Sunday, January 4th, 2026

Making America great again apparently means ALL of the Americas. Venezuelan President Nicolas Maduro sits in a Federal jail in New York City after being ‘arrested’ over the weekend on narco-terrorism charges. US President Donald Trump has said the US will ‘run’ Venezuela in the meantime.

Attention now turns to the impact of these events on financial markets, especially oil. Who wins? Who loses? What happens next?

Below are some relevant facts. While Venezuela has the world’s largest oil reserves, it’s unlikely there will be any immediate or significant boost to its daily production. That doesn’t mean oil prices won’t move lower anyway in the short-term. But it DOES mean sorting the winners from the losers over the long-term will take more research.

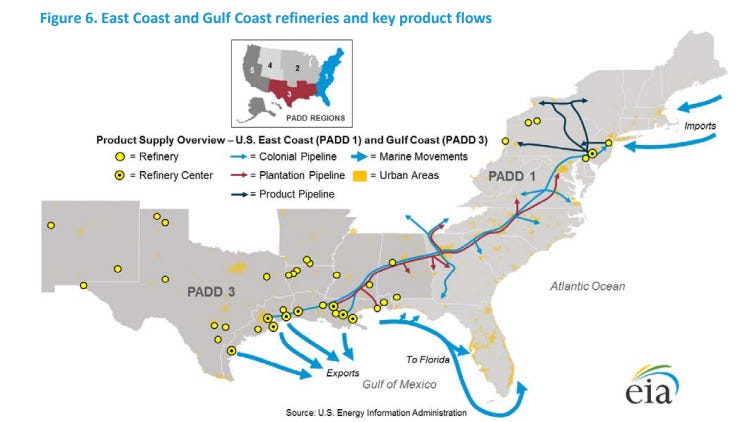

About half of American’s total oil refining capacity is on the Gulf Coast. That’s according to the last Refining Capacity report from the US Energy Information Administration (data current through Jan. 1 2025). Major owners of the largest facilities include Marathon Petroleum, ExxonMobil, Valero and Citgo.

There are ‘only’ 11-12 billion barrels of oil recoverable from the Stabroek Block off the coast of Guyana (just east of Venezuela). This region already produces around 900,000 barrels per day. The producing wells are deep-water and offshore and produce light sweet crude—fundamentally different in cost and quality from the 300 billion barrels of oil thought to be in Venezuela’s Orinoco Belt. Exxon and Chevron are heavily invested in Guyana (which may have become more ‘de-risked’ based on the weekend’s events.)

The largest Canadian producers of ‘heavy’ oil (mostly from the oil sands in Western Canada) are Canadian Natural Resources, Suncor, Cenovus Energy, and Imperial Oil. Smaller ‘pure’ Canadian oil sands plays are Athabasca Oil, MEG Energy, and Strathcona Resources. Increased exports of Venezuelan crude to the US may reduce Canadian exports to the US.

Damn national sovereignty and Climate Change we need energy for data centers -Bill Gates

Venezuelan crude is sour (ie not sweet) as is most Canadian crude. But where does Canadian crude get refined? Not on the gulf. So, first restarting Venezuelan crude will be both time and money intensive and if the US refines heavy crude in the gulf refineries (which are equipped to do so) what happens to the mid-west refineries and what happens to the cost of eg diesel in the mid-west? And, at what point does the benefit of presumably lower cost oil from Venezuela become painful for the fracking industry.