The Middle Class Delenda Est

Soaring debt and massive layoffs cut deep into America's bleeding Middle Class...

Bill Bonner, reckoning today from Baltimore, Maryland...

The Middle Class Delenda Est (the middle class must be destroyed).

In the next couple of days, we will look at Baltimore rowhouses …the plight of small farmers during the Roman Empire…and the meaning of “common sense,” among other things.

All of these themes come together in one extraordinary and magnificent spectacle – think “Gone with the Wind” meets “Stalingrad” – that is, the destruction of the middle class and the societies that depend on them. CNBC:

Household debt soars at fastest pace in 15 years as credit card use surges, Fed report says

Total debt jumped by $351 billion for the July-to-September period, the largest nominal quarterly increase since 2007, bringing the collective household IOU in the U.S. to a fresh record $16.5 trillion, up 2.2% from the previous quarter and 8.3% from a year ago.

And while debt is increasing, job prospects are receding. Charlie Bilello updates us on the job cuts in the tech industry:

Twitter cutting 50% of its workforce (estimated 3,700 jobs).

Facebook ($META): cutting 13% of its staff (11,000 jobs), its largest round of layoffs ever.

Snap ($SNAP): cutting 20% of its workforce (1,200 jobs).

Shopify ($SHOP): cutting 10% of its workforce (1,000 jobs).

Netflix ($NFLX): cut 450 jobs in two rounds of layoffs.

Microsoft ($MSFT): cutting <1% of workforce (1,000 jobs).

Salesforce ($CRM): cutting 1,000 jobs.

Robinhood ($HOOD): cutting 31% of its workforce.

Tesla ($TSLA): cutting 10% of its salaried workforce.

Lyft ($LYFT): cutting 13% of its workforce (700 jobs).

Redfin ($RDFN): cutting 13% of its workforce.

Coinbase ($COIN): cutting 18% of its workforce (1,100 jobs).

Stripe cutting 14% of its workforce (1,000 jobs).

In addition to these cuts, Amazon ($AMZN) has announced a hiring freeze, Apple ($AAPL) has paused almost all hiring, and Google ($GOOGL) is reducing new hiring by 50%.

War and Taxes

Jobs, debt, housing, income, inflation – when these go the wrong way, the middle class is doomed. Add war and taxes…and the destruction is complete.

But America won’t be the first country to destroy its middle classes. It is what great empires, as well as banana republics, do. From ancient Rome to modern Venezuela – eliminating the middle class is not just a by-product of a corrupt elite, it’s the name of the game.

The success of the Roman Empire was mostly thanks to its middle-class farmers and craftsmen. They were the backbone of the Republic, ready to take up their swords and shields as duty called. They were a largely homogenous group, sharing the same culture and values.

But they were a threat to the ruling class, too. Dispersed and independent, they were not so easily distracted by circuses in Rome or so cheaply bought off with the free bread distributed to urban mobs. And they might turn on the elite as well as support them.

As the Republic became an Empire, it expanded its borders in a series of almost permanent wars around the periphery. Generals gained wealth and glory, returning in triumph with their booty…including slaves.

Middle class farmers had small plots of land that they worked themselves, with their families, and sometimes a few slaves. But when the imperial conquests really got rolling, the number of slaves grew proportionally. In the capture of Epiros alone, in the Third Macedonia War, 150,000 people were sold into slavery.

The slaves changed the domestic economy and the soldiers and free farmers themselves found themselves squeezed. In the early days, a citizen-soldier did his duty and soon returned home to take up his plow again. But as the Empire became more far-flung, it stationed its young men in Africa, Spain, and the Middle East, on bases hundreds of miles from Rome, often with a tour of duty that lasted as long as 20 years.

When they got home, the soldiers found their farms long neglected. Their families often had to borrow in order to survive until the fighting men returned. Then, to pay the debt, the farm was sold to elite landowners. These rich men consolidated the small farms into ‘latifundio’ that were worked by teams of slaves, rather than free men.

Large plantation-style farming then lowered farm prices; independent farmers had a hard time competing. This, combined with the constant need for more soldiers, inflation, and higher taxes, led many farmers to abandon their land…and finally, to sell themselves and their families into slavery.

Common Nonsense

“What goes around, comes around,” is an expression arising from observation and embedded in the popular mind as “common sense.”

“Be nice to the people you meet on the way up,” is another common dictum, “because you will meet them again on the way down.”

As it turned out, the rich and powerful met invading barbarians.

By then, the ‘Roman’ army had disintegrated. But it had ceased being ‘Roman’ anyway. When the middle class was destroyed so was the stock of loyal, patriotic soldiers willing to fight and die for the homeland. The empire had been forced to turn to mercenaries and pay-to-fight armies that were reliable…but only to a point. And as the empire’s finances dissolved, the pay-to-fight soldiers often didn’t get paid and didn’t fight. In the heat of battle, many turned against Rome.

Finally, the Empire was unprotected; there were no citizen soldiers to rally…and no middle class to keep order.

Oadacer deposed the last emperor in 476. By then, the barbarians – which included Goths, Huns, Alans, and other Germanic tribes, escaped slaves, starving and displaced peasants, deserters and brigands of all sorts – roamed freely over the country, raping, pillaging, stealing, slaughtering, enslaving and destroying every thing and everyone they came in contact with.

More to come…

Regards,

Bill Bonner

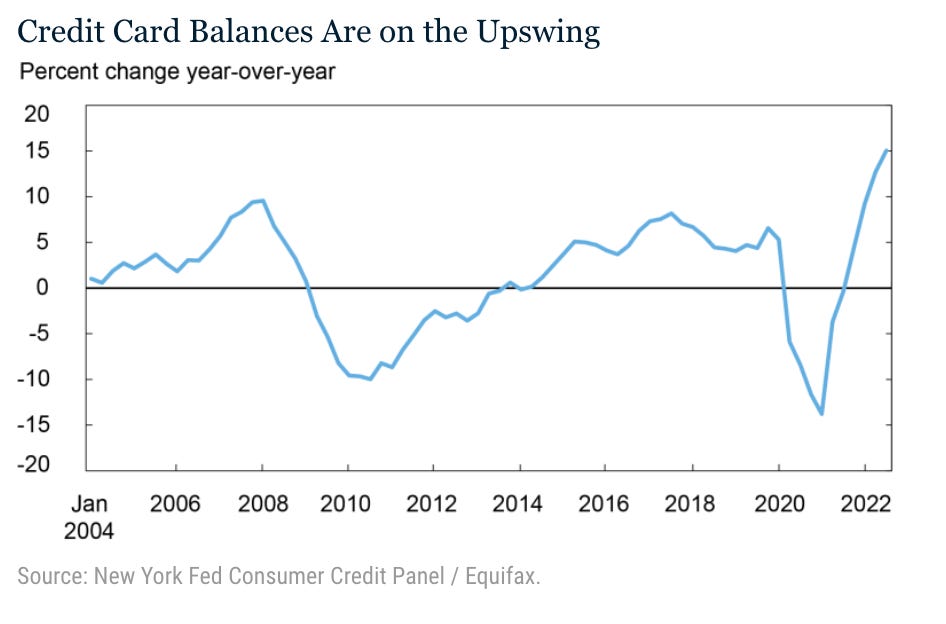

Joel’s Note: On the subject of soaring debt, Dan Denning shared this vertiginous chart among the BPR braintrust yesterday. It’s what the kids used to call “fugly”…

This year’s third quarter increase of $351 billion was the largest nominal quarterly jump since 2007 and included a $282 billion increase in mortgage balances, according to the New York Fed’s Center for Microeconomic Data. Continued the report, from Liberty Street Economics:

Mortgages, historically the largest form of household debt, now comprise 71 percent of outstanding household debt balances, up from 69 percent in the fourth quarter of 2019. An increase in credit card balances was also a boost to the total debt balances, with credit card balances up $38 billion from the previous quarter. On a year-over-year basis, this marked a 15 percent increase, the largest in more than twenty years.

Of course, borrowing money at low (or even negative real) rates is one thing… but, as reported in this space over the weekend, this outstanding debt comes at a time when interest repayments are cresting multi-decade highs, further putting a strain on middle class families.

The New York Fed’s data suggests Americans are on track to hold close to $1 trillion (with a “T”) in collective credit card debt before year’s end. And that’s at eye-wateringly high rates, too. A survey by Bankrate.com puts the average credit card interest rate at just over 19%, the highest it’s been in over thirty years. Here’s a look at the year-over-year increase in credit card balances outstanding.

What does this spell for the mighty American consumer… and for earnings of the aforementioned tech companies, already struggling with massive layoffs? What does it portend for the job market in general? And what does it mean for foreclosures on households struggling to juggle mounting debt as interest rates continue to rise?

Back in September, Bonner Private Research Investment Director, Tom Dyson, alerted members to a foreclosure specialist that was poised to do well in a deteriorating housing market. As of this morning’s opening, that “tactical trade” is up just over 43%. It’s exactly the kind of situation Tom is looking for while keeping the overall portfolio locked in “maximum safety mode” (that is, mostly cash and precious metals).

If you’re looking for a strategy to help guide you through the Great Recession of ‘23 and beyond, and you like what you read in these pages, perhaps consider joining Bill’s private research network today. Details here…

I always enjoy reading about Bill's historical comparisons. :)

Having studied the depression at length, I have seen this movie. It is the removal of the group that will not work and replacement by the ones that will. Paul's writing does address this in the Bible. I agree with PG V on most of his comments. But, we may see a preview this winter in Europe. Green is a long way off and oil and gas are here. We are a stiff necked people, we Americans. We learn slow but well.

Just sayin'

Don Harrell