Artificial Exuberance

There is a season for everything. And this is not the season for a real mania.

Bill Bonner, reckoning today from Youghal, Ireland...

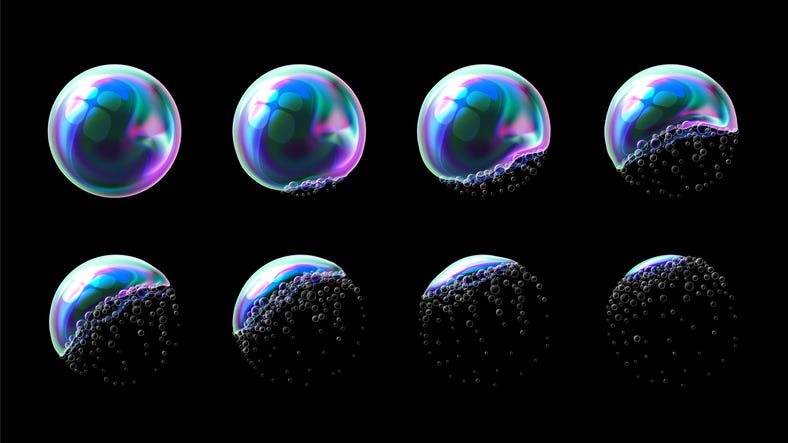

Last week we watched the debt ceiling go up and the AI bubble expand. The first was inevitable. The second… entertaining.

The debt ceiling shootout was fake. The characters had no reason to go gunning for each other; this was the one issue on which they were all in agreement – the feds should borrow more money. Everybody knew how it would end, too: in a slimy compromise of some sort.

Still, it was even slimier than we expected. The Republicans, supposedly, were using the ceiling to pry loose some concessions that would appeal to their supposedly ‘conservative’ base.

As it turned out, they got nothing. And nobody cared anyway. It was theater. But bad theater. The characters were shiftless and phony. The dramatic tension was false. And there were no surprises. And now debt will continue to grow unmolested.

Artificial Exuberance

Meanwhile, this is not the first time that we’ve seen a tech bubble…what is a little surprising is that we’re seeing one now. And it is one of the best. Charlie Bilello reports:

The exuberance over generative artificial Intelligence had been building throughout earnings season, with 190 mentions of the word “AI” in earnings calls for the largest tech companies versus just 36 mentions a year ago.

And then Nvidia reported earnings, transforming the AI boom into a full-fledged mania. While Q1 revenues were actually down 13% year-over-year, all the attention was on forward guidance. Nvidia said revenues in the current quarter would hit $11 billion, a new record high for the company (prior high was $8.3 billion) and 50% above wall street estimates.

Nvidia jumped 25% last week…putting it in the $trillion category and erasing all of last year’s losses.

What is unusual about this mania is that it takes place in the wrong season. Like a young Frenchman, reaching adulthood in 1914 and doomed to the army, the AI mania has a short life expectancy.

A Tale of Two Streets

Typically, the stock market flourishes when credit flows. That is what happened in the 2009-2022 bubble. The Fed lent out money below the rate of inflation – lots of it. In 2009, the Fed balance sheet – a measure of its lending – stood at under $900 billion. By 2022, it was almost over $9 trillion. Most of this money went out to the big banks and to their big financial borrowers on Wall Street.

They made their bets….driving up asset prices. The Nasdaq, home of much hope and wishful thinking, rose in line with Fed lending, up from 1,300 in 2008 to 13,000 in 2021.

This increase in prices did not represent an increase in values. While Wall Street headed to the moon, the Main Street economy limped along on earth with some of the lowest growth rates since the Great Depression.

Asset prices are a claim on things in the real world. If you own a factory, for example, you should be able to sell it for about 10 times the net value of its output. That’s the connection between Wall Street and Main Street; values on Wall Street should represent the expected stream of earnings on Main Street from selling real goods and services. They are meant to rise and fall together

But now, Wall Street prices represent trillions of dollars’ worth of output that hasn’t yet been put out and never will be. At 38 times sales, for example, Nvidia is extremely unlikely to produce enough profits to make the stock price reasonable. Even with a 100% profit margin (impossible)…and a 100% dividend payout (never going to happen)…at the current price, it would take until 2061 for investors to get their money back.

A 180-Degree Shift

The outlook for a bubble is never good. All bubbles pop. And all booms built on central bank credit eventually go back whence the money came – to nowhere. But the outlook for this bubble is particularly bad. The timing is off. The Fed’s key rate is about zero, in real terms, after being as much as 6% negative in 2022. Neither is the Fed’s balance sheet ripping skyward as it did during the last bubble epoch. Instead, the money supply is now falling at the fastest rate in history. Here’s Charlie Bilello again:

After a 40% increase in 2020-21, we’ve seen a 180 degree shift. The US Money Supply has fallen 4.6% over the last 12 months, the largest year-over-year decline on record (note: M2 data goes back to 1959).

There is a season for everything. And this is not the season for a real mania.

So, here’s a prediction: either the Fed puts more money into the system….or the AI bubble dies in the trenches.

Regards,

Bill Bonner

Joel’s Note: It’s late at night… the band is playing… and the champagne is flowing freely. It’s easy to lose one’s bearings.

Should we stay for another hour? Sure!

Another round of drinks? Why not?

How about jumping in the pool? Last one in’s a (gurgle, gurgle…)

Caught up in the sway of the moment, it’s helpful to ask just how late it is. Here’s Bonner Private Research’s macro analyst, Dan Denning, putting Nvidia’s 38x sales figure into perspective…

Trading at 38x sales may seem fine to you if you’re convinced that next year’s revenues–or the next TEN years’ revenues are going to blow it out. But it’s a huge risk and a poorly calculated gamble. Why? Because think about what it takes for a company to pay you back over the next ten years when you buy it at 10x sales today.

Then Sun Microsystems CEO Scott McNealy pointed this out to Bloomberg in 2002 (What Were You Thinking?) –after the dot. com crash. At 10x revenues, he’d have to pay out shareholders 100% of revenues for 10 straight years in the form of dividends. And to do THAT, the company would have to get permission from shareholders to pay no taxes (which is illegal), no wages, reduce cost of goods sold to zero, and make no capital investment.

Those assumptions–that a company could do any or all of those things AND get permission from shareholders–are obviously stupid. No thinking person would think them. McNealy was making the point that investors understand and that speculators forget: price matters.

Now map that onto Nvidia’s 38x sales. Is the company going to pay out shareholders 100% of revenue each and every year from now until today’s newborn babies are entering middle age?

“No matter how good the future may be,” Dan reminds us, “if you pay too much for it now, you’ll get burned.”

Right now, the BPR team are urging caution. Maximum Safety Mode is the order of the day… not another round of drinks or cold water skinny dipping. That means plenty of gold (to protect against currency devaluation) and cash (to offset nominal price declines).

If you’d like to learn more about the BPR investment strategy, including getting access to the official BPR stock watchlist, find a membership plan that works for you, below…

Almost everyone in the Congress would agree that the biggest problem we have is the national debt. That is a macro-economic problem. But every member of Congress is more concerned with their own micro-economic problem which is getting reelected. The things that must be done to balance the budget and get the debt under control are contrary to their major objective of getting reelected. The system is the problem

From an interview with David Stockman the only way this gets fixed is to eliminate the Federal Reserve. Once that goes all the rest will be forced in line . Electing the right politician won’t work. Debt monetization needs to be ended.