Sunday, February 1st, 2026

Laramie, Wyoming

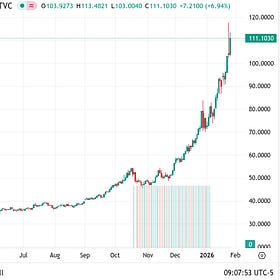

It was little noted in the Western press, after Friday’s bloodbath in precious metals, that the price for physical metal in Asia hardly budged. If you’re taking delivery of silver in Shanghai—for your factory, your safety deposit box, or to hoard—it’s going to cost you. Not so in London and New York. What will this week bring?

The data don’t support the idea that higher margins on Comex are, at least by themselves, responsible for squeezing out ‘speculative longs.’ That’s the story they’d like to tell, that silver was overbought by manic FOMO trading. If it’s not true, though, I’d expect to see the price rising again later this week (once Asia opens, the paper markets in London and New York lose control of the narrative).

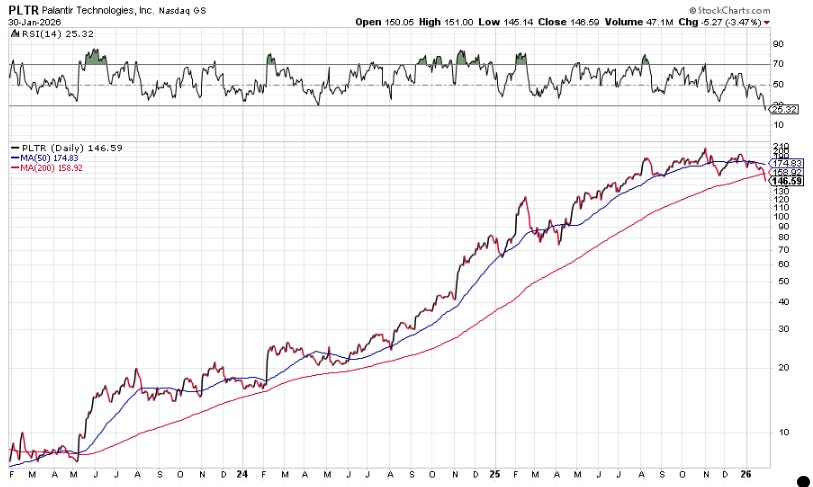

Meanwhile, Palantir [PLTR] reports this week. With a market capitalization of $350 billion, Palantir isn’t the biggest AI or tech stock. But it’s one of the most expensive. The trailing P/E is 350, the forward P/E is around 150 (depending on earnings estimates), and it trades at 89 times sales. Have a look at the chart.

It’s ‘oversold’ on an RSI basis (below 30). But the recent price action has dropped the share price below the 200-day moving average. It’s rolling over. But is the bull market sparked by AI in October of 2022 dying? Tune in for more this week…

Dan

P.S. Nerd Alert: Palantir is named after the lost ‘seeing stones’ of Middle Earth in JRR Tolkien’s Lord of the Rings trilogy. In Tolkien’s world, the stones were a kind of super powered wireless device, allowing communication over long distances and even the ability to see different versions of the future.

But not THE future…because what the stones showed was influenced by the will of whoever ‘commanded’ them. To a weak-willed watcher, the stones might show you only what someone else wanted you to see. They could mislead, deceive, and manipulate.

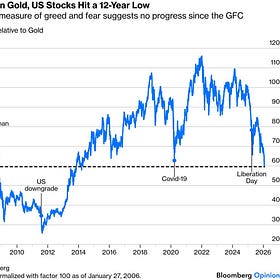

Markets are always discounting different versions of the future. Narratives compete for investor buy-in. There will be a point when investors realize the huge investment in AI is the largest mis-allocation of capital in recent history…and re-price the ‘hyperscalers’ and Palantir accordingly. The valuations suggest it is inevitable. But is it imminent?

Shots Fired

PAYING SUBSCRIBERS CAN ACCESS THE FEBRUARY MONTHLY STRATEGY REPORT BELOW, PUBLISHED LAST EVENING BY INVESTMENT DIRECTOR TOM DYSON, WHO IS CURRENTLY TRAVELING IN INDIA

The Shanghai silver price closed Friday (China time) at $122.30. The COMEX price closed about 12 hours later at $85.25, with nearly all of the decline in the US occurring after the China close. As I see it, there are two possibilities when the Shanghai market opens again in a few hours.

1) The traders there may panic at the decline in US prices and start selling their silver to drive their price down, or

2) They may look at the decline over here as a fire sale, and wade into the US markets, buying every contract they can, at prices far lower than in their own market.

I suppose in theory, the markets might just separate, with silver in China selling for $40 or so more than in the US, but in practice, there is too much money to be made on arbitrage, assuming that they can get their hands on physical silver over here and get it shipped to China.

Thus, when the Globex market opens tonight in the US, and Shanghai opens a couple of hours later, the two prices - COMEX and Shanghai - will converge, and I'm betting that it will be the COMEX that rises back toward the Shanghai price, rather than the Shanghai price dropping to meet the COMEX. It would not surprise me at all if tomorrow the US silver price were to close again above $100, but we shall see. This is not a prediction that will take a long time to see, just 24 hours or so.