Bad Strategy

Saylor, still at the helm of MicroStrategy, saw a comeback opportunity. Not a new business strategy; it wasn’t a real business at all. It was a speculators’ strategy.

Monday, December 8th, 2025

Bill Bonner, from Baltimore, Maryland

Strategy (formerly MicroStrategy) CEO, Michael Saylor, always seems to over-do it, over-state it, and over-pay for it. And now, with BTC on the decline...he may be over-exposed to it. Bloomberg:

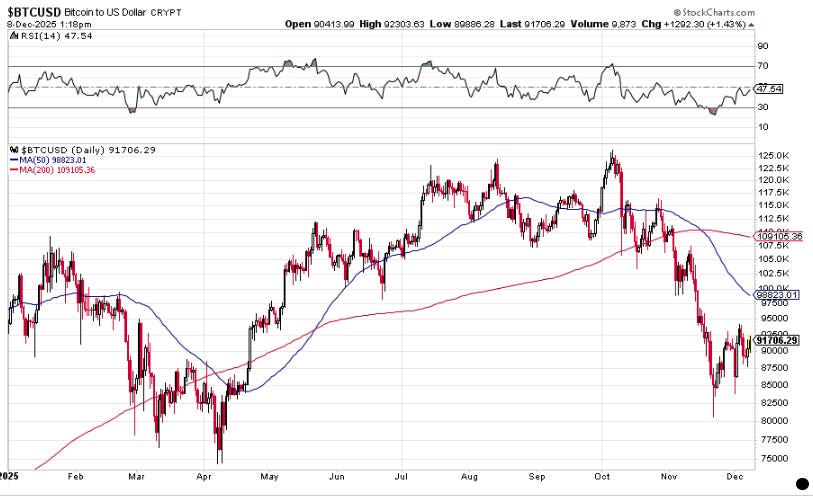

The S&P 500 has climbed more than 16% in 2025, while Bitcoin is down 3% — the first time since 2014 that stocks have rallied while the token is down, according to data compiled by Bloomberg.

The digital asset has rarely deviated so cleanly from other risk assets even during past crypto winters. The dislocation defies expectations that cryptocurrencies would thrive under President Donald Trump’s return to the White House amid favorable regulation and a wave of institutional adoption.

Back in the dot-com days, Saylor made a name for himself by vastly overestimating the value of the dot-com innovation. He became the voice of the dot-com revolution...a true believer whose middling software company set the pace for the dot-com bubble.

He was perhaps over-confident:

“I think my software is going to become so ubiquitous, so essential, that if it stops working, there will be riots.”

The stock soared. But Saylor had over-estimated his company’s value...and over-stated its importance. Then, the Nasdaq crashed in March 2000 and Saylor lost $6 billion in a single day. Not only that, he was attacked by the SEC for accounting irregularities and had to settle for millions more.

This experience might have induced a lesser man to go straight. But Saylor kept at it. He had bought up some domain names — such as Angel.com, Wisdom.com and Voice.com — which he was later able to sell at a profit. Then, with the price of bitcoin around $8,000...he became over-enthusiastic.

We’ve been looking at the way fake money spawns monsters... $38 trillion in federal debt...$420,000 average house price...three major bubbles on Wall Street...wars...corruption...and a late, degenerate empire. It also tempts alternatives...such as crypto money, which promises not to go bad like the fake stuff.

It will have to go bad in a different way.

Bitcoin and other cryptos have proved useful...and resilient. And Saylor, still at the helm of MicroStrategy, saw a comeback opportunity. Not a new business strategy; it wasn’t a real business at all. It was a speculators’ strategy.

He turned his company into a proxy for owning bitcoin. He bought bitcoin...then borrowed money to buy more bitcoin. This made it easy for gamblers. They didn’t have to remember their passwords or their crypto wallets...or any of the other techie things you need to be a bitcoin owner.

Instead, they could simply buy Strategy (MSTR).

And as they bought, the stock went up and eventually traded for twice what the bitcoin was worth. This turned the stock not only into a proxy for BTC, but a way to get more bang for your gambling buck. Matt Levine:

Strategy was a leveraged way to invest in Bitcoin, and it got good leverage. A retail (or institutional, really) investor who wants to borrow money to buy Bitcoin will probably have to do so in a risky way: The loans might be expensive and short-term, and they will almost certainly have margin calls, so if the price of Bitcoin drops you need to come up with more money at the worst time. Strategy is a public company, and it borrowed money in safe, long-term, no-margin-call, corporate sorts of ways. It issued convertible bonds with low coupons, and then later it got into issuing perpetual preferred stock: Strategy could borrow money to buy Bitcoin and never pay the money back.

But it was odd. You bought MSTR to get BTC...but you got only half as much BTC as you would have gotten if you’d bought it directly. This was seen as an advantage...as long as the price was going up. MSTR rose more than BTC itself.

And then came the drop in BTC. And suddenly the leverage disappeared. Or reversed.

Right now, MSTR faces no immediate danger. The company says it has enough dollar cash to pay 21 months of its obligations. And if BTC goes back up, all will be well.

As Matt Levine points out, MSTR got its leverage by selling stock and bonds directly to the public. Its ‘investors’ were its lenders. This gives it a big advantage. It doesn’t have to pay a bank. And if it runs out of money...well...too bad for the shareholders.

Regards,

Bill Bonner

Long ago, JP Morgan testified to Congress that “gold is money, everything else is credit.”

I like Mr Morgan’s way of thinking. And maybe it’s just me… but I have a hard time squaring Bitcoin with any true semblance of underlying value.

Bitcoin is a string of 1s and 0s that represent a sizable past input of electric power. Interesting math, perhaps, but is that all there is? And all that power was converted to heat, which went up the ventilation shaft.

When you mine gold, at least you have gold at the end of the day.

A quote from a Dan Denning associate, Charlie Morris, "Gold is a zero coupon perpetual bond with no credit risk, and no counterparty risk, issued by God!" The big guys are buying like there is no tomorrow but they tell us little people it's a useless yellow relic.

I'll stick with 5000 years of financial history.

Jim Marshall