Sunday, March 23rd, 2025

Laramie, Wyoming

by Dan Denning

Dear Reader,

Is the US already at war with China? Not a ‘kinetic’ war or a shooting war. But things are definitely ‘hotting’ up. What do I mean?

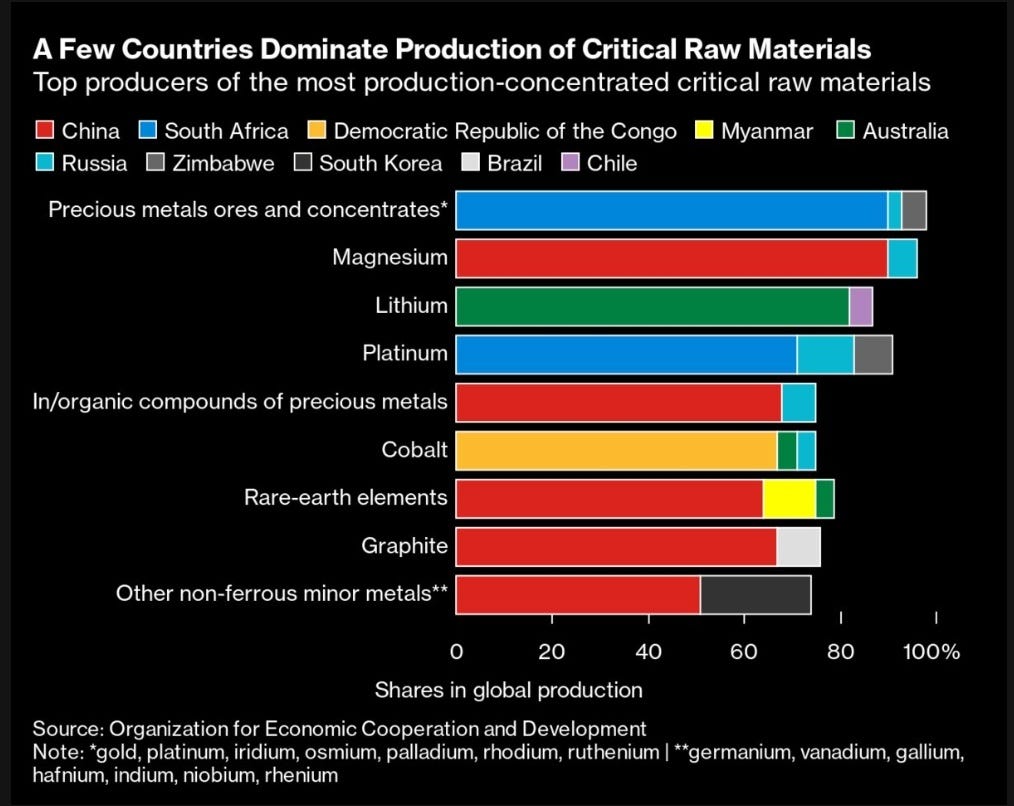

On Friday, I notified paid readers that President Trump invoked the Defense Production Act. He issued an Executive Order to fast-production of uranium, copper, and rare earth elements in the United States, especially on public lands. Many of these ‘critical minerals’ are essential to the United States military. This is all about China. Why?

Tariffs have consequences. And sometimes ‘blowback.’ The supply chain for many of the critical minerals America relies on begins in far off places like Australia (lithium), the Democratic Republic of Congo (cobalt), and of course, China (rare earth elements). Until the US can mine and refine these minerals itself, it is dependent on other countries for them. China knows this and may eventually act on it.

Luckily there’s a thing called ‘the mining industry.’ Early next month at BPR, we’ll be taking a special look at the publicly listed companies who can fill the breech until President Trump’s EO starts to have consequences (if that happens). In the meantime, enjoy the highlights from the last week at Bonner Private Research.

Regards,

Dan

PS Today is the last day you can secure discounted registration for Rick Rule’s Natural Resource Symposium, this summer in Boca Raton, Florida. You can be sure uranium, copper, and rare earths will be on the menu (not for eating, but presentations from specific companies and speakers). As will gold and silver of course. Please note if you can’t make it in person the digital registration allows you to watch (or rewatch) any and all of the presentations at your convenience. Register here today.

Hi Dan.

The lead graphic, from OECD, in your introduction is a puzzle.

Just the first bar, "precious metals ores and concentrates," opens up some questions.

1. By the footnotes, this bar includes gold, platinum, iridium, osmium, palladium, rhodium, and ruthenium.

2. However, platinum has its own dedicated bar a few spots down, which correctly lists SA as the primary world supplier.

3. Logically, gold would be an important portion of the metals listed. Yet the country accounting for 90% of the bar is South Africa. But SA produces only 3% of the world's gold. The big five are China, Australia, Russia, USA, and Kazakhstan, which produce 40% of world output.

I may be missing something, but the easy answer is that, as with many global organizations, they may have a narrative supported by creative reporting.

Gary H

Fredericksburg Texas

The gold and precious metals bar does not seem correct.