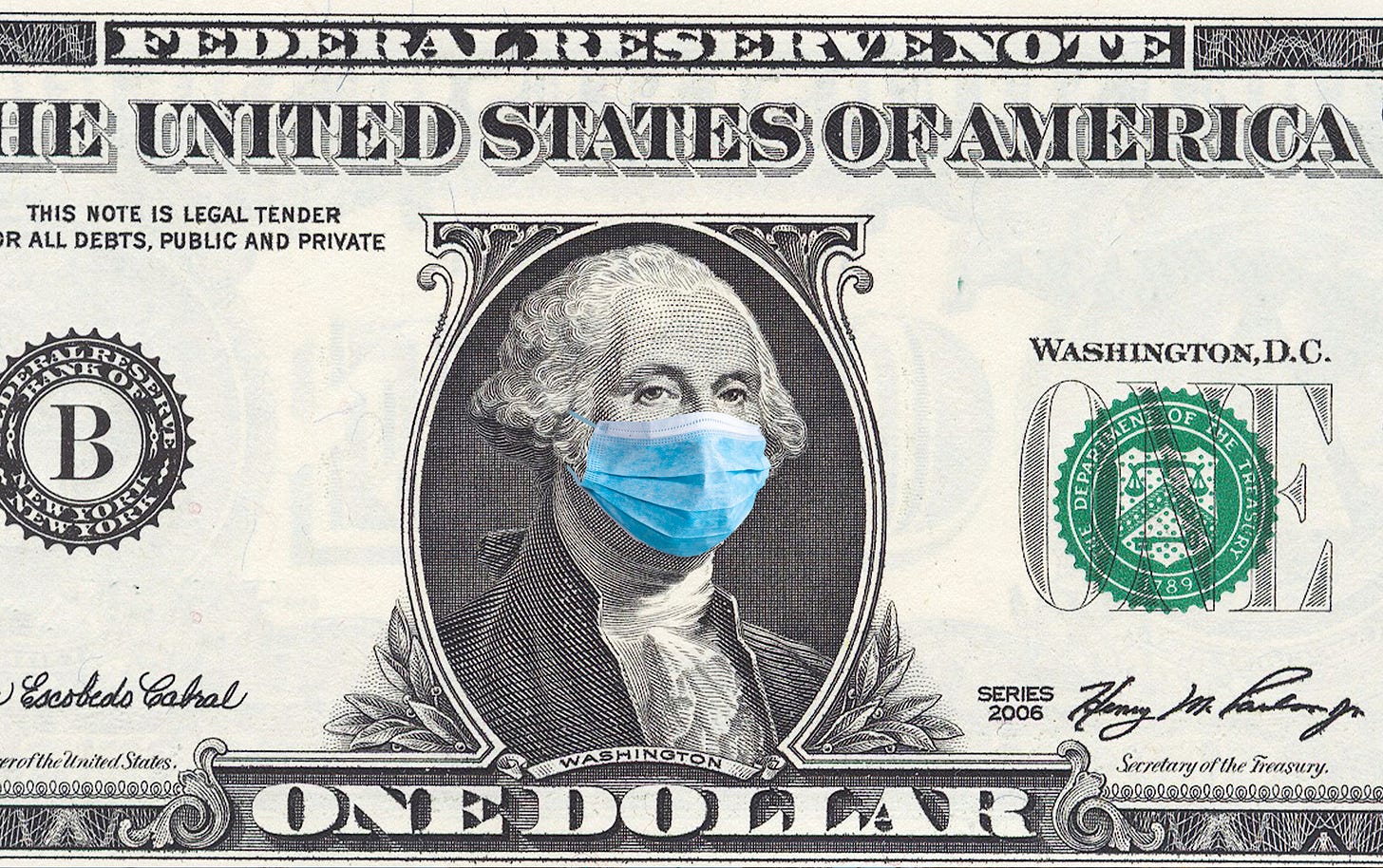

Beware Money Pox!

Symptoms may include inflation volatility, extreme market fluctuations, falling income, housing crises, political unrest, recession, revolution and more...

(Source: Getty Images)

Bill Bonner, reckoning today from Youghal, Ireland...

We wrap up another week.

And what’s new?

Oh no… not again! The New York Times:

As Monkeypox Spreads, U.S. Declares a Health Emergency

President Biden’s health secretary on Thursday declared the growing monkeypox outbreak a national health emergency, a rare designation signaling that the virus now represents a significant risk to Americans and setting in motion measures aimed at containing the threat.

“We’re prepared to take our response to the next level in addressing this virus, and we urge every American to take monkeypox seriously,” the health secretary, Xavier Becerra, said at a news briefing

Not a single American has yet died from monkeypox. Millions die each year from murder, suicide, disease, heartbreak and old age. Why make a federal case out of the simian pox?

Oh, dear, dear reader… you know as well as we do. Emergencies… alarums… war – each one is a call to arms… and an excuse to spend money. The feds love ‘em all.

Sound and Fury

Meanwhile… the world of money is full of noise too… and mixed signals. On the one hand, many of the most immediate causes of inflation – stimmies, PPP, rampant money-printing, Covid lockdowns, and the Russo-Ukrainian War – seem to be working themselves out. Like a bad meal, they are passing through the system. The stimmies are over… the Russkies are winning… and, for now, the money-printing has stopped.

On the other hand, the Fed is still lending money to member banks at 650 basis points (6.5%) below the Consumer Price Index. And some price increases show no sign of easing off.

Wages, for example, go up in response to higher prices. Then, employers need to pass along the higher costs in the form of even higher prices.

Here’s USA Today:

Restaurant, fast-food and retail pay has risen sharply, especially since the pandemic triggered widespread labor shortages, presenting fresh competition to higher-skill fields like health care, manufacturing and construction in the battle for workers.

For entry-level positions – such as certified nursing assistant, welder and painter – wages have broadly converged in the $15 to $18 an hour range, with fast-food and retail pay often near or above the skilled roles, experts say.

Fifteen dollars an hour doesn’t seem like much to us. But it’s 50% more than many workers were getting a couple years ago.

The markets too are sending puzzling messages. WTI oil slid below $90 yesterday. Coinbase rose nearly 40%.

Investors don’t seem to know what to make of it. Stocks wandered around yesterday, like a Congressional candidate, with no clear idea of where they were going.

A Crescendo of Debt

But as we saw earlier this week, major trends get underway in confusion and contradiction. Mr. Market seems to make a point of keeping investors guessing. Years go by and they guess wrong about what is afoot. It is only after the fact that we see the long, broad strides of a primary trend.

Looking back on the last 42 years, you’d have to be blind to miss it. Paul Volcker tamed inflation. Interest rates fell from 1981 until 2020. Falling interest rates meant that you could refinance – your home, your business – every few years… borrow more and more… and still have lower monthly payments. Leveraged real estate speculators, for example, were able to refinance their holdings at higher prices and lower interest rates… over and over. This is what enabled the debt explosion. Federal debt in 1980 was less than 33% of GDP. Today it is 125% of GDP. Private debt followed a similar path, with total public and private debt in 1980 at 150% of GDP. Today, it is more than three times as much – around 350%.

The real crescendo of debt came during the last 10 years – when the Fed went hog wild with inflation-adjusted interest rates below zero, and trillions in giveaways. By the time it reached its climax, the Dow was 44 times higher than when it began in 1982… and total debt had risen from under $5 trillion in 1980 to nearly $90 trillion today.

It is obvious what was going on. The Fed was pumping in money. The tide raised almost all boats.

And now?

Hell to Pay

The Fed is turning off the pumps… and even beginning to reverse the flow. Its QT program (quantitative tightening) will sop up liquidity, by allowing existing bonds, now in custody at the Fed, to expire. When they go, the money they represented will die.

The Fed giveth; the Fed taketh away. And there will be Hell to pay.

As long as the Fed sticks with the anti-inflation program the primary trend should be roughly equal and opposite to the last 40 years. That is, asset prices, now high, should fall. Interest rates, now low, should rise.

Does the Fed have the backbone to follow through? Won’t it get confused by the mixed signals… and bow to Elizabeth Warren, Donald Trump, Wall Street and other “low interest” activists? And won’t today’s trend come to an abrupt halt?

Stay tuned…

Bill Bonner

Government statistical mills just like the alphabet agencies are not immune to becoming politicized. A deeper look at the July payrolls report reveals a very unpleasant trend. Fewer people working, but more people working more than one job. A rotation which picked up in earnest some time in March and which has only been captured by the Household survey. Remember the good old days when you could make ends meet with one job :-)

You forgot that tens of thousands die from the common Flu every year,

yet no crisis for that disease. This COVID flu should be treated the same way the flu is teated.

What's your take on the recent massive drop in the price of GOLD?

When will the price of Gold ever return to over $2,000/ounce?