Back with the Breeze

People are neither always good nor always bad, but they are always subject to influence. The last three decades tells them they can get other peoples’ stuff without ever paying for it.

Monday, October 27th, 2025

Bill Bonner, from Baltimore, Maryland

Bubble-like behavior?

A friend is a builder in Washington, specializing in high-end houses.

“I’ve never seen anything like it. There’s just so much money in Washington. We’re doing 15 different projects. Every one of them is spectacular.”

Money is everywhere. Everything is going up. Gold, for example. CNBC:

Gold could reach $10,000 by the end of the decade, says Ed Yardeni.

Which is another way we could reach our 5-to-1 target, Dow/Gold. If gold goes to 10,000...while the Dow advances only to 50,000...we’d get the ratio we’ve been waiting for.

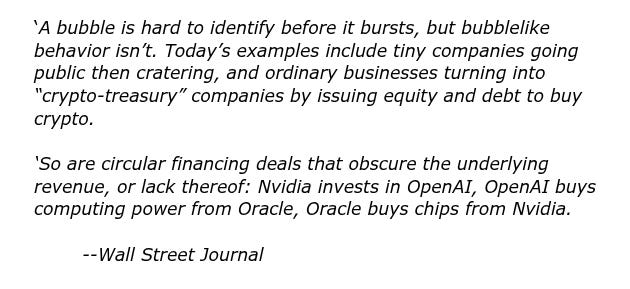

In the meantime, the most alarming bubble news is that almost everyone is in on it. Reports came in from an investment conference held last week in Las Vegas.

“Every speaker was bullish. Everyone. Usually, there will be a few doom-and-gloomers. But this time, the doomers said they had seen the light. They told us how AI had changed the picture. Yes, of course, there are worrisome things going on, they said. But AI is going to make us all rich.”

It sounds like a re-run of the dot-com delirium of 1999. Then, it was the internet that was going to make a whole new world. And then, we investors could make a fortune by buying Global Crossing or Webvan. After all, for the first time in human history, we had all the world’s knowledge at our fingertips.

Alas, even with a complete set of electronic encyclopedias, we weren’t able to stop the Nasdaq crashing from over 5,000 in March 2000 to 1,100 in October 2002.

The problem with having all the world’s knowledge at your fingertips was that you could spend a lot of time just trying to separate useful knowledge from time-wasters and fake news.

But now that problem is solved. We will now bask in the warmth of real wisdom...as AI rakes the coals of human experience for us.

We may not know what it is we don’t know...or what we want to know...or what good it will be for us to know it...but AI will know!

Better vintages of wine at lower prices...coming soon. Roofs that never leak and socks that never get holes — AI will figure it out.

And how about plastic packaging that you can actually open with your bare hands...or restaurants that know exactly what music you want to hear...or films with your favorite dead stars; Vivien Leigh and Clark Gable in that sequel you’ve been waiting for: ‘Back with the Breeze.’

Let AI take our exams for us...fill in our census paperwork...fix our speeding tickets and show our favorite barista how to give the ICE man the slip.

Oh what a wonderful AI world! But wait. Did the thieves at the Louvre have Grok 3 helping them?

And what’s this? Inflation is still going up. The Wall Street Journal:

Inflation Edges Up, But Less Than Expected, to 3% Rate

Let’s see...3% is a lot more than 2%, the Fed’s target. It’s 50% more. And at that rate, prices will increase by more than a third by 2035. But the 2% target was always nothing more than malarkey.

The Fed announced its 2% target in 2012. It claimed that moderate inflation helped grease the wheels of commerce...that it increased employment...that it would help us ‘grow our way’ out of debt...that it boosted asset prices (such as houses), and made people feel wealthier so they would spend more freely.

This is a ‘bubble-like behavior’ too. People are neither always good nor always bad, but they are always subject to influence. And the influence they’ve been living with for at least three decades tells them they can get other peoples’ stuff without ever paying for it.

Maybe AI can solve that problem too?

Regards,

Bill Bonner

I have no issue with the general thesis that we are due for a market correction. Well overdue in fact. From my economics class instruction from my High School days (over fifty years ago), we were instructed that economic cycles generally run in eleven to thirteen year increments - so yeah, a correction from the low of 2008 to this current high in 2025 is a foregone conclusion. Better to ask why it hasn't occurred to date. Prolific money printing by the Fed, I suspect.

As to the Feds 2% forecast for inflation, this one's far harder to rationalize.

Having spent about fifty years as a Process Plant design engineer/Capex estimator, our forecast for multi-year domestic industrial projects expenditures were always forecasting a 2.5% - 3% annual inflation rate for the $US- and we made a lot of money the old-fashioned way.

I would suggest that people now dive into the latest chart from Dan Denning related to the CPI of end September 2024-2025. Note that the Trump inflation that was predicted from his tariff campaign has never really materialized. We continue to keep our fingers and toes crossed.

Further note that the inflation we are seeing is very much associated with food and energy prices. Two major items produced domestically and not on Trumps tariff list.

Now, understand fully that any energy induced inflation will quickly work through the entire economy - starting with farming. Of course, a drought didn't help (never does) but the energy inflation involved in producing fertilizers and fuel for tractor, feed for animals and transport of product to market, is rather immediate. Higher food prices and energy cost for commuting and heating and AC costs mean higher wages are required for everyone. QED, ipso facto, and all that rot.

I've commented here in the past citing McGraw-Hill's Engineering News Record (ENR) inflation data. ENR has been in publication since 1915 and, from first-hand experience, I can assure readers that it's very accurate within a tight range of probability.

My most recent issue now shows an annual "Building Cost Index" forecast for inflation recently jumping from a 3.1% to 3.6% - quite a bump. When digging in, however, we see that the materials portion - one heavily reflective of imports - has hardly moved for the entire year. The Labor portion, one entirely dependent on domestic supply is the entire root of the increase being seen. Domestic Labor wage increase harkens back to the general domestic rate of inflation and as demonstrated, is reflective of the obscene increases to energy costs. One that predates el' heffe' (Trump) and is directly correlated to Bidens IRA era literal "tilting at windmills" campaign.

I rest my case. This mess the Progressive DC lawyers energy scheme has put us under a dark cloud. One that will take years to work out from under.

If we now decide to throw open our border once again with an invitation to the world for free medical insurance, etc. - as the "Sanctuary City" Marxist inspired democrats are proposing, we may never see a sane inflation rate or a coherent economy, ever again.

This is exactly what happens when America ditches the paper dollar! Oh yeah, brilliant plan, because nothing screams “stability” like turning the entire economy into an app. The same people who can’t open a PDF are now supposed to trade groceries in Bitcoin.

You think inflation’s bad now?

Wait until your retirement account disappears because you forgot your crypto password. Blockchain isn’t money, it’s a $5,000 scratch-off ticket with extra steps.

And the Administration’s out there preaching it like gospel, “Don’t worry folks, we’ve digitized prosperity!” Yeah, and I digitized my ass, too, it’s still broke.

Since Nixon terminated the paper dollar convertibility to gold, they became IOUs from clowns in suits. But now they’re replacing them with digital IOUs you can’t even hold. At least with paper you could roll a joint, snort a line, or wipe your ass. Try doing that with a blockchain wallet. America’s sprinting away from paper money like it’s radioactive, but guess what? The radiation was always in your head. You’re not free. You’re just trading one leash for another, only now the leash is made of code. When the bubble bursts, you’ll wish you had paper just to burn for heat. Your paychecks will go straight into a digital wallet, until the server crashes in Malaysia. Then you’re broke, but hey, at least your socks don’t have holes thanks to AI. You know, the paper dollar has some dignity. You can hold it, fold it, and hide it in your mattress. Try hiding your crypto wallet in your mattress, unless you like sleeping on a laptop that bursts into flames. But don’t worry, the Administration says it will be fine. Just like they said about Iraq and Afghanistan, yeah, It all turned out great.