily increasing their holdings, now up over 23% of their total reserve assets, as the chart below shows. I’ll let you guess what they might be selling to make room.

Source: Bloomberg monthly chart of percentage IMF World Reserve holdings of gold, as of 03/31/2025.

And recently, gold ETF flows (indicating retail interest) have started perking up, as reported by the World Gold Council in the chart below as of April 11th. Notably, US retail investors are getting back in… Worth pointing out that China has also had large flows, especially in April which accounted for over half of their YTD flows (YTD, nearly 30% of AUM).

But recent $10-$20 Billion ETF flows alone are not enough to have moved a $5T financial gold market from $2,000 to over $3,000 in the past year. We maintain the move has been largely driven by Central Bank buying.

In my opinion, traditional safe havens like the dollar and US Treasuries are now broken.

The US has about $36tn in debt outstanding and is currently running a nearly $2tn annual deficit, $1tn of which is interest expense alone!

At roughly 120% debt-to-GDP, the US economy might be circling the drain – and its competitors might be catching onto it. Tack on a trade war, mired in controversy, and the economy is in dire straits.

The uncertainty forces businesses to scale back. Some, particularly those more heavily reliant on the $450bn of imported Chinese goods, might even be facing outright bankruptcy.

And as a result, the stock market might begin to stall, and one might expect upper-income spending to respond in kind, as a lot of their net worth and savings are tied up in the stock market.

According to BMO Economics, the current equity bear market could potentially erase $7tn of American household wealth gains. Based on a rule of thumb that consumers spend about 3 cents less for every sustained dollar loss of equity market wealth, this suggests that annual spending could slow by around $200bn this year.

They go on to infer that weaker equity markets could contribute to tighter lending conditions and wider credit spreads which may restrict loan growth. As a result, BMO Economics suggest that financial conditions in the USA have gone from being a moderate 1% tailwind on real GDP growth in 2024 to a 1% headwind on GDP growth in 2025.

Moreover, BMO Economics also estimates that trade war impacts will remove >1% of GDP growth in the USA this year, bringing the USA closer to recession territory…

Now, as an international investor, you might start to worry about having so many of your assets tied up in the US market and in the US dollar. According to the Department of the Treasury, foreign portfolio holdings in US securities account for nearly 20% of US equities and 30% of US debt. In fact, the US equity market currently accounts for over 60% of the MSCI All Country World Index.

Stealing a line from Peter Boockvar, the world has been having a love affair with US assets.

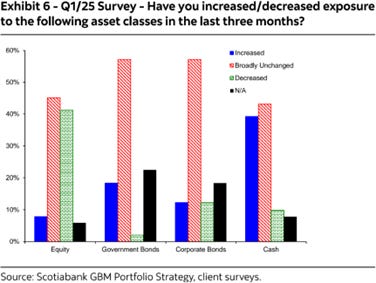

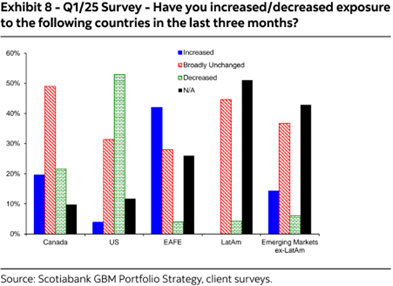

The Magnificent 7 dominate even some of the biggest foreign national banks. So, in effect, the S&P500 trade may have become a global reserve asset. Scotiabank recently published a survey of over fifty of their institutional clients. Granted, these are just a snapshot in time, during an especially volatile period, but it does help highlight current sentiment.

The bar charts below show the drastic decrease in equity exposure, particularly of US assets, as well as the commensurate increase in cash and the allocation to the EAFE region (Europe, Australia, Far East).

Breaking up is hard. It probably won’t be a smooth transition. But too much has been said and done; it’s hard to see a path back to the way things were, especially when one loses faith and credibility.

So where does that leave us?

If I’m right about the deterioration of the US investment case, then we should expect Price-to-Earnings (PE) ratios to continue re-rating back to the mean, closer to 15x (from their peak around 20x). And in the meantime, we might expect the opposite move in defensive sectors.

For all the excitement in the gold price recently, the chart below indicates that gold is still massively undervalued compared to the S&P500.

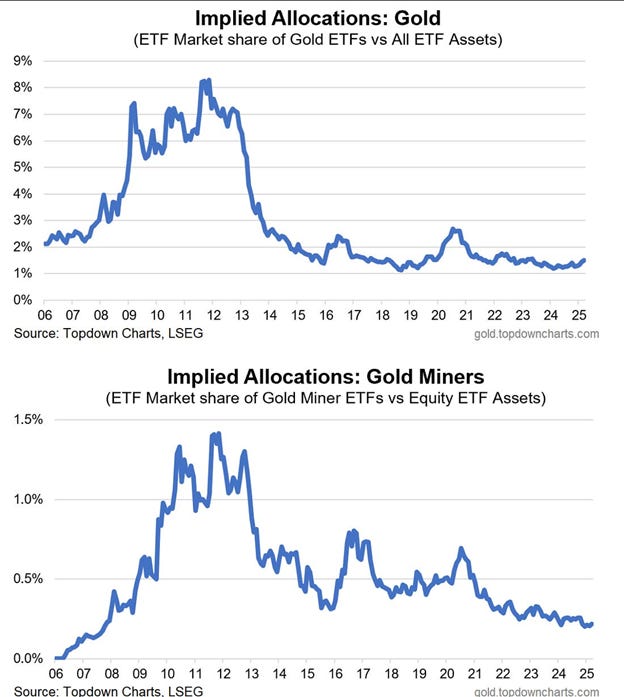

Gold still only represents a tiny fraction of the global financial system. Physical Gold ETFs account for barely 1% of all ETFs. Gold mining equity ETFs account for even less of all equity ETFs.

For reasons unbeknownst to us, while physical gold ETF flows have recently inflected upwards, gold miner ETF flows have fallen further after a long period of decline. According to Bloomberg, flows in and out of the aggregate gold ETFs globally resulted in a net 8% outflow year-to-date.

Yet, with gold priced at over $3,000/oz, I reckon the margins on these gold miners could look favorable to the rest of the investment community – especially if the love affair with the S&P500 trade starts to sour.

So, we believe there is ample room to go.

Interestingly, Scotiabank just updated their gold and silver price deck earlier this week (snapshot below): $3,000/oz, $2,800/oz and $2,500/oz (from $2,600/oz, $2,500/oz and $2,300/oz) for 2025, 2026 and 2027. Long-term (2028+) the price assumption is for gold at $2,000/oz from $1,900/oz in prior assumptions.

To me this just further highlights how investors are still underestimating gold’s future value, in spite of the current socio-economic landscape. Based on these price assumptions, gold miners still trade as if the commodity price will actually decline overtime…

To use a Columbo phrase: “Ah… just one more thing.”

I’ve shared these last two charts with you before, but I think it’s worth revisiting to give oneself a sense of perspective of where we might be in this current cycle, and where we might be headed. In my opinion, the current setup looks a lot more like the 1970s, than the early 2000s.

Source: LSEG daily chart from 1969 to 2025 showing gold price (XAU: yellow) performance relative to US 10-Year Treasury Note (white).

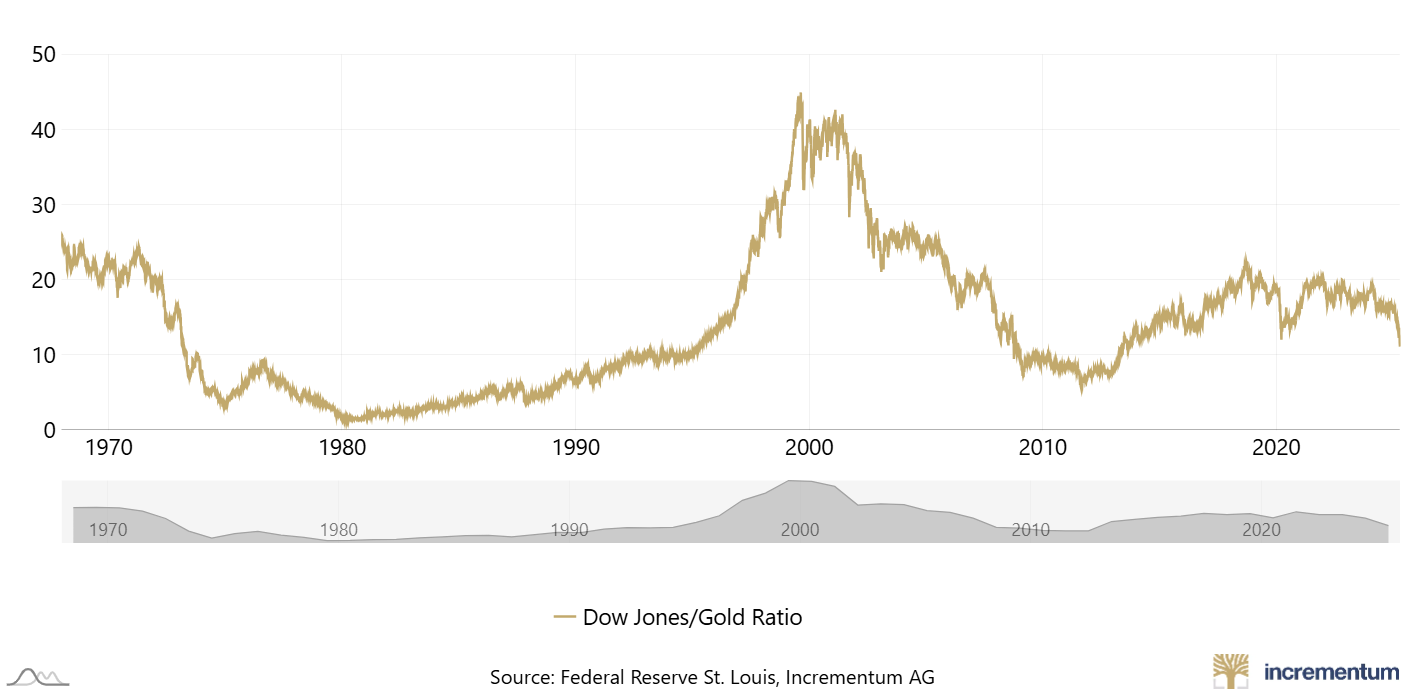

This last chart was taken from the latest In Gold We Trust report. It shows the relationship between the Dow Jones Index and Gold since 1968. In the early 1970s, when the Dow was relatively overvalued, it cost about 20 ounces of gold to purchase one unit of the Dow Jones Index.

Today, it costs about 11 ounces of gold – a steep drop from just a few months ago when it cost around 15 ounces.

But given historical peaks and troughs, I think there could be yet another shoe to drop before gold might be considered overvalued relative to the Dow.

On that note, please feel free to reach out if you have any questions.

Regards,

Edward Bonner

Investment Advisor, Geologist, Sprott Global Resource Investments Ltd.

P.S. If you need help with managing your portfolio of mining equities, please reach out for a free consultation. You can reach me at ebonner@sprottglobal.com

P.P.S. If you have any questions about a particular commodity – silver, copper, uranium, rare earths, energy - please ask and I can share with you our latest insights.

Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

*Gold and precious metals are referred to with terms of art like store of value, safe haven and safe asset. These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary, and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.

This article is just more fake news fearmongering from the same people who said the economy would collapse when Lord Trump won in 2016, and we had the greatest economy in the history of the world!

Our tariffs were a negotiating tactic, and they worked. We brought China to the table, we protected American workers, and we rebuilt our economy stronger than ever.

The stock market soared under the leadership of the American Savior, President Trump, unemployment was at record lows, and we were energy independent.

If anything, the real disaster happened under Crooked Joe Biden, Mr. Weekend at Bernie’s had out-of-control inflation, sky-high debt, and a totally broken economy, but they blame The Son of Fred, President Truck because they can’t fix it. Now back in the White House, none of this will be happening, America is winning again, and everyone knows it!

Some web, guessing and imagination will weave. You and most pundits do not know what is cause and effect until very long after and then all of YOU use 20--20, hind-sight.

RALPH W.