An Instinctive Revolt of the Blood

The silver deficit won’t be solved overnight. China’s export controls should put upward pressure on prices. It’s going to be a volatile year, of course. Buckle up. But enjoy the ride while it lasts.

Friday, January 2nd, 2026

Laramie, Wyoming

By Dan Denning

‘We will replace the frigidity of rugged individualism with the warmth of collectivism.’

–New York City Mayor Zohran Mamdani

‘But in this century blood and instinct will regain their rights against the power of money and intellect. The era of individualism, liberalism and democracy, of humanitarianism and freedom, is nearing its end. The masses will accept with resignation the victory of the Caesars, the strong men, and will obey them.’

–Oswald Spengler, The Decline of the West

Greetings from the High Plains of Laramie. And Happy New Year! Also, welcome to all new subscribers to BPR who’ve joined us in the last few weeks. There’s an update for you below from our Official List of BPR recommendations.

First, though, everyone wants to talk about that little communist mayor in New York City, and how democracy has failed. Or, they want to talk about China’s export restrictions on silver. What does that mean for the silver price, especially the position we took in BPR last year?

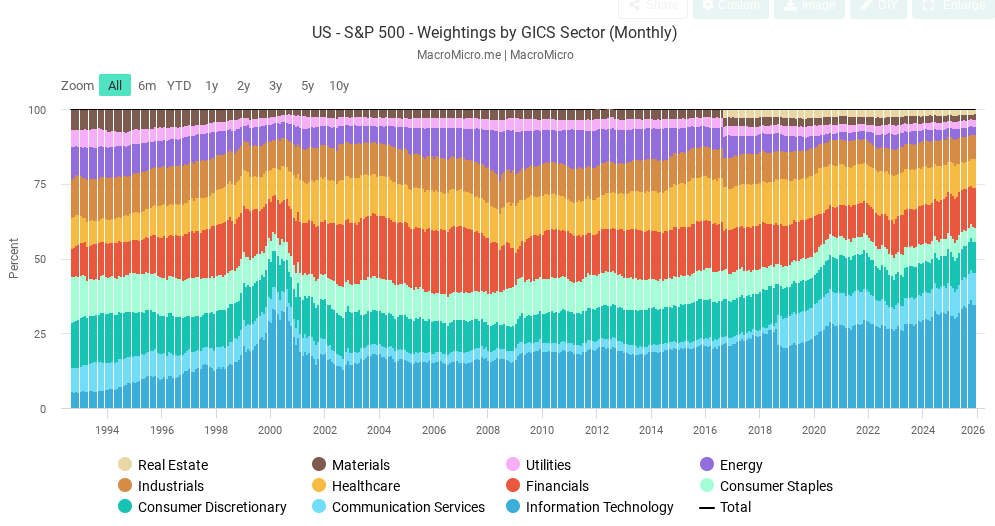

I’ll get to both points in a moment. But first have a look at the chart at the top of this week’s research note. It shows the weightings of all eleven S&P sectors going back to 1992. The little purple wedge, three down from the top, is the energy sector. It was 9.74% of the S&P 500 in 1992. When the oil price peaked before the 2008 crash, the energy sector was 16.2% of the S&P 500.

But go back to January of 2022. That’s when we made oil and gas producers the center of our new Trade of the Decade. At that time, the energy sector was 3.35% of the S&P 500. Today? It’s 2.81%. And tech is 34.4% today (compared to a previous high of 33.93% in August of 2000). Now take a look at the chart below.