Another Death Valley?

The US had a paper currency. We all knew what happened to paper currencies. Over time, all paper money reverted to its inherent value — which was zero. Weimar...here we come!

Friday, September 19th, 2025

Bill Bonner, from Poitou, France

The headline story for today. CBS News:

Inflation rose in August. Here's why a gold investment makes sense now.

Does it really ‘make sense’ to buy gold now?

If we ever had the gift of prophecy, we lost it a long time ago.

Like our virginity, it was lost in a heat of miscues and misunderstanding, lust and wonder...when we discovered how things really work.

That is one advantage of age. We may not remember where we were 45 minutes ago, but we remember the sound of Maggie Thatcher’s voice from 45 years ago.

Today, we recall the ‘greatest investment event ever’ held in New Orleans under the guidance of our old friend Jim Blanchard...and we remember how we lost our investor virginity.

It was then, before a crowd of thousands, that Ms. Thatcher described how “societies that allow individuals to use their talents to create and flourish...also allow their economies to flourish.”

She was right about that.

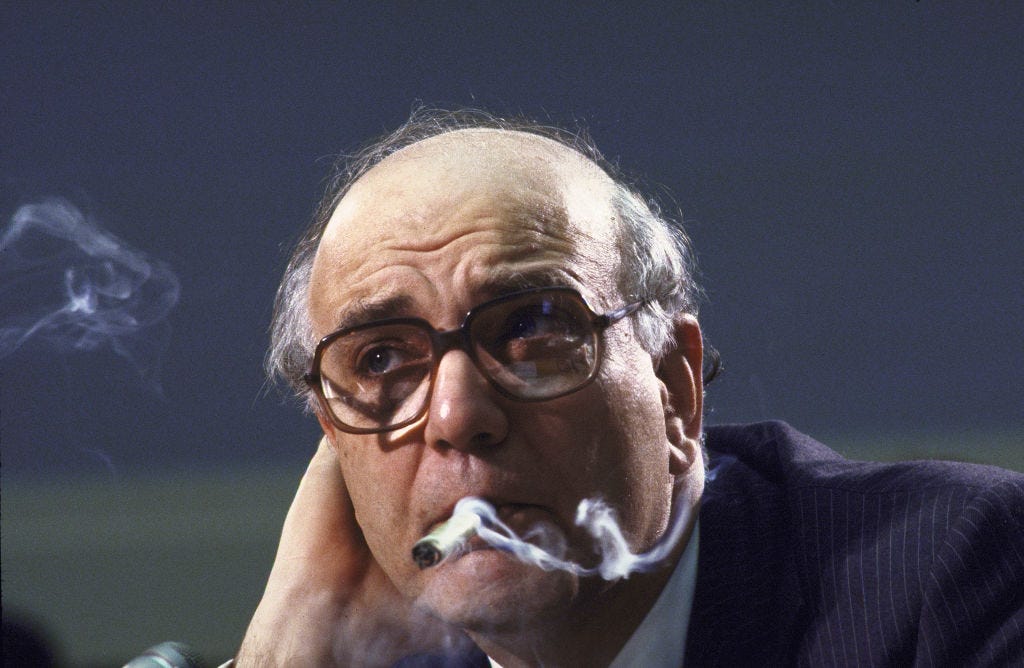

Milton Friedman was right, too, when he stood at the microphone and told us that ‘central planning never worked’...and why ‘conservatives’ had to counter the natural tendency of politicians and bureaucrats to expand their power.

But it was this very same Milton Friedman, champion of free market capitalism, who had encouraged the Nixon administration to make the biggest financial mistake in America’s history. It was he whose ‘monetarism’ brought central planning to the nation’s money system.

Friedman’s new currency — announced by Richard Nixon in 1971 — was cut loose from gold. Henceforth a committee of bankers and economists would set interest rates and carefully keep the expansion of the money supply in line with GDP growth. Friedman suggested that the supply of dollars should increase at about 3% per year...a level that should keep prices stable. These wise men and women at the Fed would manage the economy, he thought, ‘loosening up’ on credit when times were lean...and tightening back down in the years of plenty.

But Milton was woefully ignorant about politics...and had a dangerous shortage of cynicism in regard to human nature. The result proved disastrous.

It was his monumental error — allowing the feds to print as much money as they wanted — that set the stage for the third towering figure at the New Orleans conference. Howard Ruff was a former tenor with the ‘Singing Sergeants’...and a devout Mormon. (“I’m a practicing Christian,” said Howard. “And I’ll keep practicing until I get it right.”)

Whether he was getting his faith right, or not, we don’t know. But he was a hero when he strode to the podium in New Orleans in 1980. His message — ditch the dollar, buy gold — had proven, well, ‘golden’ for the last five years. His many followers were fat and happy. His business — as a financial soothsayer — was expanding.

We were all ‘gold bugs’ by then. In a short decade, the price of gold had gone from only $35 to over $600. We had made 17 times our money. We understood something that most people didn’t — gold was real money; everything else was credit. And we believed time was running out for the dollar.

So, who could doubt Howard when he boomed out his forecast:

“Gold will go to $5,000 an ounce.”

And why wouldn’t it? The Fed had lost control of inflation. The US had a paper currency. We all knew what happened to paper currencies. Over time, all paper money reverted to its inherent value — which was zero.

Weimar...here we come!

But here is where advanced age pays off. We also remember what happened next. Gold hit a high of $875 on January 21, 1980. Then, unbeknownst to us, another hero decided gold’s fate. Investors largely failed to notice when he stood before another microphone in another city and announced:

‘By emphasizing the supply of reserves and constraining the growth of the money supply through the reserve mechanism, we think we can get firmer control over the growth in money supply in a shorter period of time.’

It was on October 6th, 1979. But it was ‘technical.’ What did it mean? Paul Volcker was warning that he intended to bring inflation under control, but hadn’t other Fed chiefs promised the same thing? And where would he get the political muscle to see it through?

Those biceps came onto the job site a year later. On November 4, 1980, Ronald Reagan was elected. He backed Volcker. And Volcker set out to crush inflation.

If only we’d looked more closely...and seen more clearly. We could have spared ourselves huge losses. But the case for gold seemed so persuasive.

Everyone knows now what happened. The price of gold didn’t go to $5,000 or anywhere near it. It fell to $259 over the next 20 years. Including inflation, the loss to investors was about 80%. And in real terms, the price of gold didn’t return to its 1980 level until last week. Barrons:

Gold prices extended their extraordinary gains, with bullion prices surpassing their inflation-adjusted record set more than four decades ago.

Spot gold prices rose 0.1% on the session to $3,656.40 an ounce, topping the inflation-adjusted record of $3,498.77 an ounce established in 1980.

The gains followed another set of economic data suggesting mounting stagflation risks in the world’s biggest economy. Weekly jobless claims figures were at the highest levels in four years, according to the Labor Department, while headline inflation quickened to 2.9%, the highest level of the year.

And now, once again, the case for investing in gold seems flawless. Mom and pop investors are being encouraged to add gold to their portfolios. Central banks are stocking up. Investment funds are discovering gold too.

So, we have to ask ourselves. Are we approaching another learning experience? Another Death Valley for gold...one that will take 45 years to cross? Another opportunity to lose our investment virginity?

Tune in on Monday.

Regards,

Bill Bonner

What am I getting wrong?

Gold is the standard of value. Gold is valued in US dollars. The dollar price should not need to be inflated or deflated to adjust for inflation. The ounce of gold that went up to $875 on January 21, 1980, meant the US dollar lost value, and its lowest value was on that date. The dollar regained value because it took fewer dollars to buy the same ounce of gold when the price of gold, in dollars, dropped to $259. Gold's purchasing power does not change in terms of gold, only in terms of the currency you are converting it to. Gold's purchasing power can only be affected by supply and demand for the products and services being purchased with gold.

This inconsistency of saying an investor is earning a return on gold when it has gone from $2,000 to $3,600 is wrong. The value of the dollar changed, not gold. The dollar has lost value. Between Bill Bonner, Tom Dyson, and Dan Denning, this point gets lost.

The only way gold can get hammered now (or ever) is if there is a sharp reduction in the desire for a safe haven from a depreciating dollar. What could make the dollar stabilize? Can't raise interest rates to 18% like Volcker did. Will Congress have an epiphany and balance the budget?? HAHAHAHAHA. However.... if the Mar-A-Lago accords is a thing and Bessent and Trump succeed in revaluing gold from $42 to whatever is required to once again back the dollar with gold, the dollar would be saved, and Congress would be forced to balance the budget. Of course, that also entails a 40% devaluation in the dollar, which would be painful short term but balance trade issues in the long term. I doubt they'll be able to pull it off, but it's an interesting gambit.