Sunday, January 25th, 2026

Laramie, Wyoming

By Dan Denning

It’s a big week ahead to close out the first month of the year (already!). Investment Director Tom Dyson will publish the February Monthly Strategy Report on Wednesday for paid subscribers. We’ve got a new update on the Doom Index. And of course analysis of the key ratios in the markets, especially Dow/Gold (by which time gold may have hit $5,000/oz and the Dow 50,000).

More earnings kick off tomorrow that give us an insight into the see-saw battle between the energy sector and the tech sector. Apple [AAPL], Microsoft [MSFT], Meta [META], and Tesla [TSLA] all report tomorrow. But so do ExxonMobil [XOM] and Chevron [CVX]. And throw in Visa [V] and Mastercard [MA] for a look at consumer credit and health.

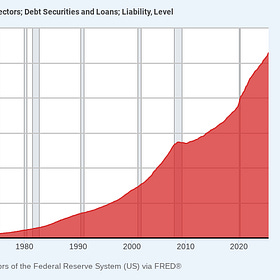

The chart above shows the cycles between the tech and energy sectors over the last 27 years. It includes the dot.com boom in 2000, then the great bull run in oil up to mid 2008 (oil peaked at around $147/barrel in July of that year). You’ll note that the current ratio is far below the tech peak in 2021, and hasn’t been able to hold the same level of the 2000 peak.

What next? Higher oil? Lower tech? AI or crude oil? Or some combination of both. Look for what Tom has to say when he reviews the new energy stocks we added to the Official List late last year (for free readers, the Official List is where keep tabs on all open investment recommendations at BPR…there are 14 positions on the List now, with eight listed as ‘BUY’ and six listed as ‘HOLD’).

And don’t forget Wednesday! We’ll find out whether America still has a nominally independent central bank. The Federal Reserve’s Open Market Committee will announce its first interstate rate decision of 20265.

Higher? Lower? Will there be dissent? What would you do?

Will Fed Chairman Jerome Powell say anything about the recent grand jury investigation into his testimony in front of Congress last year? Did you know three Fed governors (Richard Clarida, Randal Quarles, and Adriana Kugler) have resigned while being investigated in ethics probes under Powell's tenure as chair? And will anyone ask Powell about what gold and silver are saying about the creditworthiness of the US government as another government shutdown looms?

All that and more coming up this week at BPR. In the meantime, enjoy your frigid Sunday and a review of all the research we published last week.

Until tomorrow,

Dan

What would I do? you ask. Not that anyone values my opinion, so here it is anyway. The Fed is really in a bind. They can't tighten interest rates because the negative reaction of those addicted to easy money (everybody) would be long and loud. But if they continue to push rates down, that's just another step down the path that got us into these straits in the first place. Volcker was able to take drastic action because inflation was out of control and everyone knew it. Still, he was vilified as the economy tumbled into the recession of the early '80s. But he did what had to be done. Today, inflation seems "tame" to those who don't read Shadowstats. Neither the politicians nor the people would stand for a ratcheting up of rates, which is the only way to begin to flush out the malinvestments of the zero interest days. A lot of people will be hurt. But that's what I'd do if I were the Fed. A deflationary recession is bad, no question, yet a return to easy money will be worse. Powell is one of the people I'd least like to be at the moment. He must be on the verge of a stroke 24/7....