A Stock-Bond Combo Buy

Sunday, June 2, 2024

Laramie, Wyoming

Dear Reader,

Here’s hoping this letter finds you well and that you’re enjoying your Sunday. No video Private Briefing today. We got some great suggestions from you on who you’d like to hear from later this year. We’re working on that as we speak. Stay tuned

In the meantime, I contacted our friends at Porter & Co. last week to see if they’d be willing to share more of Martin Fridson’s work on distressed investing. They agreed. And they suggested that rather than telling you about it, we just show an example of Marty’s work. We agreed!

That’s what you’ll find below. You can download, in full, the latest report with the links below. For the sake of brevity, I’ve included the first third of the latest report it in this email. The convergence between real estate, health care, and American demographics—and one company in the middle of it all—is the focus of this month’s recommendation.

Enjoy,

Dan

PS Just a reminder that the purpose of our Private Briefings is to share the research of colleagues and other analysts we respect, even if we don’t necessarily reach the same conclusions at BPR. All investors benefit from reading world-class research, and Marty’s work certainly qualifies. One of our goals this year is to share that work with you when we find it. If you’re a serious investor and you find value in what you read below, you can learn more here.

A Stock-Bond Combo Buy

Profiting From the Long-Term Growth of Senior Housing

After Cleaning Up Its Debt, This Company’s Bonds and Shares Will Rise

This month’s distressed-debt recommendation

Uses multi-pronged valuation,

The product of our rumination

Is a bond-stock combination.

Martin Fridson

Halloween came six months early for custom-home builder Pat McNeil.

On an early April day in 2002, Pat was on a private haunted hayride... cruising through the cornfields of Omaha, Nebraska, past several half-finished, abandoned million-dollar mansions he wouldn’t be completing.

It was a chilling sight for an independent developer.

The empty houses were haunted by the ghost of Level 3 Communications, an Omaha-based dot-com bubble company that had nearly ruined many local investors after it dropped from its $132-per-share peak in March 2000, to below $4 in April 2002.

Nebraskan investors – who reported just $400 million in total capital gains in 2002, down from a high of $3.3 billion before the bubble popped – could hardly be blamed for going all in on Level 3, though...

The fiber-optic cable company, a home-grown sensation, was a spinoff from Peter Kiewit Sons’ Inc, a long-standing and well-regarded Omaha construction company. Walter Scott, Kiewit’s upstanding CEO, was a local institution, too… and loyal Omahans had been thrilled to back Scott’s new internet startup.

Until the bubble popped, that is.

During the late 1990s, Level 3 built out an impressive network of fiber broadband cable – over 16,000 miles spread across America. But as the tech economy deflated, the paying internet traffic that traveled those “roads” dramatically slowed. “[I]t’s like a great racetrack,” Fortune reported in 2002. “You still need the fans. You still need the customers.”

As the information superhighway shut down, Omaha felt the pain. "There are hundreds, probably thousands of investors in Omaha who have suffered combined losses in Level 3 stock equal to tens of billions of dollars," Fortune reported in the same 2002 story.

The financially fallen-to-earth recent retirees dusted off their ties to return to work, and backed out of pricey building contracts. Their abandoned homes became known as “Level 3 squeezes.”

“It was so good, so long that people thought it would stay good forever,” Pat McNeil told The Wall Street Journal, adding that construction work had slowed down a lot for him since the dot-com crash. “It’s scary.”

However, one very famous Omaha citizen wasn’t spooked.

Multibillionaire Berkshire Hathaway CEO Warren Buffett and Walter Scott were long-time pals who shared an office building in downtown Omaha and – back in their high-school days – had a crush on the same girl, Carolyn. (Scott, who Buffett described as “the best man,” ultimately won out and married her.) Over the years, Scott served on the board of Berkshire Hathaway, and partnered with Buffett to launch Berkshire Hathaway Energy.

And while Buffett declined to comment publicly on Scott’s internet company during the boom – the Oracle of Omaha voted with his deep pockets during the bust.

As “Level 3 squeeze” houses rotted in the cornfields, Level 3’s bonds traded at 40 cents on the dollar, and Merrill Lynch downgraded the stock to “Sell,” Berkshire Hathaway stepped in where angels feared to tread. Buffett and his investors purchased $500 million in convertible bonds, giving the distressed telecom an extra $1.5 billion cushion, along with the cachet of a Buffett endorsement.

Buffett bet – albeit with a convertible-bond hedge – that Level 3 would weather the dot-com carnage. Even at its lowest point in 2002, the company had lined up promising contracts to provide broadband to new, large clients like Microsoft, AOL Time Warner, and Yahoo, and expected to break even on a free cash flow basis by 2004.

"With the cash we have, the company is hardly a Chapter 11 candidate," Walter Scott told Barron’s in 2001. "The business plan is working fine, and we continue to sign up important customers on a regular basis."

And the bet paid off. Plenty of internet companies filed Chapter 11 after the crash – but Level 3 leveled out… and then began to level up.

The company’s deeply discounted bonds were refinanced and paid off. Everyone got paid (including Buffett). By 2003, Level 3 had enough cash to start buying other internet companies. In 2012 – a decade after its $3 low point – it accepted a 10-year U.S. government defense contract.

Then, in 2017, it ultimately got bought out by a larger telecom, CenturyLink, for $34 billion (just $10 billion less than its overinflated peak bubble market cap, which, at the time, had been larger than General Motors’).

One thing never changed, though – Warren Buffett and Walter Scott remained great friends until Scott’s death in 2021, at the age of 90. (Contractor Pat McNeil also weathered the storm, and is a successful builder in the Omaha area today.)

It was an impressive, and unusual, turnaround tale...

Very occasionally in the distressed-investing world, we come across a turnaround like the Level 3 story: so dramatic that it’s almost like looking at a different company. Pre-transformation, the investment thesis might be a story of upside potential (often, cautiously hedged, as we see in the case of Buffett’s convertibles).

But after the makeover, it’s a bona fide success story... and we approach the opportunity in a completely different way.

In this issue, we’re revisiting an old story in a new light. A year after we first wrote about it, this company is out of distress and now presents a long runway of opportunity.

That means an entirely new recommendation. Let’s dig in...

What a Difference a Year Makes

In the March 2023 issue of Distressed Investing, “A Safe Bet on the ‘Graying of America,’” we recommended Diversified Healthcare Trust’s (Nasdaq: DHC) 9.75% bonds maturing on June 15, 2025.

We liked DHC’s 9.75% bonds because the company’s portfolio of senior-housing communities, medical offices, and life-sciences buildings (used as pharmaceutical labs, among other things) were worth a lot more than all of DHC’s debt put together.

At the time, the operating performance of DHC’s senior housing properties (“SHOP”) had declined significantly as a result of the pandemic. The company’s bank lenders – which it owed $450 million – would not commit to renewing DHC’s loans when they matured. DHC faced $700 million in debt that was beginning to come due in 2024 and it wasn’t clear if the company could repay it. On the surface, it was a scary picture, but we recommended the bonds because, as we said above, the value of DHC’s properties was significantly more than its debt and the SHOP properties had just started to show improving results.

Indeed, much has changed for DHC over the last 14 months – for the better. As we detail below, its operating results are improving, and its debt is under control. The “graying of America” – the increasing number of aging Americans – is providing DHC years of opportunity to expand its senior-living facilities and medical and life-sciences office business.

Let’s look at the industry as a whole and then the details of DHC’s business.

The Megatrend of Aging Continues

It’s good to be on the right side of a growth trend – to know that time is your friend.

America is getting older.

People aged 65 and older will make up 21% of the U.S. population in 2030, up from roughly 15% in 2016, according to the U.S. Census Bureau

The percentage of people in the U.S. aged 85 and older will grow 30% over the next five years

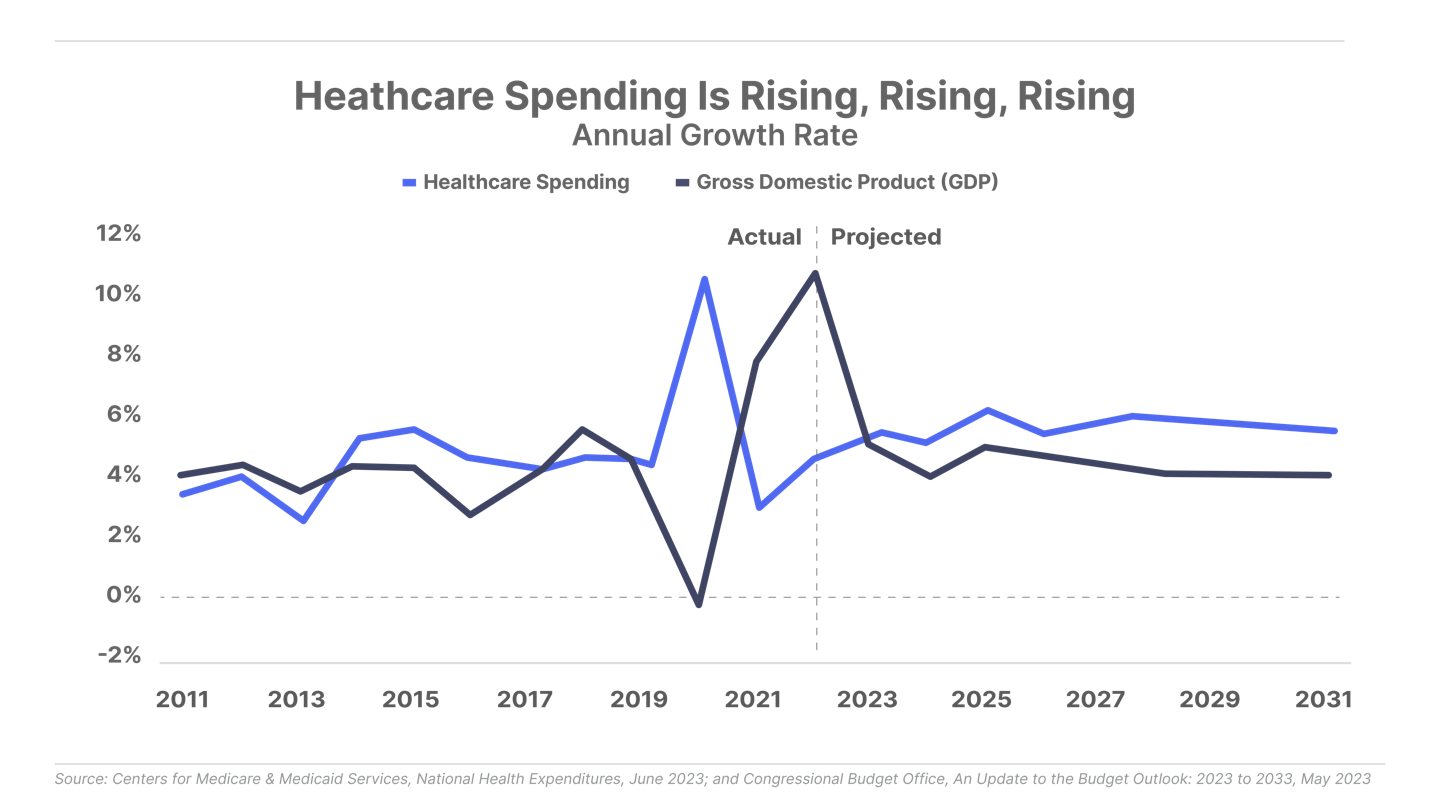

Total healthcare spending is projected to rise 5.4% annually between 2022 and 2031, outpacing gross domestic product (“GDP”)

These long-term trends will work to DHC’s advantages in both area of its business:

Occupancy at its senior-living communities will rise – and as occupancy increases, profits go up

DHC’s medical-office buildings will benefit because an older population will require more medical attention – which means demand for doctors’ offices should rise

Research on new pharmaceuticals and medical devices will increase – bolstering demand for DHC’s life-sciences buildings, which feature laboratories and other areas designed for medical research

Overview of DHC’s Properties

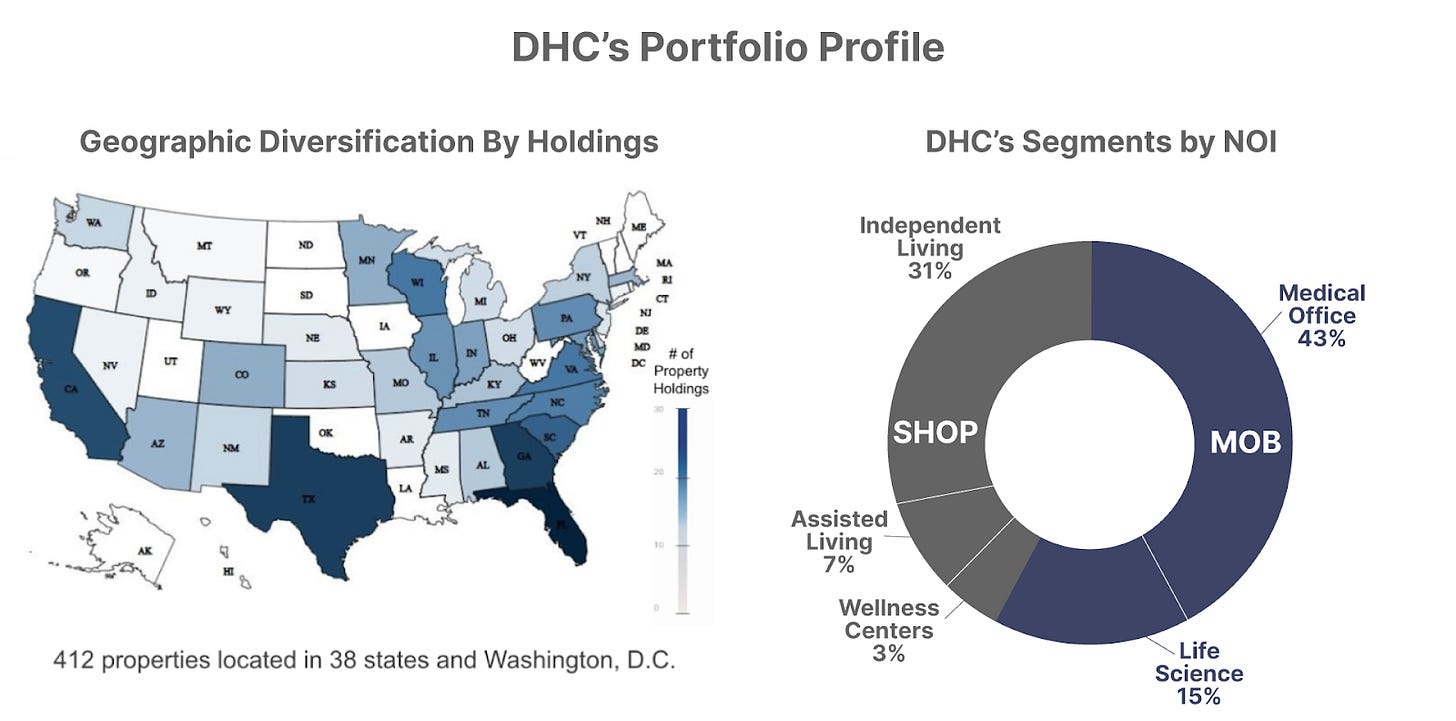

As of December 31, DHC owned 371 properties – 234 senior-housing communities and 137 medical and life-science office buildings. The company’s holdings are geographically diversified – the largest concentrations are in Florida (10%), California (9%), and Texas (9%).

SHOP accounts for just over 60% of DHC’s assets, based on their current book values, but 42% of its net operating income (“NOI”), which is rental income minus operating expenses.

Let’s take a look at DHC’s two business segments – senior housing, and medical and life-science offices.

Senior Housing Operating Portfolio (SHOP)

DHC owns 234 senior-housing properties that together have 25,300 residential units – a unit being one residence. The company’s portfolio has a depreciated book value (the original value minus an annual discount for aging) of $2.9 billion and includes:

To maintain its status as a REIT, DHC is not permitted to operate the senior-housing portfolio. The company relies on outside management companies to run its existing communities. Five Star Senior Living, in which DHC has a roughly 33% ownership interest, oversees operations of half of the properties (119 out of 234). Various other management companies operate the balance of the communities (RMR Group manages DHC’s business on a broader level – purchasing, construction, and ownership management).

SHOP generated NOI of $214.7 million in 2019, when occupancy was 84.1%. This business declined severely during the pandemic, with NOI falling 93% – and bottoming out at $13.8 million in 2022. Despite this decline, the company has spent more than $200 million annually since 2021 renovating its retirement communities – and it will spend a similar amount in 2024.

Occupancy has risen since 2022. NOI rose sharply in 2023. The company projects net operating income will exceed 2020’s level this year – reaching $130 million.

Management has emphasized that once occupancy rates rise above 80%, the company can easily raise prices. We expect this trend of increasing occupancy leading to higher profits to continue, thanks to the aging population – further helped by the fact that, as the chart below shows, the construction of new properties has not kept up with demand. For example, according to the National Investment Center for Senior Housing and Care, in the last quarter of 2023, demand for senior-living units in the U.S. rose 4.1% while the supply rose just 1.3%.

This beneficial trend for DHC should continue well past 2024. In February, commercial real estate broker Jones Lang Lasalle published the results of a survey of investors in senior housing. It reported the central point:

“The underlying market fundamentals continue to bounce back from the lows experienced during the COVID-19 pandemic with occupancy increasing, construction starts slowing, and the market showing signs of stabilization and growth.”

In a sign that the market for senior-housing communities is heating up, on February 13, 2024, Welltower Inc. (NYSE: WELL), owner of a large portfolio of senior housing, announced the acquisition of competitor Affinity Living Communities. Welltower will pay $969 million for 25 high-end retirement communities with 3,900 residential units, largely concentrated in the Pacific Northwest, where the growth of people aged 55 and older is 2.5x higher than the U.S. average.

These are high-end communities that have many more amenities (like gyms and pickleball courts) than are typically found at other developments. The price equates to a little under $250,000 per unit, or “key,” as they are called.

The acquisition increases Welltower’s portfolio of age-targeted and age-restricted units to almost 25,000 – equaling the size of DHC’s SHOP business. Many of DHC’s 25,000 residential units are similar in quality to Affinity’s.

Based on company data, our best guess is that DHC’s SHOP properties are worth something like $150,000 per key – which works out to a roughly 40% discount to the Welltower price. If that is the case, DHC’s SHOP would be worth $3.75 billion. It’s currently on DHC’s books at $2.9 billion – and the stock is trading at roughly a 70% discount from book value. So buying the stock at current levels is equivalent to paying approximately $870 million – 30% of $2.9 billion – for the entire SHOP portfolio, before assigning value for its medical and life-science offices.

DHC owns 102 medical office and life-science office buildings – its segment referred to as MOB – located in 24 states and Washington, D.C. Though it represents less than half of its total value of assets, the segment generates 58% of DHC’s net operating income.

The buildings total 8.6 million square feet – equivalent to more than three Empire State Buildings. About 85% of the space is rented to medical-service providers, and to life-sciences companies (including pharma giant Merck, medical-device leader Medtronic, and insurance company Cigna). The remaining 15% is leased to a variety of tenants.

In 2023, DHC signed new and renewal leases for about 10% of its office space, 886,000 square feet, at an average rental-income increase of 11.1%. The company has roughly 655,000 square feet of leases coming due this year and has labeled the leasing pipeline “strong.”

MOB net operating income fell by roughly half between 2020 and 2022 – from $241.7 million to $118.1 million. However, a significant part of this decline is related to lower-performing properties that DHC sold off during those years to pay down nervous bank lenders and to invest into existing SHOP properties. Looking only at the MOB buildings that DHC continues to own, NOI fell just 26% between 2020 and 2022, and stabilized in 2023.

We are optimistic that operating results for DHC’s MOB segment will get stronger over time because of ongoing underlying demand. As noted, spending on doctors and medical services is projected to increase just over 5% annually in the U.S. – reaching $1.2 trillion by 2027.

While the company does not offer specific estimates for NOI in this segment, we expect 2024 to be in line with 2023, at $125 million.

So let’s see what the company did to get itself from a precarious position to a secure one…

You can read the rest of the latest issue of Distressed Investing by downloading the PDF below. Our friends at Porter & Co. have given us permission to pass this report on to you in full—including the analysis AND the recommendation—so you can see exactly what kind of research Marty Fridson is doing. Bonner Private Research receives a small commission if you subscribe to Distressed Investing through these links. To learn more about Distressed Investing and subscribe today, please go here.

I am SHOCKED that this post is public. Thank you for allowing me to share it!

The link on my email gives me a blank page. No download. Is it a defective link, or is my system screwed up?